China could raise nearly $1 trillion of fresh debt in the next 3 years to revive its economy

China’s fiscal stimulus efforts could include racking up almost $1 trillion in fresh debt over the next several years, according to local media.

Beijing could raise 6 trillion yuan, or $850 billion, by issuing treasury bonds over the next three years, sources told the outlet Caixin Global in a report this week. The money could be used as fiscal stimulus and to help “off-the-books debt” in local governments, the people added.

If implemented, the measures would mark the next policy plan China has unveiled to boost its sagging economy. The government rolled out a fresh monetary stimulus package in late September, which included measures like lowering interest rates and injecting $114 billion into the nation’s stock market.

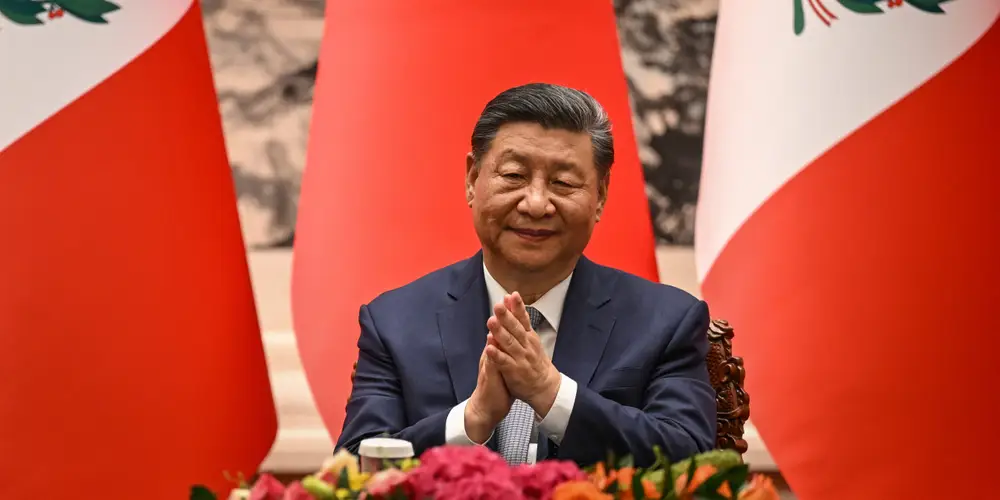

In a recent briefing, Lan Fo’an, China’s Minister of Finance, said the nation was eyeing additional fiscal stimulus measures, with the nation having a “rather large” capacity to increase its deficit, according to a CNBC translation of the event. The announcement lacked key details over how much stimulus could be announced, though analysts polled by Bloomberg were eying around $283 billion worth of stimulus to be pledged.

Chinese stocks were little changed on Wednesday, with the CSI 300 trading lower by 0.63% to 3,831. Hong Kong-listed stocks also wavered slightly, with the Hang Seng Index dipping 0.16% to 20,286.

Forecasters have questioned the efficacy of Beijing’s stimulus efforts if they aren’t met with more fiscal spending. One researcher recently estimated that the direct effects of China’s latest stimulus package may not be felt until 2025, mainly because more fiscal stimulus needs to be unlocked before the policies can bolster the nation’s economy.