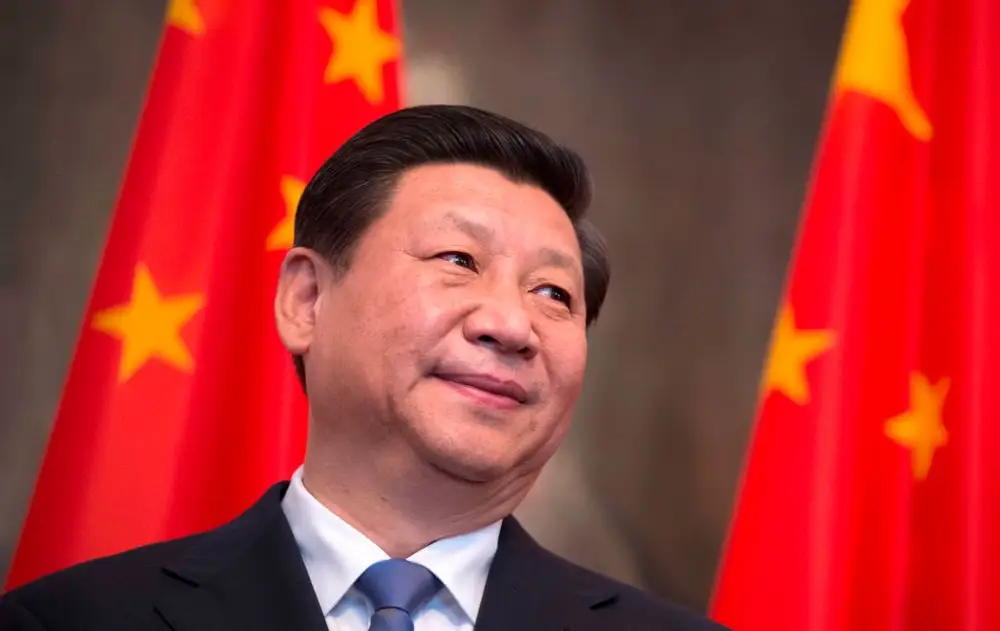

China’s surprise stimulus could be a red flag, so investors should approach the nation’s long-awaited rally with caution

China’s Xi Jinping may be dealing with a worse economy than he’s willing to acknowledge.

Chinese stocks had their best single-day showing in years earlier this week after China unexpectedly unveiled new economic stimulus efforts, but the long-awaited rally might not last.

The flurry of surprise support was designed to kickstart an economy that has been struggling since the pandemic. Unlike the US, the world’s second-biggest economy has had a lackluster recovery, though China hopes to reverse that by easing financial conditions and housing rules.

On the monetary front, the People’s Bank of China slashed banks’ reserve requirement ratio, cut deposit rates to help financial firms’ net interest margins, and reduced reverse repurchase rates modestly. China also introduced a relending program for share buybacks.

China also lowered second-home buyers’ minimum down payment ratio from 25% to 15% and cut existing mortgage rates by half a point to ease the burden on current homeowners.

Individually, each of these changes would be noteworthy. Put together, they’re head-turning.

“This is the first time since the pandemic that the central bank offered a combination of rate cuts, RRR cuts, and structural monetary policies at the same time,” Betty Wang, the lead economist at Oxford Economics, wrote in a note this week.

Monetary stimulus is a half measure — not a cure-all

While the consensus in markets is that these moves are steps in the right direction, many strategists and economists believe China’s economy needs even more help.

“The central bank’s announcement was slightly more aggressive than expected, though we think more fiscal intervention is needed,” wrote Solita Marcelli, the chief investment officer Americas for UBS Global Wealth Management, in a September 24 note.

Lorraine Tan, Morningstar’s director of equity research for Asia, also thinks monetary stimulus won’t be sufficient. While adding liquidity into China’s system should help, it may not do much to address the country’s stagnant consumer spending. Fiscal stimulus will soon follow, in her view.

“The government appears more willing to intensify efforts, and this should help reduce the risk of a deeper slowdown rather than one where GDP growth expectations go back to 5+%,” Tan said in written commentary sent to B-17.

Brian Mulberry, a client portfolio manager for Zacks Investment Management, seconded those predictions that more stimulus is coming. That call stems from his suspicion that China’s economic situation is more dire than the government will admit or disclose with its data.

“I don’t necessarily think this is the only step that China’s going to have to take to prop up their economy,” Mulberry said in an interview. “Things might actually be weaker underneath the surface than they’re letting on.”

Although China’s exports boomed to a two-year high in August, its imports were startlingly low.

“The weaker-than-expected August economic data suggest that the risk of missing this year’s growth target has grown,” Wang wrote.

Even if China isn’t already suffering from a substantial slowdown, it’s clear that the timing of its stimulus isn’t coincidental.

Central banks around the world have eased monetary policy, including the Federal Reserve, which just cut interest rates by half a point. That allows China to follow suit without hurting the yuan. In fact, China’s currency is at its strongest value relative to the US dollar since mid-2023.

“I think the Fed move paved the way for the People’s Bank of China to cut rates without worrying about the currency today,” said Jeff Kleintop, the chief global investment strategist at Charles Schwab, in written commentary sent to B-17.

China also could be trying to get out ahead of a Donald Trump victory, since he promised to implement more tariffs if given the opportunity. Economist Rory Green had expected China to hold off on stimulus until after the election, but the People’s Republic might feel as if it can’t wait.

Or, as Mulberry pointed out, President Xi Jinping may have concluded that there’s no need to wait since Democrats’ stance on China isn’t dramatically different from that of Republicans.

“It seems like the policies really aren’t that far apart,” Mulberry said. “The Biden administration had the opportunity to relieve the tariffs that the Trump administration had put in place. They chose not to. My suspicion would be, you would just simply see more of the same. That’s just the most likely outcome, rather than some type of a radical change.”

China’s rally may fade, but opportunities remain

Investors in Chinese stocks have waited ages for the government to better support its markets, so these latest monetary stimulus measures were a cause for celebration.

However, many strategists are on guard for a head-fake rally. History says their skepticism is warranted, as China’s past stimulus efforts have often failed to lead to sustainable gains.

“We may already know how this is all going to end,” Kleintop said. “We know that Chinese stocks have rallied 20% in the past when hopes about a stimulus-driven turnaround happen — as happened in May of this year — but that rally fizzled as details revealed plans were not as big or broad as hoped.”

Even if this surge holds up, it won’t necessarily spark a self-fulfilling prophecy that provides a lasting boost for China’s economy. Higher stock prices may lift consumer sentiment, but Kleintop observed that confidence in China’s property market is still an issue as property prices slide.

In Mulberry’s view, the risks of investing in Chinese companies outweigh the potential upside.

“You need to be aware of the downside risks, that the Chinese economy could potentially be worse than expected — and it could be softer for a longer period of time than expected,” Mulberry said.

But others like Tan from Morningstar believe this bad news is reflected in Chinese stocks’ cheap valuations. Surprisingly, she’d recommend targeting companies that aren’t exposed to exports, which have been the country’s strength, due to slower global growth and rising geopolitical risks.

The team at UBS Global Wealth Management is also cautiously optimistic about Chinese stocks after this news. Marcelli would steer clear of property developers, for obvious reasons, but would dabble with leading property agencies as well as state-owned enterprises in dividend-heavy sectors like utilities, telecommunications, energy, and financials.