Amazon is getting an impressive number of people to watch Prime Video, new data reveals

L-R: Ryan Fitzpatrick, Charissa Thompson, and Tony Gonzalez attend Amazon’s first upfront presentation in May in New York City.

Amazon has been trying to break into TV for close to three decades, starting with the launch of Prime Video in 2006 and Amazon Studios, now Amazon MGM Studios, in 2010. New data suggests it’s succeeding.

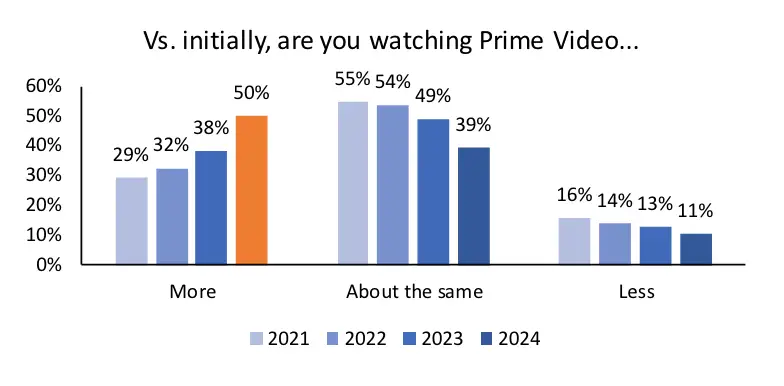

A new Evercore ISI survey of 1,100 Amazon users showed that the share of users who watch Prime Video is a “consistently high” 80%. This year, 50% of Prime Video watchers surveyed said they’re watching more than before, an uptick from 38% in 2023. Amazon is Evercore’s top internet stock pick.

According to Evercore’s survey, Prime Video has an impressive 75% satisfaction score, versus 61% for Netflix. The survey also found that 58% of Prime members had watched at least part of the 2023 season of the NFL’s Thursday Night Football, which Amazon started streaming exclusively for Prime members in 2022.

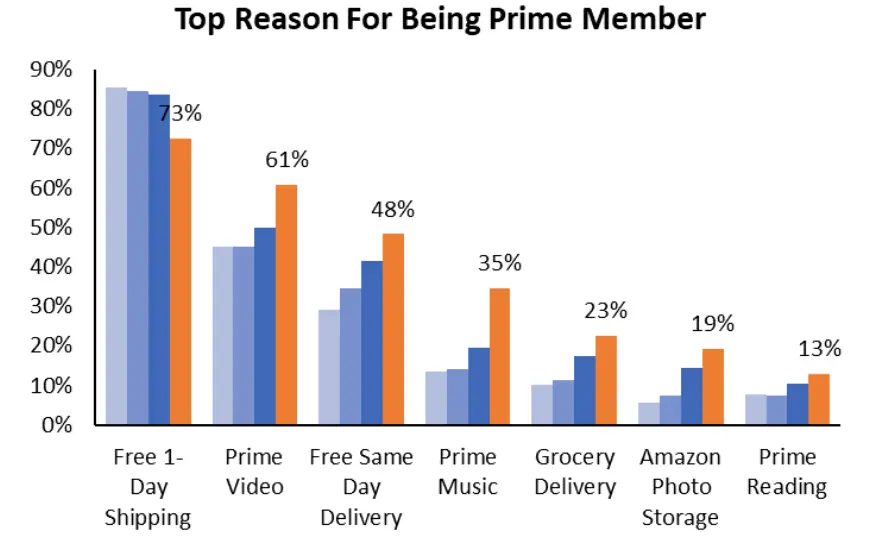

Prime Video is also helping Amazon keep its $139-a-year Prime subscribers. Free, one-day shipping remains the top factor for Prime members, but Prime Video was the second most important factor, cited by 61%, a notable increase over a year ago. Prime already has a high penetration rate, with 81% of Amazon users subscribing, per Evercore.

The findings mean a couple of things for Amazon. First, Prime Video gives it another way to keep people paying for Prime, which in turn gets them to spend more on Amazon and help it fend off rivals like Walmart and Temu.

Next, they help Amazon justify spending on sports and entertainment, which has come into focus at Amazon and across Hollywood. Earlier this year, Amazon made big cuts to its entertainment arm as part of widespread layoffs while aggressively pursuing sports rights.

The numbers also show Amazon has a big opportunity in advertising. Prime Video started pushing into video ads this year when it joined Netflix and other streamers in launching an ads tier.

People spend far more time on Netflix than Prime Video, but Amazon’s decision to roll out ads by default to Prime Video users (reaching 115 million monthly viewers in the US, per Amazon) gave it a huge advantage right out of the gate. The viewership for “TNF,” in particular, suggests there’s room for Amazon to bring in more sports fans and associated advertisers.

Perhaps because most people get Prime Video through their Prime membership, or because like most streamers, Amazon shares very little viewing data, it’s always been hard to gauge Prime Video’s success. The knock on Prime Video has been that it’s also hard to name many recent hits compared to Netflix, which has generated tons of buzz for originals like “Bridgerton” and “Squid Game.”

The new data gives Amazon another talking point when it makes its pitch to advertisers.