America’s sports-betting boom is supercharging these 6 gambling stocks

The United States is still learning about the societal impacts of its sports betting boom.

America might have a new favorite pastime: gambling.

Sports betting has exploded in popularity in recent years. This Super Bowl Sunday, Americans are expected to wager a collective $1.39 billion in legal betting markets, according to the American Gaming Association.

As consumers open their wallets to place wagers, Wall Street is pouring money into the companies behind the sports betting craze.

That’s largely thanks to a friendlier legal environment, according to Dan Ahrens, the chief operating officer and portfolio manager at AdvisorShares who oversees the “sin stock” AdvisorShares Vice ETF (VICE). The Supreme Court gave states the right to regulate sports betting in 2018. Since then, 38 states and the District of Columbia have legalized the activity.

According to PGIM, the sports betting market is on track to double in size from $80 billion in 2022 to $160 billion in 2030 — and much of that expansion will be led by the early-phase US market. Morgan Stanley sees the sports betting industry in its early stages, with growth driven by a user base expanding beyond its core of young, high-income males to include older and female bettors.

Bettors aren’t just wagering on the final results of the game, either. Microbetting — or placing small bets on specific moments of the game — has become popular and is a promising driver of future growth, according to Rene Reyna, Invesco’s head of thematic & specialty ETF strategy. People can bet on anything from the success of a field goal to whether Taylor Swift will make an appearance.

Additionally, sports betting companies are poised to become beneficiaries of AI, Reyna told B-17. Many of these companies are using AI to enhance predictive accuracy, personalize user experiences, and create operational efficiencies — leading to growing earnings.

Listed below are 6 stocks that some analysts, strategists, and money managers expect will win big as sports betting continues to spread across America. Stocks on the list either have overweight ratings at Wall Street banks or were mentioned in interviews with B-17.

1. DraftKings

Ticker: DKNG

Description: DraftKings is a leading digital sports entertainment and gaming company offering daily fantasy sports, sports betting, and online gambling services in multiple states and countries.

Commentary: DraftKings is top-of-mind for investors and bettors alike. Morgan Stanley’s 2024 Bi-Annual Sports Betting Survey found that DraftKings was the number one app that online bettors turned to, with 68% of survey respondents reporting using DraftKings in the past six months.

JPMorgan forecasts that DraftKings will be able to grow its revenue by 31% in 2025 and achieve increasing profitability. “We see DKNG as a direct beneficiary of attractive same-store and new market growth prospects against the backdrop of an industry-wide improving operating expense control environment, with competitive strengths from its superior product capabilities, customer acquisition competencies, and scale that have allowed it to compete against new entrants like ESPN BET and Fanatics,” the bank wrote in its 2025 gaming and lodging outlook.

Both Morgan Stanley and JPMorgan have overweight ratings on DraftKings.

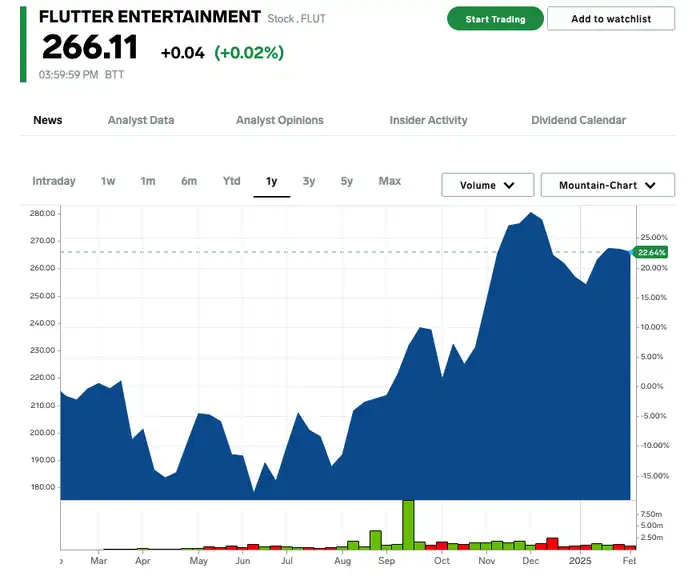

2. Flutter Entertainment

Flutter Entertainment

Ticker: FLUT

Description: Flutter Entertainment is a global leader in online sports betting and gaming, operating renowned brands such as FanDuel, Sky Betting & Gaming, Sportsbet, PokerStars, Paddy Power, and Betfair.

Commentary: Along with DraftKings, Flutter’s FanDuel is one of the top two sports betting apps of choice for consumers. According to Morgan Stanley, over 80% of online sports bettors are using either DraftKings or FanDuel, meaning these two companies have secured an early-mover advantage in the market. The bank is overweight on Flutter Entertainment.

PGIM sees Flutter Entertainment’s global footprint as an advantage. “It is geographically diversified with scale in Europe and among the leaders in the US, has lower leverage relative to its peers, and its stable cash flows in Europe and the UK may offset a wider range of outcomes in early-phase markets in the US,” Shehriyar Antia, head of thematic research at PGIM, wrote in a sports investing note.

Ahrens is also bullish on Flutter Entertainment. The stock is currently the seventh biggest holding in the VICE ETF, which has 23 stocks.

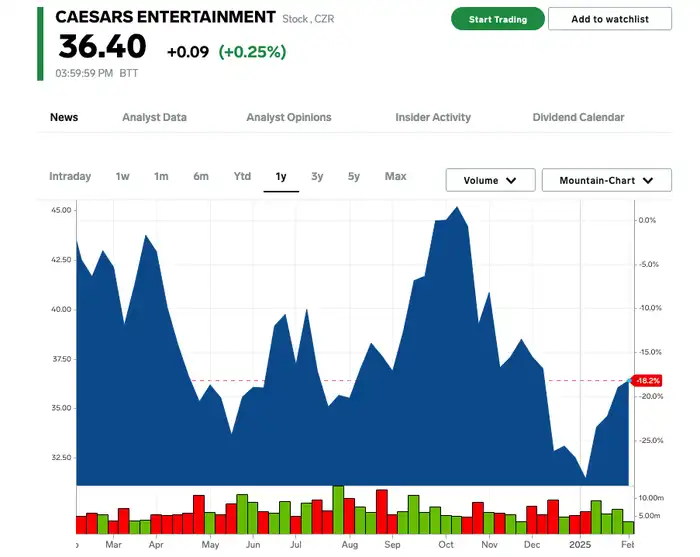

3. Caesars Entertainment

Ticker: CZR

Description: Caesars Entertainment is one of the largest gaming and hospitality companies in the US. It operates casinos, resorts, and online gaming platforms under brands like Harrah’s and Horseshoe.

Commentary: Caesars Entertainment isn’t a pure-play sports betting company, but its digital gaming business has been increasing its market share in 2024.

As sports betting gains prominence, traditional casino operators are changing their strategy to involve more digital sports betting products, Ahrens said.

“CZR expects all 3 of its verticals to grow in ’25, led by Digital,” wrote Wells Fargo analyst Daniel Politzer in a recent note. Politzer sees the Digital segment as the company’s “highest growing and most underappreciated business.”

Wells Fargo and JPMorgan are overweight on the stock.

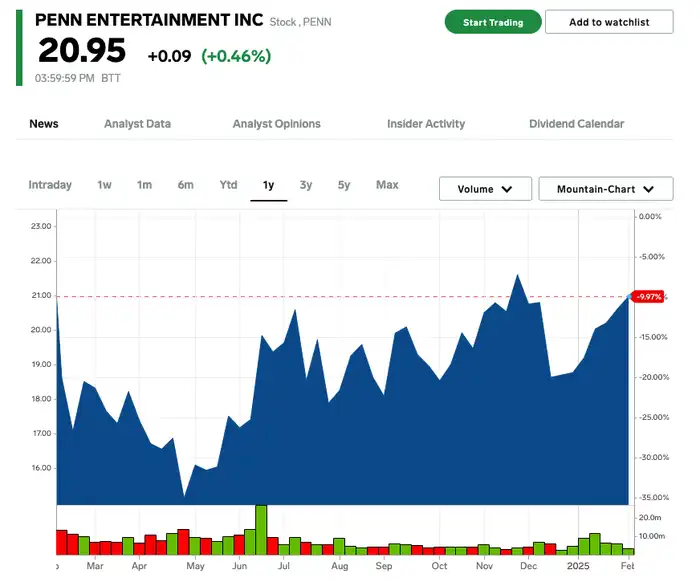

4. Penn Entertainment

Ticker: PENN

Description: PENN Entertainment owns and operates casinos and racetracks across North America and has a strong presence in online sports betting through its digital gaming division. The company operates the online sportsbook ESPN BET.

Commentary: Penn Entertainment began as a racetrack operator but has since expanded into casino operations and sports betting. As the company winds down its capital expenditures on its land-based casino business, it can deploy more cash to invest into its growing ESPN BET business, JPMorgan analyst Joseph Greff wrote in the bank’s 2025 gaming and lodging outlook.

JPMorgan believes ESPN BET will be a strong driver of returns for the stock that investors haven’t fully priced in. The bank is overweight on PENN Entertainment.

5. Boyd Gaming

Ticker: BYD

Description: Boyd Gaming operates casinos and entertainment properties across the US, with a mix of regional gaming venues and a growing online gaming presence.

Commentary: Boyd is another name that Ahrens holds in his VICE portfolio. The company offers the Boyd Sports app and also owns a 5% stake in FanDuel’s US division. The strategic partnership between Boyd and FanDuel allows Boyd to operate FanDuel sportsbooks at its physical properties in exchange for access to FanDuel’s technology and services.

Wells Fargo is overweight on Boyd Gaming, with Politzer calling it the “preeminent value stock” in the bank’s gaming, lodging, and leisure coverage. He believes the company trades at a low multiple relative to operating profit compared to peers.

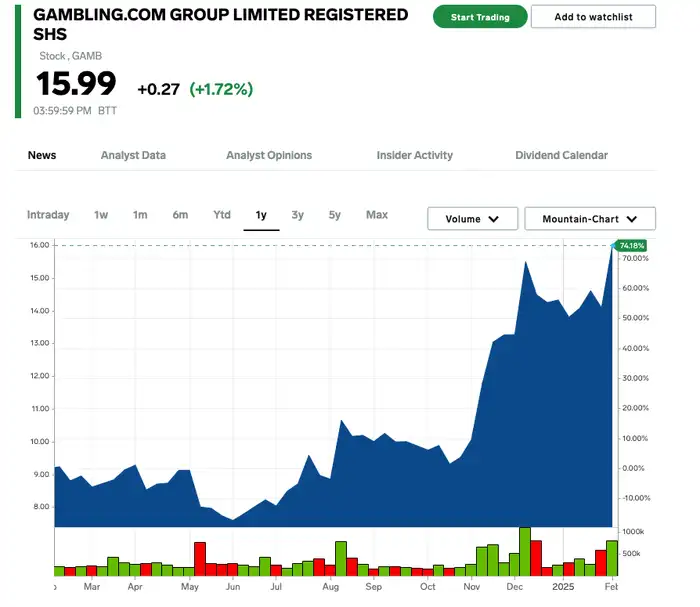

6. Gambling.com Group

Ticker: GAMB

Description: Gambling.com is a performance marketing company that helps sportsbooks and online casinos acquire customers through digital marketing and affiliate services.

Commentary: Ahrens flagged Gambling.com as one of his high-conviction trades. The company doesn’t offer gambling services directly, instead providing player acquisition services to some of the biggest online gambling companies such as DraftKings, FanDuel, ESPN BET, and others.

The company recently completed the acquisition of Odds Holdings, which processes real-time odds data for sportsbooks. The acquisition is expected to boost Gambling.com’s revenue streams from both consumer and enterprise customers.