As Costco sells platinum, experts explain how the precious metal differs from gold

Costco has expanded its precious metal offerings to include platinum after seeing success with gold bars and coins.

Costco shoppers have been snapping up a broad selection of gold and silver products over the past year.

Gold sales were up by a double-digit percentage in the fourth quarter, Costco CFO Gary Millerchip said on the company’s earnings call last week, and now the wholesale club is adding platinum to the mix.

Multiple rounds of one-ounce platinum coins and bars priced at roughly $1,090 have sold out at Costco in the past week, according to the automated listing tracker on a Reddit forum for enthusiasts of the retailer’s precious metals.

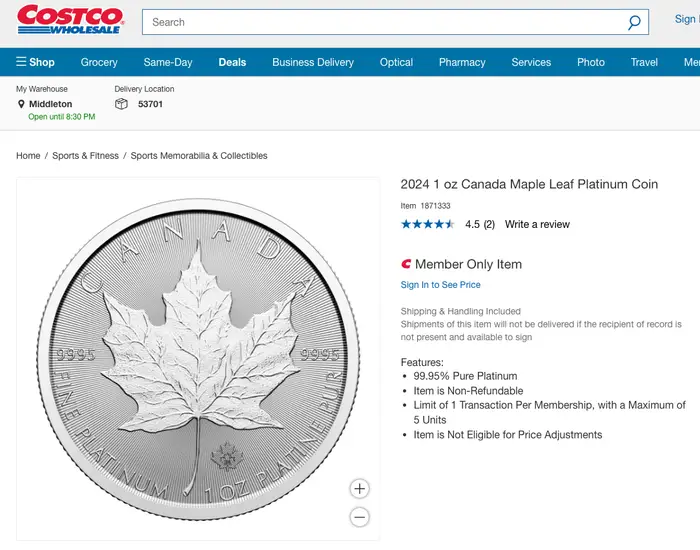

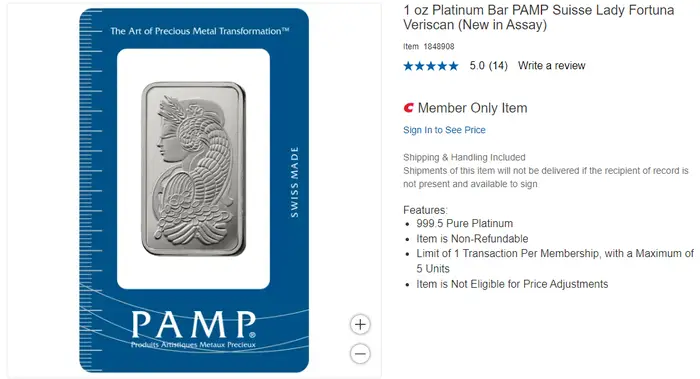

Costco now offers platinum products online, including both bars and coins.

The coin, produced by the Canadian Mint, and the bar, from the Swiss PAMP refinery, were each listed at a slight premium to the metal’s spot price, which hovered around $1,005 as of Friday.

In addition, Costco’s website says members are limited to a single transaction, with a maximum of five units per transaction.

Each one-ounce item sells for a slight premium over the commodity spot price.

Global prices for platinum peaked around $1,780 per ounce in 2011 as booming Chinese development caused demand for many commodities to outstrip supply, said Edward Sterck, director of research for the World Platinum Investment Council.

Sterck declined to comment on Costco directly, but noted that while platinum is widely used in consumer products like jewelry and watches, the largest share of demand for the commodity is driven by industry. In particular, the automotive industry uses it to manufacture emissions-reducing catalytic converters for internal combustion engines.

And while the popularity of electric vehicles has been a headwind to platinum prices in recent years, the current struggles of the EV market are renewing demand for the material.

Sterck told B-17 the industrial need for platinum, coupled with it being rarer than gold, could bode well for its long-term value.

A technician etches a catalytic converter.

However, it’s hard for any precious metal to compete with gold as a wealth-preservation asset, according to GoldCore CEO David Russell.

GoldCore’s business is primarily in gold and silver, but Russell told B-17 that platinum makes up a “very small percentage” of what the company sells.

“An investment in platinum is not a hedge against uncertainty or a hedge against inflation,” Russell said. “It is not a reserve asset on the Central Bank’s balance sheet.”

Russell also noted that the private market for platinum coins and bars is less robust than for gold and silver, which can make it challenging to trade when the time comes.

“If people want to speculate on the resurgence of the ICE [internal combustion engine] while they do their weekly shopping, buy platinum,” Russell said. “But be warned, it is not a safe-haven investment.”

One member who has bought and sold more than $100,000 worth of gold from Costco told B-17 he was glad to see the company expand its selection of precious metals, “but I only prefer gold.”