Baby boomers were hit hardest by inflation last year. Here’s what they buy compared to younger Americans.

Americans over 65 faced a higher inflation rate in 2023 than younger groups, based on the types of things they tended to buy.

Senior discounts might be particularly handy these days for America’s retirees and older workers.

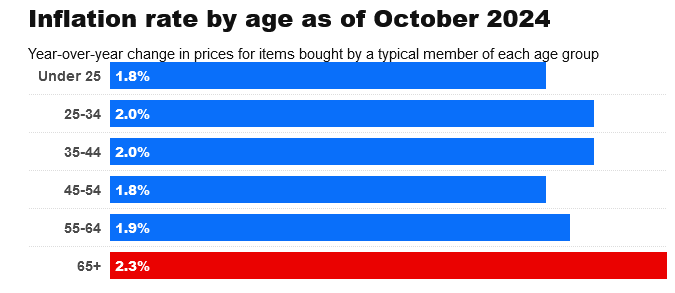

In 2023, Americans 65 and older experienced the highest inflation rates among age groups based on the items they buy, per an analysis from Wells Fargo economists. The analysis found that mounting healthcare costs, which have outpaced broader inflation, particularly weighed on baby boomers, who are between about 60 and 78 years old. Older Americans did not spend as much on things like gas, which saw price declines.

It’s not just healthcare that ate away at boomers’ wallets. Business Insider analyzed data from the Bureau of Labor Statistics’ annual consumer expenditures survey for 2023 and looked at how Americans 65 and older spent on different categories compared to all households.

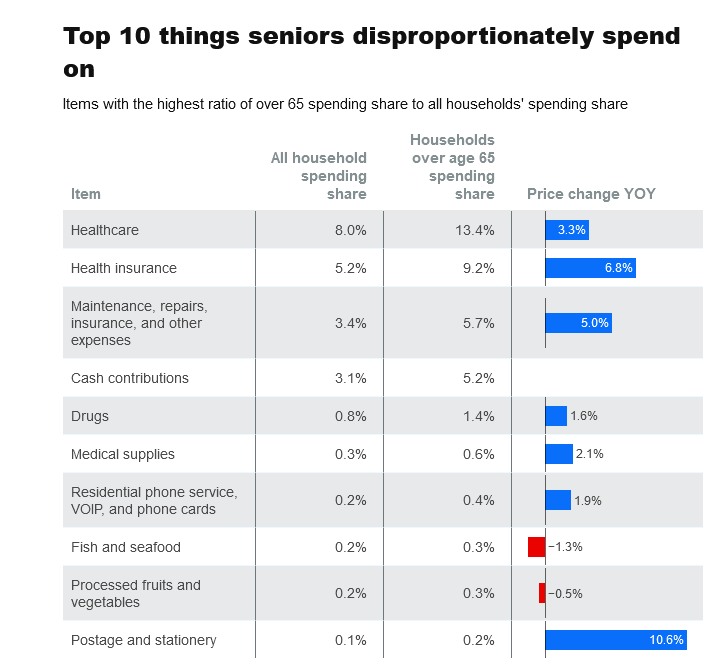

Across all age groups, health insurance made up around 5% of annual spending in 2023; for Americans over 65, it was just over 9%. That’s likely making a big dent in their finances, with health insurance prices rising nearly 7% year over year in October, per detailed consumer price index data from BLS, more than double the broader year-over-year inflation rate in October of 2.6%.

In addition to spending more on health insurance, Americans over 65 disproportionately spent on healthcare itself in 2023; they devoted 13.4% of their annual spending to healthcare, while Americans of all ages allocated just 8% of their spending on the same expenses. They also outspent other Americans on life and other personal insurance.

People 65 and older spent more of their incomes on items subject to higher inflation than other age groups. For instance, older Americans devoted around 0.2% of their spending to postage — a small expense, but one where prices have grown by nearly 11% year over year.

We want to hear from you. Are you an older American with any financial regrets that you would be comfortable sharing with a reporter? Please fill out this quick form.

Boomers also spent a greater chunk of their annual expenditures on maintenance, repairs, insurance, and other expenses. Year over year, the cost of repairing household items grew by 5%.

Meanwhile, Gen X households have weathered inflation better than other generations. Wells Fargo’s analysis showed that Americans between 45 and 54 experienced 1.8% inflation year over year, while those 55 to 64 saw 1.9% inflation. This is because Gen X, on the whole, spent less of their budgets on items with high price growth like housing and healthcare.

A recent Gallup survey of 1,001 adults suggested Americans are doing well in retirement overall. Gallup found that three in four retirees said they could live comfortably off their savings, compared to less than half of non-retired Americans who expect to have enough for a comfortable retirement.

Still, even wealthier Americans told B-17 they’ve been hit hard by inflation.

Over the past few months, over 2,000 older Americans have shared their biggest regrets with B-17 in a voluntary, informal survey. An overwhelming majority said they’re worried about their finances. A majority wished they had saved more or invested better for their retirement, and hundreds said they’re still working or relying heavily on Social Security to get by.

Hundreds said health conditions, the death of a spouse, and job loss have contributed to less rosy finances. A few dozen said they weren’t sure how much to save for retirement and spent too much shortly after retiring, hurting their wallets.

Many said they’ve cut back on experiences and more expensive purchases to focus on essential goods. Others said they’ve fallen through the cracks in the nation’s social safety net, making too much for government assistance but not enough to feel comfortable.