Billionaire investor Ray Dalio has a solution for China, but it’ll need Beijing to radically remake its own rules

Ray Dalio, founder of Bridgewater Associates, is again promoting the idea that China should undertake a “beautiful deleveraging.”

Billionaire investor Ray Dalio thinks China can save its economy through two major debt policies, though that would require big changes to how China has operated for years.

However, the Bridgewater Associates founder said that if China does not enact them soon, the country risks suffering as Japan did in its “Lost Decade.”

In a LinkedIn post on Tuesday, Dalio wrote of what he called a “beautiful deleveraging,” or an aggressive, two-pronged approach to solving debt issues.

Dalio wrote that Chinese leader Xi Jinping’s unprecedented stimulus sparked a “big week” for economic optimism, but it won’t be enough.

If China wants its big week to go down in the history books as a turning point to success, then Beijing has to “do what it takes, which will require a lot more than what was announced,” Dalio said.

What’s a “beautiful deleveraging?”

The concept isn’t new for Dalio, whose company runs the biggest foreign hedge fund in China. He coined “beautiful deleveraging” after the 2008 crisis.

According to him, the first move involves a country restructuring bad debts to free up beleaguered borrowers from their loan commitments.

They’ll have to be spread out over time in a “balanced way” to avoid leaving debtors out to dry and prevent a sudden shock to the economy, Dalio wrote.

The billionaire added that China should simultaneously lower interest rates to encourage fresh loans.

The interest rate cuts would ideally be so drastic that they run below inflation and nominal growth rates, Dalio wrote.

If the government can’t implement that policy, it could monetize debt instead while weakening China’s currency to lighten the burden, he added.

These measures essentially aim to do two things: Give China’s struggling borrowers — of which there are now many — some breathing room to grow their businesses while encouraging them to borrow more and take risks.

“This beautiful deleveraging can only be done in countries that have most of their bad debts denominated in their own currencies and have most of the debtors and creditors as their own citizens, which is the case for China,” wrote Dalio.

Why China’s massive debt is seizing up its economy

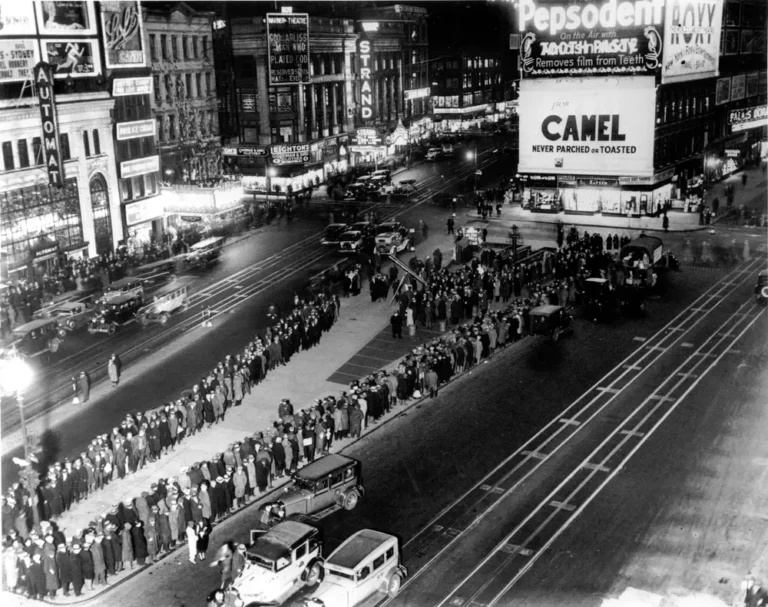

China’s economy has been slammed by swelling debt levels after years of businesses and local governments gobbling up loans on lax interest rates, only for many to later find themselves overleveraged.

The country’s debt-to-GDP ratio is nearly a whopping three times as high as it was 10 years ago, and that’s been fueling a snowballing pessimism in the country as major sectors like real estate buckle under the weight of their lending payments.

And because of it, many businesses and people have been holding on to their cash and not spending, thereby stalling the economy.

Dalio believes a “beautiful deleveraging” would help the country climb out of that rut, largely by making it so that holding cash in the bank would be one of the most unattractive options in China.

“Doing these things starts to rekindle ‘bottom fishing’ and ‘animal spirits.’ We are clearly seeing that happen now,” he wrote.

Major ‘painful’ changes needed

Still, Dalio warned that his “beautiful leveraging” would cause Beijing to face “difficult and painful changes.”

A debt restructuring would fundamentally reshape how years of previous loans in China are now handled and could badly hit many people’s wealth, especially if they lose out on the new terms, Dalio wrote.

“Imagine the situation of a perfectly good company that lent to the local government and/or is dependent on local government spending facing the current situation,” Dalio wrote. “Who should do what in what amounts to deal with this situation?”

Dalio also urged major reform for China’s tax system, saying it has been “highly ineffective at the national, provincial, and local government levels” and making it difficult for regional governments to stay out of the red.

And he warned of China’s rapidly aging population, calling a recent move to raise the retirement age a “minor change in policy.” The decision was already deeply unpopular and rewrote a decadeslong standard that retirement was possible at 50.

Yet Dalio emphasized that China is at a crossroads. If Beijing doesn’t start a “beautiful deleveraging,” he said, it risks allowing its crisis to drag on and create an “economic and psychological malaise like Japan experienced.”

China’s debt crisis is just one of five challenges that Dalio believes the country faces in a coming “100-year storm.” The others include the climate crisis, the US-China tech war, its souring ties with Washington, and growing wealth inequality.

The investor has long styled himself as bullish on China, but regularly speaks out on fiscal decisions the country should make to avoid catastrophe.