Bank of America says small caps are at their cheapest in 14 months. Here are 12 stocks expected to soar by more than 100% to 200%, according to Wall Street’s top analysts.

- Bank of America says small caps are trading at a 19% discount.

- During economic recovery, small-cap stocks, especially value, tend to outperform.

- Below is a list of the sector’s names with the highest expected gains, as compiled by TipRanks.

If you’re planning to spend your hard-earned money on Black Friday sales, you should set aside some money for stocks.

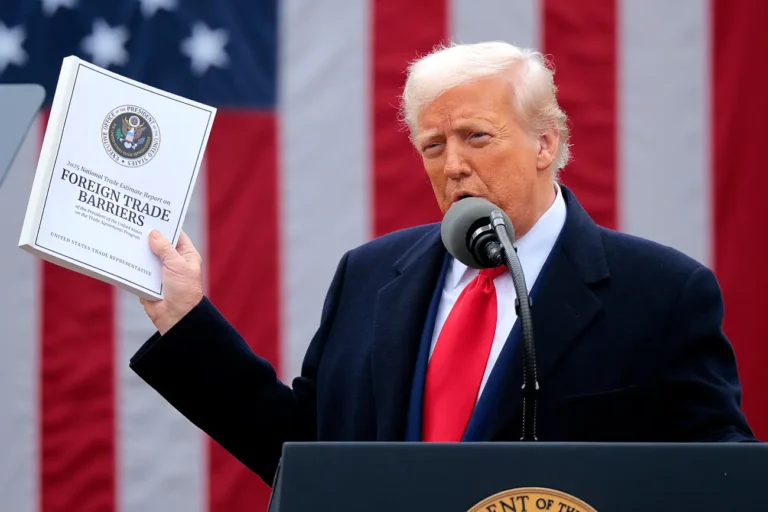

Some stocks are also on sale, according to a recent note from Bank of America. Small caps, in particular, have been falling since July 31. The Russell 2000, the sector’s benchmark, has fallen nearly 16% since then. According to a November 13 note from equity strategists Jill Carey Hall and Nicolas Woods, the index’s forward price-to-earnings ratio is now at a 14-month low and the lowest since September 2022. Small-cap stocks are currently trading at a 19% discount.

According to Bank of America’s US Regime Indicator, value names have historically outperformed growth during an economic recovery, which is where we are now. However, small-cap stocks have generally outperformed mid- and large-cap stocks during recovery periods.

An October 26 note from Bank of America listed 1 3contenders among its buy-rated mid- and small-cap value names. Alarm.com Holdings (ALRM), e.l.f. Beauty (ELF), NMI Holdings (NMIH), Strategic Education (STRA), BellRing Brands (BRBR), BWX Technologies (BWXT), Celsius Holdings (CELH), Ciena Corporation (CIEN), Deckers Outdoor Corporation (DECK), RH (RH), Trex Company (TREX), and Wingstop (WING) are among them.

TipRanks, a stock-market research platform, compiles a list of strong-buy-rated stocks that top-rated Wall Street analysts most recommend for investors looking for higher returns.

TipRanks designates four or five-star ratings to the top 20 to 30% of analysts based on three main criteria:

- An analyst’s average returns

- Profits or losses on recommendations

- The volume of corrections and transactions they make

The 12 names below were pulled from TipRanks’s list of top strong-buy-rated stocks with the highest potential upsides within the small-cap category. They have “Smart Scores” above seven, referring to a TipRanks proprietary ranking system from one to 10 that measures eight factors, including how the best-performing analysts rate stocks, whether hedge funds are buying or selling, and fundamental and technical analysis.

1. 89bio

Ticker: ETNB

Market Cap: $563.09M

Top analysts’ price target: $28.00 (293.81% Upside)

2. Arcus Biosciences

Ticker: RCUS

Market Cap: $1.01B

Top analysts’ price target: $47.00 (255.25% Upside)

3. Viking Therapeutics

Ticker: VKTX

Market Cap: $978.28M

Top analysts’ price target: $33.33 (243.96% Upside)

4. 4D Molecular Therapeutics

Ticker: FDMT

Market Cap: $464.69M

Top analysts’ price target: $33.00 (213.39% Upside)

5. Syndax Pharmaceuticals

Ticker: SNDX

Market Cap: $943.63M

Top analysts’ price target: $36.33 (169.71% Upside)

6. Vir Biotechnology

Ticker: VIR

Market Cap: $1.18B

Top analysts’ price target: $23.00 (161.66% Upside)

7. Aspen Aerogels

Ticker: ASPN

Market Cap: $642.15M

Top analysts’ price target: $23.00 (151.09% Upside)

8. Scholar Rock

Ticker: SRRK

Market Cap: $724.68M

Top analysts’ price target: $24.50 (159.95% Upside)

9. Treace Medical Concepts

Ticker: TMCI

Market Cap: $382.19M

Top analysts’ price target: $14.80 (120.90% Upside)

10. Xencor

Ticker: XNCR

Market Cap: $1.04B

Top analysts’ price target: $40.50 (141.36% Upside)

11. Cabaletta Bio

Ticker: CABA

Market Cap: $711.71M

Top analysts’ price target: $37.00 (111.91% Upside)

12. IHS Holding

Ticker: IHS

Market Cap: $1.83B

Top analysts’ price target: $11.33 (100.89% Upside)