Bitcoin’s latest rally will push the token 60% higher by April of next year, strategist says

Bitcoin looks poised to soar 60% by April 2025 as a technical breakout takes hold in the cryptocurrency, according to Ned Davis Research.

On Thursday, the Wall Street research firm upgraded bitcoin “as a long-only trade” with a $121,000 price target.

“We like the set-up for Bitcoin. The crypto is breaking out on optimism of a Trump victory and we see the price running with little resistance at least until Trump takes office,” said Pat Tschosik, strategist at Ned Davis Research.

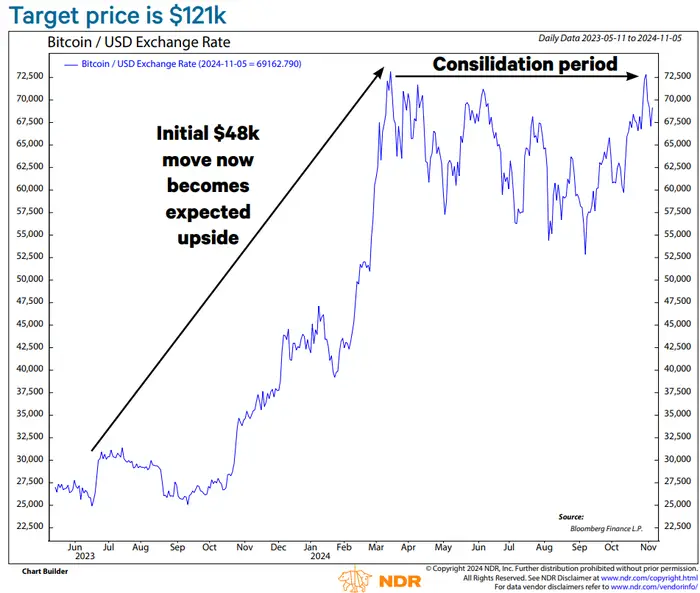

The bullish setup in bitcoin is based on the cryptocurrency consolidating sideways since it peaked at just under $74,000 in mid-March.

Bitcoin has since broken above the seven-month consolidation range, surging past the $75,000 level following Donald Trump’s election win.

That’s a bullish technical breakout as long as prior resistance around the $73,000 level can hold as a new support level, where buyers step in during periods of weakness.

And that’s how Tschosik is positioning the bitcoin trade recommendation in terms of managing downside risk.

“If Bitcoin simply breaks below its support (former resistance) level near $73K, its March 2024 high, we will likely downgrade. This represents about 5% downside from current levels near $75.5K,” Tschosik said.

Tschosik’s price target is based on a measured move from around $25,000 in June 2023, when the cyclical bull rally in bitcoin began, to around $73,000 in March.

The $48,000 difference between $73,000 and $25,000 is added back to the breakout level of $73,000, generating the $121,000 price target.

But Ned Davis Research won’t wait for the price of bitcoin to reach $121,000 to close out the trade, and instead will rely on real-time indicators as to when to realize potential gains.

“We want to stress that we will rely heavily on our favorite short and intermediate-trend indicators for closing this trade rather than simply reaching a price target,” Tschosik said.