Balyasny leads the way for multistrategy managers in a roller-coaster November. Here’s how firms like Citadel, Millennium, and more performed.

Dmitry Balyasny speaks at the 2018 Milken Conference in Beverly Hills, California.

The biggest names in hedge funds ended an up-and-down month in markets in the black.

Multistrategy managers overcame the volatility surrounding Donald Trump’s electoral victory — when markets initially skyrocketed but then sold off briefly before rebounding — with firms like Balyasny, Schonfeld, and Citadel posting strong returns for the month.

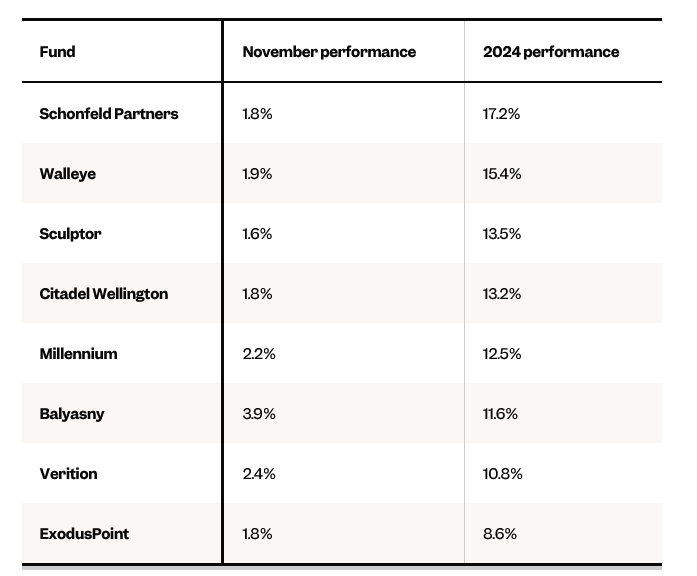

Balyasny led the way among its peers with a 3.9% gain in November to bring the Chicago-based manager’s 2024 returns to 11.6%, a person close to the manager confirmed.

Schonfeld meanwhile continued its strong streak for the year, returning 1.8% in its flagship fund. The New York-based manager is up 17.2% for the year, a person close to the firm said. Ken Griffin’s Citadel was also up 1.8% last month in its Wellington strategy, while Izzy Englander’s Millennium made 2.2%.

The billionaires’ firms are up 13.2% and 12.5%, respectively, on the year. Bloomberg previously reported on the firms’ November returns.

While multistrategy managers’ returns were dwarfed by those of macro managers like Rokos and Discovery Capital that took big swings on Trump’s victory, their biggest selling point — steadiness in turbulent markets — was proven true in November.

See below for more performance data. Additional firms will be added as their numbers are learned. The managers declined to comment or did not immediately respond to requests for comment.