Chinese stocks drop as Trump’s presidency spells more tariff risk

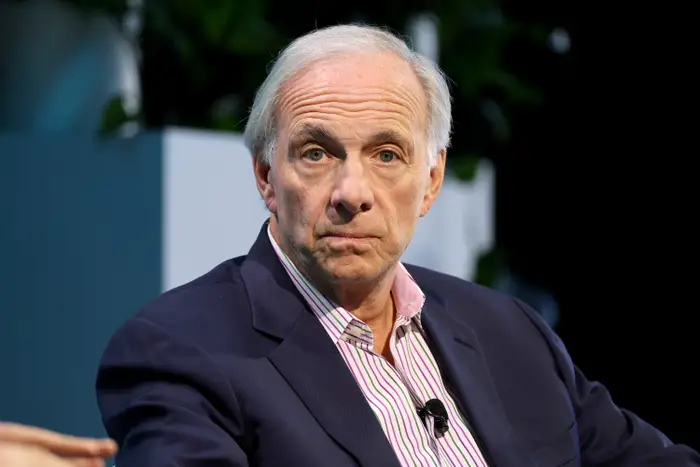

China’s leader, Xi Jinping, has had a complicated relationship with US leaders.

Chinese markets aren’t celebrating Trump’s presidential win.

Hong Kong absorbed most of the fallout, with the Hang Seng China Enterprises index dropping 2.6% on Wednesday. China’s CSI 300 slid 0.5% after declining as much as 1% at intraday lows.

Wednesday’s sell-off reflects heightened fear that global trade relations with the US could turn sour in Trump’s second term. Analysts have warned of impending trade wars if the president-elect fulfills his promise to implement universal tariffs, pledging 60% duties on Chinese exports.

“We believe that tariffs are the most potentially consequential policy from an economic perspective,” UBS wrote in a note Wednesday. “The mooted 60% tariff on imports from China and a 10% tariff on imports from the rest of the world could make much of US-China trade unviable, reduce US domestic demand and corporate profits, and lead to lower GDP growth around the world, particularly in China.”

This fresh uncertainty also weighed on international currencies. China’s offshore yuan notched its largest one-day drop since October 2022, falling as much as 1.3% against the US dollar.

Still, the impact on China’s mainland stock market was mute compared to its Hong Kong counterpart as investors awaited an expected stimulus boost on Friday.

Bank of America expects Beijing to announce 6 trillion worth of yuan in bond issuance over three years to swap local government debt. If so, this would signal more willingness by the central government to take on more fiscal responsibility, analysts wrote on Tuesday — a “welcoming gesture” for markets.