Critics said Musk ‘overpaid’ for Twitter. Thanks to Trump and xAI, it could actually be a steal.

Elon Musk acquired Twitter at $44 billion, but investors have been writing down its paper value.

When Elon Musk bought Twitter for $44 billion, it was panned as one of the worst tech acquisitions in history. Two years, an election, and a generative AI boom later, it’s starting to look like more of a bargain.

Shortly after the deal closed in October 2022, Wedbush Securities tech analyst Dan Ives said it would “go down as one of the most overpaid tech acquisitions in the history of M&A deals on the Street.”

On paper, the $13 billion that Musk borrowed to buy Twitter, now X, has turned into the worst merger-finance deal for banks since the 2008 financial crisis.

Yet the deal has provided significant benefits for Musk. He now wields considerable influence in the incoming Trump administration after using X to throw his support behind the former president’s reelection.

Not only has X served as Musk’s political megaphone, but it’s also been a lucrative source of training data for one of the billionaire’s other ventures: xAI, the startup that’s rocketed to a $50 billion valuation just 16 months after launch.

That fresh valuation means xAI has surpassed Musk’s purchase price for X. It came with a $5 billion funding round, which The Wall Street Journal reported was backed by the Qatar Investment Authority and Sequoia Capital.

Musk launched xAI in July 2023 as a springboard to get in the AI race after cofounding and then leaving ChatGPT maker OpenAI due to differences with its CEO, Sam Altman.

The startup has made up significant ground on its rivals by using X as a source of third-party data, one of the key avenues for training large language models.

In late 2023, Musk blocked other organizations from scraping X data for free — but gave xAI continued access. That gave xAI a crucial boost.

Ellen Keenan O’Malley, a senior associate at intellectual property law firm EIP, told B-17 that xAI’s access to “third-party information through X is the potential kryptonite to ChatGPT’s edge” and a potential driver behind the rising valuation of Musk’s startup.

Although the number of X users has been falling, it had 600 million monthly active users as of May, according to Musk.

“This is a level that neither OpenAI nor any other third party can access, or at least not as easily, which provides a huge competitive edge and therefore makes xAI a valuable company,” added O’Malley.

Access to 0.3% of X’s data costs around $500,000 annually, which prices many out, Wired previously reported.

“Clearly, X’s or indeed any social media platform’s data is valuable,” Advika Jalan, head of research at MMC Ventures, told B-17.

xAI gets a boost from X data.

X marks the spot in the Musk-Trump alliance

Musk spent at least $119 million on a political action committee to support Trump’s campaign.

X played a large role, too. Musk has long been an avid poster on X, but he ramped up the volume during the election cycle. Analysis by The Economist found that the share of Musk’s political posts on X has risen from less than 4% in 2016 to over 13% this year. Since endorsing Trump, has has posted more than 100 times on some days to his more than 200 million followers.

A study published by the Queensland University of Technology this month suggested that Musk may have tweaked X’s algorithm to boost the reach of his and other Republican-leaning accounts.

Shmuel Chafets, cofounder of venture capital firm Target Global, told B-17 that “X has become a powerful tool” in Musk’s ecosystem, adding that it serves “as a platform for promotion and influence, similar to how Warren Buffett leverages the Berkshire Hathaway annual shareholders meeting and his shareholder letters.”

X didn’t always seem destined to attain such influence in Musk’s hands.

In the months and years following Musk’s takeover, an advertiser revolt ensued over content moderation concerns, the company laid off about 80% of staff, and service outages disrupted users.

Musk’s co-investors have been writing down the value of their X stakes in the two years since. In September, Fidelity, one of its investors, slashed the value of its holding, giving X an implied valuation of $9.4 billion.

Yet Musk’s support for Trump, which came after an assassination attempt against the president-elect at a rally in Pennsylvania in July, gives the tech billionaire political sway that is hard to put a price on.

Donald Trump and Elon Musk have big plans together.

Musk, who Trump said was a “super genius” in his victory speech at the Mar-a-Lago resort in Palm Beach, was selected by the president-elect to run a new Department of Government Efficiency alongside Vivek Ramaswamy, who ran in the 2024 Republican primary.

DOGE will be a “threat to bureaucracy,” according to Musk, whose remit at the newly formed department will include driving $2 trillion in federal spending cuts and slashing regulations he deems superfluous and in the way of his corporate empire. As one SpaceX official told Reuters, Musk “sees the Trump administration as the vehicle for getting rid of as many regulations as he can, so he can do whatever he wants, as fast as he wants.”

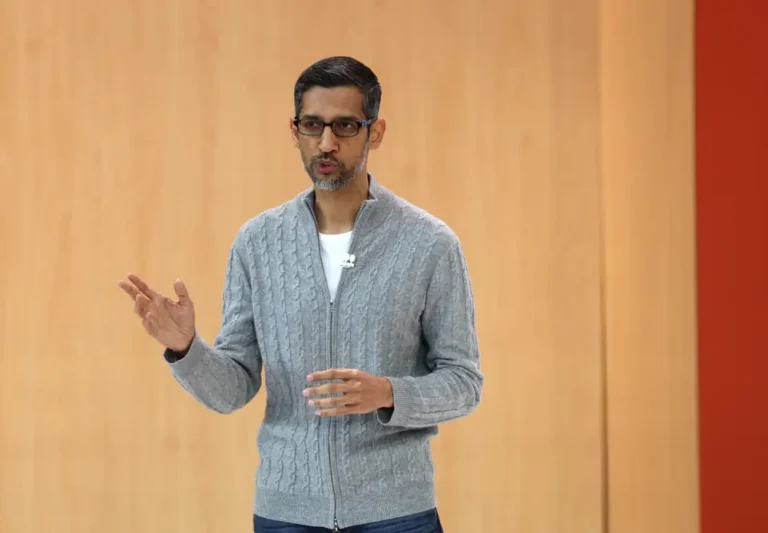

Since Trump’s election win, the billionaire has been seen side-by-side with the president-elect at a UFC fight night while reportedly joining his calls to leaders like Volodymyr Zelensky and Google CEO Sundar Pichai.

X-odus

How long X maintains a Musk-Trump bromance and supports xAI’s growth remains to be seen.

Musk, for instance, isn’t always getting his preference for cabinet appointments chosen by Trump; his choice of Wall Street veteran Howard Lutnick as Treasury secretary was shunned for Trump’s pick Scott Bessent, dismissed by Musk as a “business-as-usual choice.”

X also faces legal challenges in which judges have expressed concerns over gatekeeping user data. In May, a federal judge in California dismissed a lawsuit filed by X against Israeli firm Bright Data. X claimed Bright Data was “using elaborate technical measures to evade X Corp.’s anti-scraping technology.”

Earlier this month, X partially revived its suit against Bright Data. Should X be unsuccessful, it would raise questions about the value of the X to xAI data pipeline.

Elsewhere, the renewed interest in X rivals like Bluesky and Threads risks seeing Musk’s social media site lose users who are both key for advertising revenue and providing vital sources of data for training future models at xAI. X is now in a position where “lots of people hate it because they see it as being a weaponized instrument of MAGA,” Calum Chace, cofounder of AI startup Conscium, told B-17.

For now, though, Musk has a powerful tool in his hands with X.

“Critics may enjoy pointing out his missteps, but Musk’s ability to leverage X for both personal and business purposes reinforces his reputation as a visionary entrepreneur who consistently thinks several steps ahead of his contemporaries,” said Target Global’s Chafets.

“Ultimately, this deal could prove highly lucrative if he decides to sell or take the company public in the future.”