Bloomberg’s chief economist shares why there’s a 70% chance the US economy is recession-bound — and warns a stock-market sell-off could sink consumer spending

There’s a 70% chance the US economy is either in a recession or headed toward one in the months ahead, according to Bloomberg Economics Chief US Economist Anna Wong.

While that might be strange to hear for the majority of investors who see a soft landing coming as the Fed cuts rates, the biggest indication for Wong that a downturn is ahead is the deterioration in employment indicators.

The one that stands out most to Wong is the much-talked-about sustained rise in the unemployment rate. The Sahm Rule, measuring the change in the rate’s three-month moving average, now sits at 0.57%, having crossed its 0.5% recession threshold.

Wong believes the 0.5% level is actually conservative and that a mark of 0.33% is just as accurate in identifying a downturn in real time.

Also pertinent to Wong’s downcast view are the more under-the-radar employment flows data, or the number of people going into or coming out of various states of employment.

A rising number of people heading into unemployment isn’t necessarily a problem if they can quickly find another job. But hiring is slow right now, with job openings and hiring intentions falling. This is causing a growing number of unemployed people to stay unemployed, a pattern seen in prior recessions, Wong pointed out.

Wong said this can then set off a vicious cycle that fuels a further rise in the unemployment rate, and is why she said it would be “unheard of” for the Fed to keep the unemployment rate at 4.4% or lower.

“Initially, in all the recessions, this is how the unemployment rate tends to rise,” she said. “Then the next stage is, well, firms revenues are down, the attrition rate is down, and they have to resort to layoffs. And that usually happens two quarters into a recession.”

Can the spending boom last?

Another key metric economists watch to judge whether the economy is in recession is consumer spending, which makes up around two-thirds of GDP in the US.

While spending is still strong in terms of headline numbers, Wong is skeptical about the health of the overall consumer and how long the spending boom can last.

With the monthly savings rate at 2.9%, one of the lowest levels since the Great Recession, Wong said that spending has to be coming from two things. For the wealthiest 20% of Americans, it’s robust household balance sheets that have gotten a boost over the last few years from rising home prices and record highs in the stock market. For poorer Americans, it’s credit card debt.

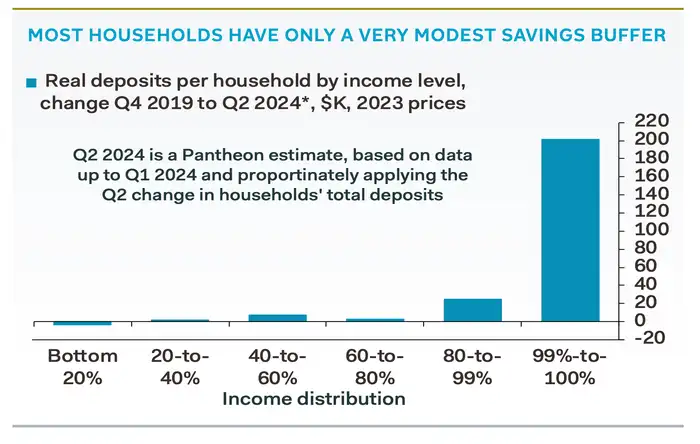

The top 20% indeed have benefited most from the housing- and stock-market gains. Here’s the change in savings in thousands of dollars from 2019 to 2024 across the income distribution.

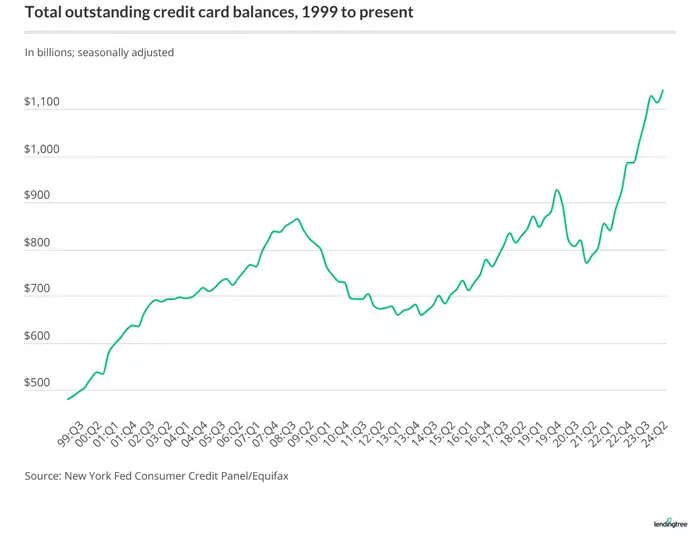

Credit card debt has also skyrocketed, as shown in the LendingTree chart below. According to Fed data, delinquencies on credit card debt have also increased almost 100% since Q1 2022.

Wong believes wealthier Americans are spending due to the wealth effect, where high asset prices boost consumer confidence and fuel spending. But if stocks undergo a correction, it could drive a reversal in this spending, slowing economic growth.

“I don’t think we have tested the resiliency of the consumer,” she said. “And my guess is, should there be an equity correction, then we would see the consumption drop off relatively quickly.”