CNBC anchors and insiders worry about their futures as Comcast looks to unload the network

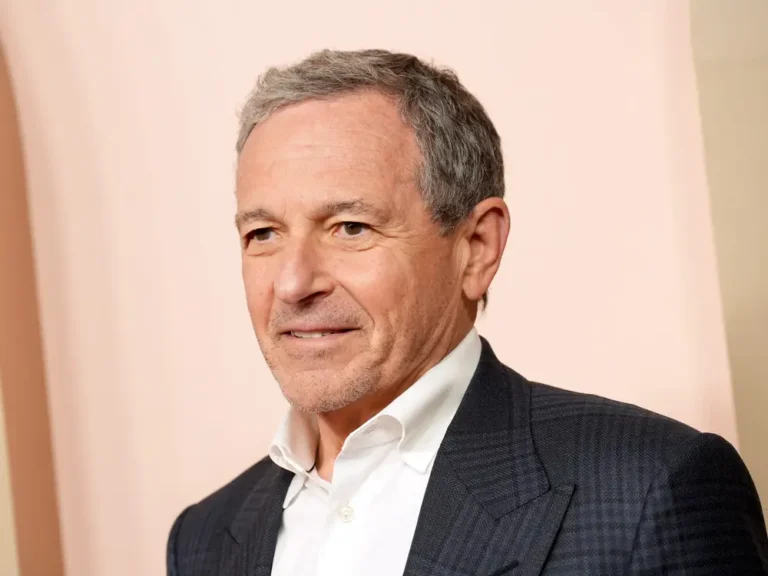

CNBC’s Joe Kernan spoke about the spinoff on air.

CNBC anchors turned their signature irreverent style on themselves on Wednesday, as their parent Comcast became a headline in announcing plans to spin off the business news network along with many other cable assets.

“We’re going out into the cold, cruel world,” Joe Kernan, co-anchor of “Squawk Box,” quipped on air.

It’s no secret that the cable business has long been in decline as viewers drift to streaming services, and fellow CNBC anchor David Faber came up with this analogy to describe the situation: “We’ve been on a life raft and it’s kind of been sinking. Now we’re all going to be able to swim for ourselves, you know, so it’s up to us.”

“Maybe we can latch on to a bunch of other people drowning,” Kernan replied.

Comcast brass presented the deal, which will see it spin off nearly all of its cable networks into a separate entity headed by Mark Lazarus, now chairman of NBCUniversal’s media group, as a way to grow its remaining businesses while enabling the spun-off networks to consolidate with others.

Bravo, the home of the Real Housewives franchises and other reality fare, will remain part of NBCU, along with its film and TV studios, Universal theme park, the NBC broadcast network, and streaming service Peacock.

“That Lazarus guy, he’s amazing,” Faber said, adding that he was “just trying to get on his good side.”

Analysts — including those featured on CNBC — did not hold back on Wednesday about what the spinoff means for the cable network.

“This is them saying we no longer want to be in this business, this is no longer a growth business,” Rich Greenfield, cofounder of LightShed Partners, said of Comcast during a CNBC segment. For CNBC specifically, he said, the question is: “Can these networks stand on their own?”

“Rich, I think I like you less today,” Becky Quick, an anchor on “Squawk Box,” responded to the analyst later during the broadcast.

Others provided further analysis of the deal.

CNBC’s Julia Boorstin laid out questions about the deal, suggesting the so-called SpinCo could make meaningful acquisitions from other media companies in transition like Warner Bros. Discovery, Paramount, and Starz.

“One of my sources very close to the situation said, ‘This isn’t the end, this is the beginning,'” she said. “The question is, what else does this company acquire, how do they try to squeeze as much revenue as possible from these linear networks, and what do they do with them from a digital perspective in terms of streaming. And what do they do in terms of non-television revenues, things like events, things like communities.”

Elsewhere, others inside NBCU had their own questions and concerns about the spinoff.

One question for CNBC folks is whether they will maintain the prestige and workplace benefits that came with being part of Comcast.

Anxiety was running high among some staffers at CNBC in London, who worried that international offices could be hit first by any cuts in shows or personnel that might result from a spinoff. These people, like some others in the story, spoke on the condition of anonymity for fear of workplace repercussions. Their identities are known to B-17.

One concern is that the spinoff could make it harder for NBCU’s separate but co-owned news outlets to compete. NBC and CNBC have closely collaborated on reporting about topics like Elon Musk’s future role in the Trump administration that draw from CNBC’s business expertise.

An NBC News staffer told B-17 that some in the newsroom felt “blindsided” by the news.

“The message has been to integrate as much as possible, so I definitely think this raises a lot of questions about whether that can continue,” this person said.