Boeing had a tough 24 hours, but with CEO Kelly Ortberg’s turnaround plan, analysts remain hopeful

Boeing union members rejected the company’s latest contract offer on Wednesday evening.

Boeing had a day to forget Wednesday.

It began with the company releasing its third-quarter earnings report, where it posted a huge loss of $6.1 billion, largely blamed on the ongoing strike by workers at its key Seattle plant.

However, these poor results largely aligned with Wall Street’s predictions, and Boeing’s stock price dipped only marginally in pre-market trading.

CEO Kelly Ortberg vowed to “return Boeing to its former legacy” and said the company would focus on changing its culture. He was interviewed on CNBC and reiterated his commitment to transformation, saying he wants to: “Get back to what everyone wants Boeing to be, this iconic company building great aircraft and defense systems.”

At the same time, some 33,000 union members in the Pacific Northwest were waiting to vote on Boeing’s third contract offer.

Wall Street analysts were hopeful that the 35% pay rise and increased 401(k) contributions would be approved — given that the acting Labor Secretary had flown to Seattle to help mediate talks.

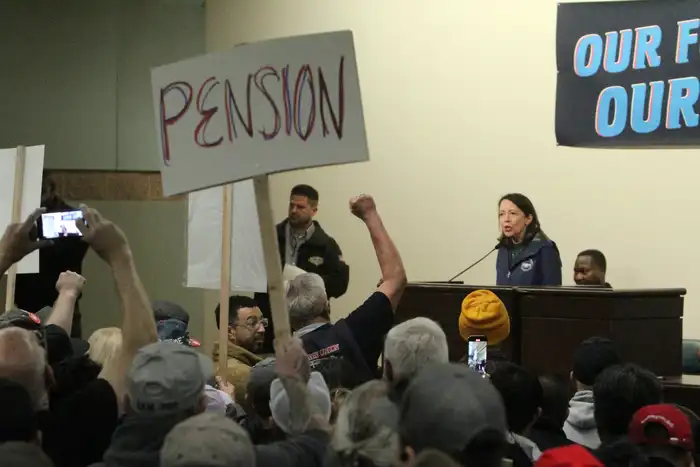

But the contract offer was again rejected, albeit by 64% of voters, rather than the more than 95% who had turned down the first offer. Boeing stock subsequently dipped 3%.

Over the four years of the deal, the pay rise would be close to the 40% that the union demanded. However, restoring the traditional defined-benefit pension plan — replaced with a 401(k) in 2014 negotiations — has been a key issue for many on the picket lines.

Boeing has appeared inflexible on this issue, with its chief negotiator telling The Seattle Times there is “no scenario” where the traditional pension plan would be restored.

Bank of America analysts estimated that restoring this pension plan would cost up to $400 million annually. At the same time, Anderson Economic Group predicted Boeing has lost over $5 billion due to the strike.

The planemaker has announced plans to lay off 10% of its workforce, plus further delays to its long-awaited 777X program.

Analysts remain positive on Boeing’s future

The percentage of workers rejecting Boeing’s newest pay deal dropped compared to previous votes.

Yet Wall Street is optimistic that Ortberg can return the planemaker to a stronger position.

“Despite all the drama associated with Boeing, we continue to believe that the company deserves a premium earnings multiple because of the expected ramp-up in production and its strong aircraft backlog,” analysts from William Blair said in a Wednesday report.

Boeing’s production has been limited as it faces supply-chain constraints and renewed scrutiny from regulators in the wake of January’s Alaska Airlines blowout. But with a backlog of 5,400 planes worth more than $500 billion, it is clear airlines still want its planes.

“If Boeing and Airbus improve deliveries, backlogs will be reduced and increase customer confidence,” Peter McNally, global head of sector analysts at business research firm Third Bridge, told B-17 in an email.

He added that a serious challenge from China’s Comac, which has been widely touted as a potential disruptor of the Boeing-Airbus duopoly, has so far failed to materialize.

“Honestly, our experts hear a lot less about Comac today than they did a few years ago, and these people have pointed to recent orders to Boeing and Airbus from Chinese customers as evidence,” McNally said.

In a note, Morningstar’s Nicolas Owens called on Boeing to lay out a “clear and bold product strategy and begin designing aircraft to meet that strategy in the next few years.”

Otherwise, he added, it could further lose ground to Airbus in the narrowbody market, where the A320 outsells the 737 Max.

Since taking charge in August, Ortberg has had to contend with many problems, and Wednesday’s union vote was certainly a further blow.

Yet, with a four-point plan to improve trust and build a new future, a path out of the crisis appears more visible than before.