AI-driven investing? Here’s how hedge fund giant Bridgewater is building a machine learning-powered fund.

- Bridgewater is planning to launch a fund next July that will be driven by AI.

- The fund’s AIA Lab is working to replicate every stage of the investment process with machine learning.

- The firm’s co-chief investment officer and chief scientist outline how they’re going to do it.

Bridgewater Associates, the world’s largest hedge fund, is developing a machine-learning engine to forecast global economic events and allocate client funds accordingly.

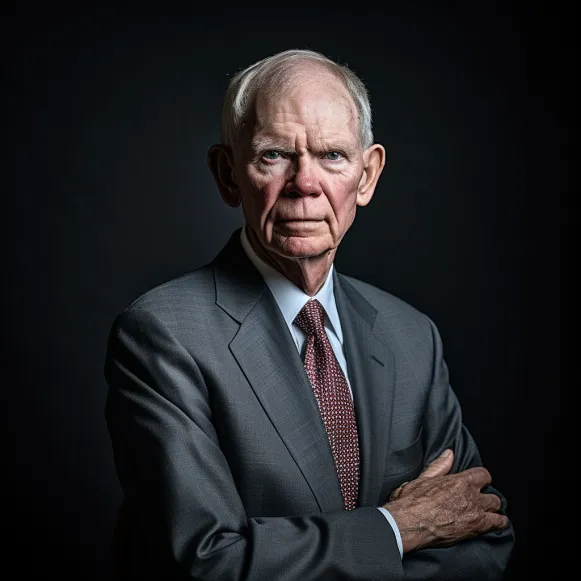

Bridgewater’s co-chief investment officer, Greg Jensen, told Business Insider in an interview that the Westport, Connecticut-based hedge fund plans to launch a fund on July 1 that will combine various AI models to make investments on behalf of a few clients.

The efforts have been led by the Artificial Investment Associate (AIA) Lab, a new group at Bridgewater. It is comprised of 20 investors and machine-learning scientists with the mission of “doing everything that we do using machine-learning techniques,” according to Jensen.

For Bridgewater, one of the world’s largest hedge funds, this means using AI and machine learning to replicate every step of the investment process, from understanding global financial and economic patterns to developing investment theories and plugging those theories into machine-learning models to see if they are correct. Risk controls and oversight will remain in the hands of humans, according to Jensen, and there will be a kill switch if necessary.

Jensen will be in charge of the fund. The rest, however, will be developed using AI and machine learning, from idea generation to testing and the models used to make trades.

This is a first for Bridgewater, which launched the fund through AIA Labs about a year ago. Bridgewater isn’t the first hedge fund to try to use AI to beat the markets, but previous attempts have yielded disappointing results. One challenge is that doing so requires a lot of data, which is scarce when it comes to major economic cycles, according to Jensen, and you need the future to behave like the past, which is also not guaranteed.

Bridgewater’s so-called “artificial investor” is outperforming expectations by making accurate predictions about what’s next for the euro or inflation, according to Jensen. Jensen hopes that once the fund is launched, the AI investor will become “much more powerful” as a “loop of learning” generates more data.

“In some sense, I feel we’ve been able to create the bones of something that will be more than the sum of its parts,” Jensen said in a statement. “We won’t describe specifics, but I do expect we will be able to generate a unique source of alpha that is designed to have both high returns and is uncorrelated to markets and other sources of alpha.”

Bridgewater intends to launch the fund with a few initial partners, “each with strong commitments to learning alongside us as technology advances and our approach progresses in parallel,” according to Jensen. The company has declined to reveal how much seed capital it will begin with.

Inside AIA Labs

As Bridgewater looks to transform itself with AI, AIA Labs will be critical. The venture is led by Jasjeet Sekhon, the hedge fund’s chief scientist.

Sekhon joined Bridgewater in 2018 after a career teaching machine learning at Harvard, UC Berkeley, and Yale. His area of expertise is causal inference, or the study of determining what caused something to happen in the world. Sekhon uses machine learning to analyze Bridgewater’s massive amounts of historical data in order to forecast what will happen in the future.

Much of the work at AIA Labs is focused on combining statistical models with language models. Language models can form sentences and are important in creating investment theories, but they aren’t so good at ensuring that what they’re saying is true. That is where statistical models come in; they can help determine whether or not the theories are correct. And now, AI language models have advanced to the point where humans can question and probe them in the same way that people communicate with one another through language, according to Sekhon.

“It’s really that this moment is the integration of language models, with the type of time-series models Jas has been working on a long time, combined with how far — in part by our own pushing — but how far diagnostic tools have come to understanding machine learning algorithms,” Jensen said in a statement. “Those pieces coming together is what has made this point so incredibly special.”

Bridgewater will still need to clear technical and regulatory hurdles before the fund can launch.

“Markets are extremely difficult, so I don’t want to overstate how well this will work,” Jensen said in a statement. “It’s good enough that I would stamp it as a good return stream,” he adds.