China is still getting its hands on US chips — and striking back too

Xi Jinping had a stern message for Joe Biden as the presidents of the world’s most powerful nations spoke on the phone in April. If the US is adamant about containing China’s tech development, Xi said: “China is not going to sit back and watch.”

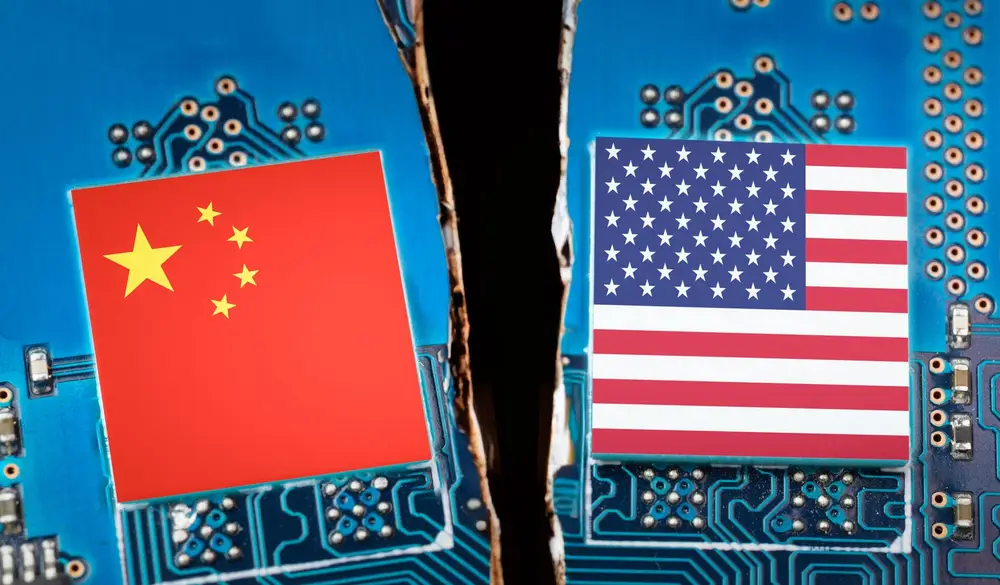

For some time now, Washington has been trying to restrict China’s access to advanced, US-built hardware needed to power smarter artificial intelligence models.

In October 2022, tough export controls were introduced to prevent Chinese chip manufacturers, such as Yangtze Memory Technologies and state-backed SMIC, from acquiring technology made with American expertise.

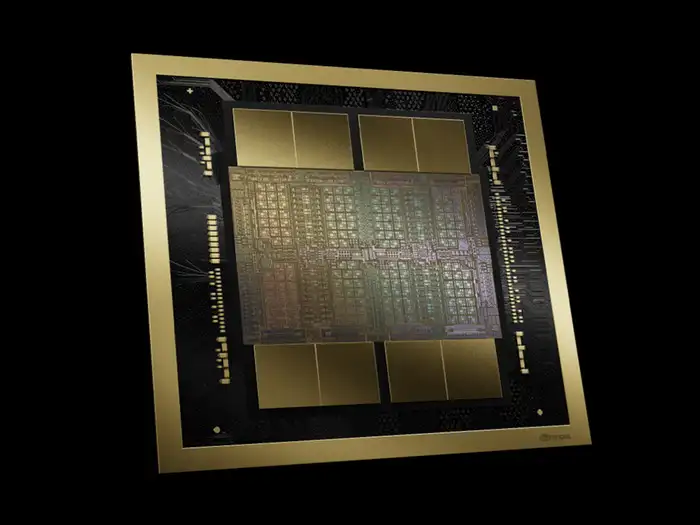

They were further reinforced 12 months later with other measures that drastically limited the ability of top Western chip giants such as Nvidia to ship their top-of-the-range gear to Chinese companies trying to keep pace with foreign rivals.

This has all been a big problem for China, of course, given that it’s spent years relying on partners overseas to source hi-tech equipment needed to bring cutting-edge innovation to its home turf.

That said, we’re starting to get a clearer picture of what China’s president meant in his warning to Biden almost five months ago: that China can get its hands on US technology if it wants — and implement devastating restrictions of its own.

China strikes back

As AI has come to dominate the technology industry globally since the launch of ChatGPT, it’s been in China’s interest to secure access to chips that offer the computing power needed to power AI applications.

But in the face of restrictions that have effectively blocked access through official channels, Chinese companies have been busy finding other means that give them continued access to chips.

In part, this has meant trying to buy up supplies of chips that find their way into black markets. According to The New York Times, Shenzhen has been witness to deals involving thousands of chips. But failing to get a hold of them physically hasn’t been make-or-break for Chinese firms.

This week, The Wall Street Journal reported that developers in China had managed to gain access to overseas servers loaded with Nvidia chips by hiding their identity from brokers through the “smart contracts” used in the cryptocurrency world to stay anonymous.

Nvidia is a global leader in the chips needed for AI processing.

Former bitcoin miner Derek Aw, who helps Chinese firms access servers in Australia running on AI chips, told the Journal he often gets “asked if we have Nvidia’s chips.”

The US government is painfully aware of this practice. In January, the Commerce Department published a proposal to address the use of US cloud services by “foreign malicious actors” who could undermine national security by training powerful AI models. It’s all legal for now, though.

China has also stepped up restrictions of its own to hurt the West.

Last year, the country introduced curbs on the supply of key minerals needed in the chip industry, such as gallium and germanium. Given China is the world’s primary producer of these minerals, that has become a bit of a problem.

Feeling the pinch

A Financial Times report this week noted that China’s rules governing supply threatened to create shortages of the vital minerals and triggered price rises. The implications are being taken seriously.

Historian and economics commentator Adam Tooze wrote on X: “China is by far the most important supplier of Gallium that everyone needs for semiconductors. So, when Beijing slaps on controls, the world feels the pinch.”

Meanwhile, macroeconomist Philip Pilkington wrote that “Western semis will be slowly choked” in response to the impact of the mineral shortages.

Just how much pain this policy will cause in the West over the long term is still uncertain. But it’s clear China is not going to just sit back and watch as the West tries to lead the AI race.