Check out the 17-slide pitch deck energy storage company Skeleton Technologies used to raise $114 million in a mix of debt and equity funding from Siemens and Marubeni

- Energy tech company Skeleton Technologies has raised 108 million euros ($114 million) in fresh funds.

- The cash – a mix of equity and debt – comes from multinational Siemens and Japanese conglomerate Marubeni.

- We got an exclusive look at the 17-slide pitch deck it used to secure the funds.

Skeleton Technologies, an Estonian energy technology company, has raised 108 million euros (approximately $114 million) from multinational Siemens and Japanese conglomerate Marubeni.

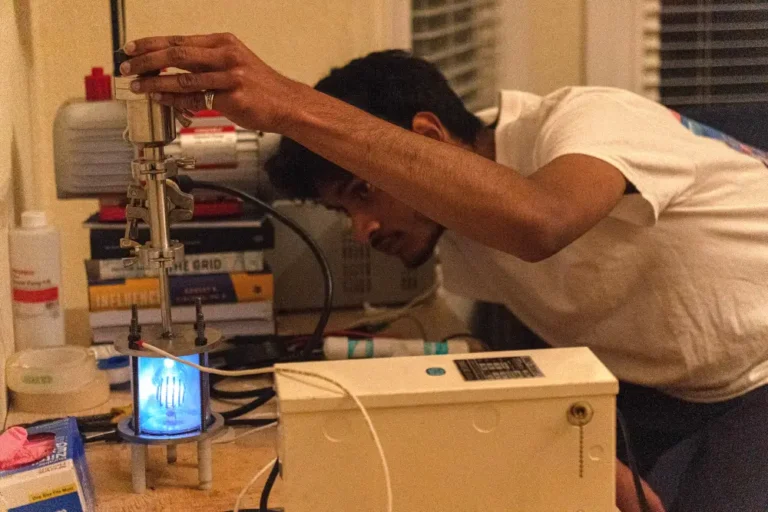

Skeleton, founded in Tallinn in 2009, manufactures fast-charging energy storage systems for transportation, maritime, the grid, and medical equipment. Its proprietary material, Curved Graphene, increases the amount of energy that can be stored in its supercapacitors. Supercapacitors are similar to batteries in that they store less energy and release it more quickly.

The new funds, which bring Skeleton’s total raised to more than 300 million euros (approximately $316 million), are a combination of equity and debt. The company stated that the majority would be equity in its Series E round, but declined to comment further.

According to Skeleton CEO Taavi Madiberk, despite a wider tech slump that has been even more pronounced at this stage, investor appetite for the funding round was strong.

“What is important about Skeleton is that our products are in use.” “We are not the next big thing; we have already arrived,” he told Insider.

“Many European companies are just getting started and are not yet in the market.” This was a key differentiator in the funding round as well. In this funding environment, tangible proof of market traction is important, but are the products available and are they available to customers worldwide?”

The funds will be used to construct a second factory – Skeleton already has one in Germany – that will be operational by the end of 2024. In addition, the company plans to increase production of Curved Graphene and its aptly named SuperBattery product, which combines the benefits of supercapacitors and batteries.

The round was co-led by strategic investors Siemens Financial Services and Marubeni Corporation, which includes Warren Buffet’s Berkshire Hathaway as a backer. Skeleton stated that Siemens is already a partner, supplier, and customer. The two are collaborating to automate and digitize Skeleton’s next factory. Meanwhile, Marubeni distributes Skeleton’s products in Asia and assists the company in gaining customers in the region.

“If you look at successful scale-ups in clean tech, they always come through a partnership,” Madiberk went on to say.

Skeleton’s primary market remains Europe, with North America as a secondary focus. It is benefiting from the “flow of government subsidies,” according to Madiberk. “Within the market, certain land grabs are taking place because we are in the midst of an industrial revolution,” he said.

Skeleton also holds “minister-level” meetings with countries; governments are interested in raw materials and strategic autonomy, according to Madiberk.

Skeleton’s 328-person workforce will grow by about 100 by the end of 2024.