As interest rates drop, ultra-rich investors are giving up their cash for risk assets. Here’s what they’re buying.

September’s Federal Open Market Committee meeting rang in the first rate cut of this cycle with 50 basis points. It’s great news for borrowers.

But on the receiving end of that are those who had been comfortably sitting on cash yielding upward of 5%. Now, they have to find a new place to park that money.

Citi Private Bank’s latest Global Family Office survey showed that family offices had already been moving into risk assets well before the central bank began cutting. The survey, conducted in June with 338 respondents, showed that the top two asset classes these high-net-worth investors were moving into were fixed income and equities. Half of the respondents manage over $500 million in assets.

“At a high level, we’re seeing more and more clients putting their cash to work, and a lower percentage of clients are increasing their cash reserves,” said Richard Weintraub, Citi Private Bank’s head of family office group for the Americas.

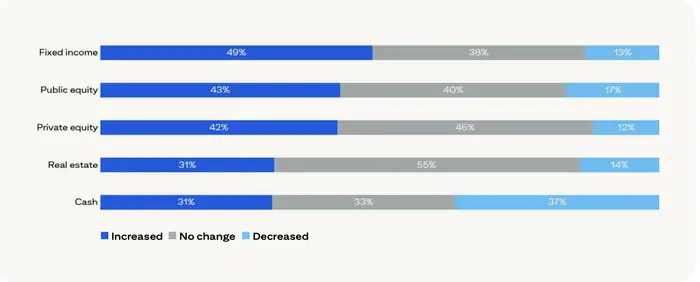

Below is a chart showing the asset allocation change among survey respondents.

The next six to nine months will be key in establishing a trend, he noted. Depending on how fast the central bank cuts, whether there’s more this year versus 2025 will determine how aggressively this group of investors continues moving out of cash and into other asset classes.

So far, the move toward equities has translated into a rush for big tech’s AI, which remains a favorite among family offices. According to the survey, more than half, or 53%, have AI exposure, and 33% of that is in public equities. Among those that haven’t jumped on the AI bandwagon, 26% are considering it.

But the advocacy around maintaining diversification also means there’s an interest in exposure to sectors like healthcare, industrials, utilities, and real estate, Weintraub noted.

When it comes to real estate, family offices often prefer private investments. However, REITs were included in the exposure, with the main area of interest being commercial real estate, specifically warehouses and data centers, he noted.

Regarding international exposure, most North American family offices are leaning into developed markets over emerging ones. This is because the availability of data that can be injected into research to help determine allocation is more widely available for those markets, he said.

Digital assets are another area of interest. Family offices don’t want to get left behind. The survey showed that a quarter of respondents had already invested or planned to invest in this sector. However, Weintraub noted that the allocation was in the form of recently approved ETFs that hold bitcoin and ethereum.

Derivatives

Finally, volatility is expected to increase as rate cuts continue. Here, derivatives are being leveraged to benefit from price changes or hedge against the drawdowns, he noted. This is a key strategy for clients that have significant exposure to certain stocks. The survey showed that a third of the 70% that reported having concentrated positions were considering strategies to manage their risk, with three quarters leaning into derivative solutions.

“There’s always a risk to having a large concentrated position as a significant portion of your portfolio,” Weintraub said. “And so our clients are using variable prepaid forwards and collars to ensure they are secure within a specific band for those holdings.”

Variable prepaid forwards (VPFs) enable investors to accept payment for their stocks in exchange for the future promise of shares or cash, which will depend on the stock’s value at expiry. It allows investors to collect on their stocks while skipping over selling their shares and incurring capital gains tax.

Meanwhile, collars enable investors to place options bets on their shares to hedge against volatility; while this would cap potential gains, it also limits downside risk.

As rates continue dropping, it’ll be harder to find 5% yield with little risk. Therefore, Weintraub added that family office clients are also being advised to consider structured notes, which can combine bonds and derivatives across various assets into one financial instrument. It balances out gains with fixed returns. They can be customized to fit priorities and risk appetite, duration requirements, or double-down on sector exposure.

Fixed income

The number one goal for any family office is the preservation of capital. Fixed income has been one way to achieve that. Right now, government and corporate investment grade bonds, which are lower risk and less volatile, are where money is moving. That trend is expected to remain so long as cash can still yield above 4% from a savings account, he noted.

“If we look seven years ago where there was no yield on the Treasury side, you had to find it somewhere. So people were willing to take risk in high yield in an emerging market local debt,” Weintraub said. “So, I think that there’s comfort in the IG space today and you can get 6%, 7%, 8% versus your savings account of four and change.”