Disney has a kid crisis

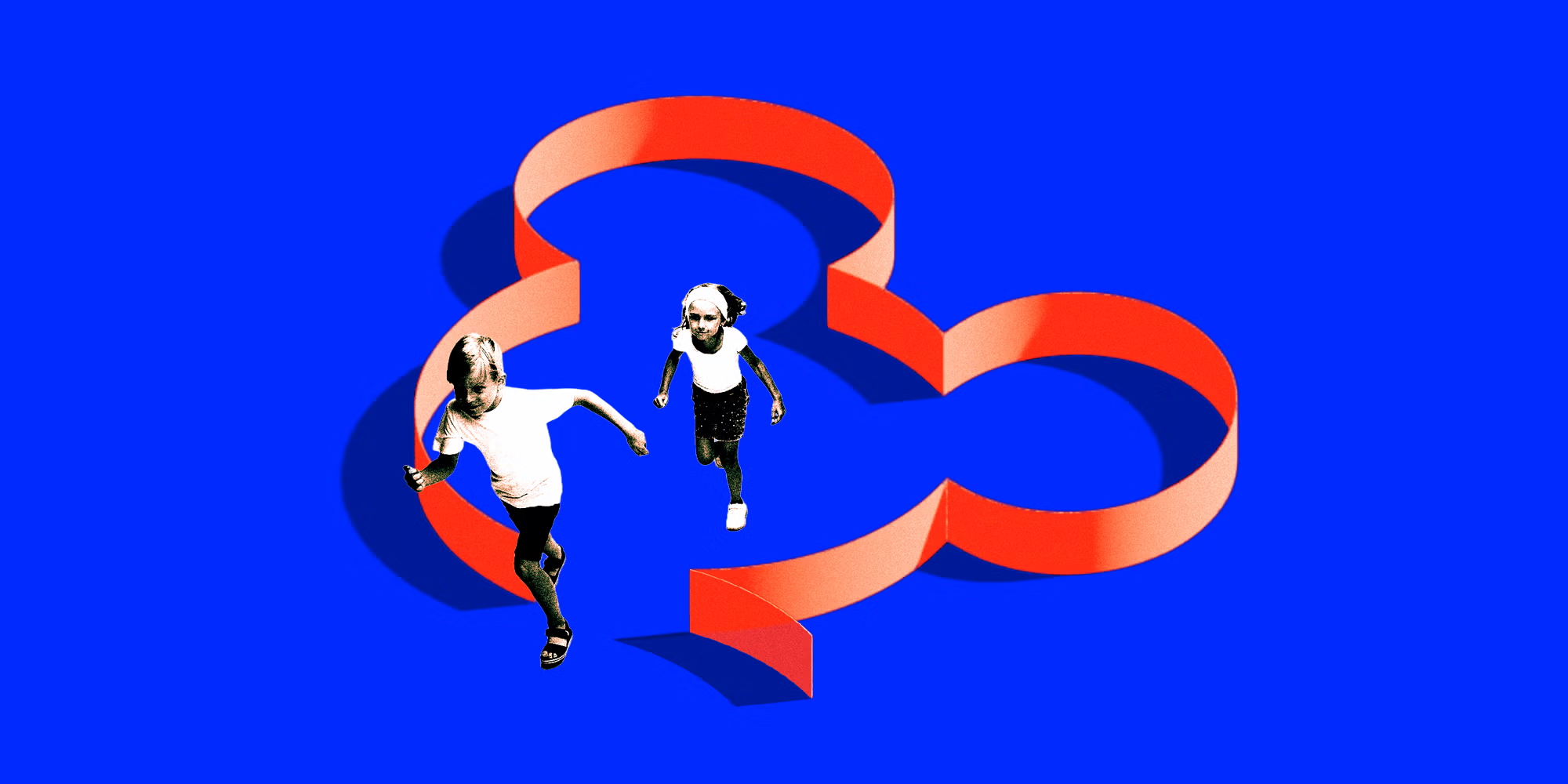

Children used to grow up watching Mickey Mouse. Now they’re all on YouTube.

When Bob Iger returned to Disney in late 2022 for his second tour as CEO, the company was in dire straits. It had just reported poor earnings, was scrambling from unpopular business moves, and was left reeling from previous CEO Bob Chapek’s bad press.

Just a year later, Iger began to put the Mouse House back in order: He delivered a strong earnings report in February, announced partnerships with Epic Games and Taylor Swift, and trumpeted a sports streaming platform. “We have entered a new era,” Iger effused to investors during his February earnings call, a nod to the news that Swift’s “Eras Tour” film would stream exclusively on Disney+. In response, the company’s stock price got a much-needed boost, and investors rejected a public challenge by the activist investor Nelson Peltz to exert control over the company.

Investors’ celebration, however, was short-lived. Amid the declining TV business, dismal box-office numbers, and the need to name a successor, Iger continues to face significant problems. Perhaps most concerning of all: Disney is losing its monopoly on kids.

The Disney Channel, once a gateway to all things Disney, plummeted from a top-10 network with nearly 2 million average daily primetime viewers in 2014 to No. 80 with a measly 132,000 in 2023. Kids are now getting their TV fix on streaming, which accounts for two-thirds of TV watch time for children 2 to 11, per Nielsen estimates. There, YouTube has become king. Kids increasingly prefer to zone out for hours watching free short-form videos instead of full-length TV episodes and movies. In April, Nielsen estimated, kids 2 to 11 watched three times as much YouTube as Disney+ content. Meanwhile, Disney said in 2022 that over 60% of Disney+ subscribers were adults without kids at home.

“YouTube is their primary platform of choice,” said Alexia Raven, a former Warner Bros. Discovery research vice president who cofounded the consultancy Maverix Insights & Strategy, where she studies kids’ viewing behavior. “It meets them where they are and meets their passions in nuanced ways. It really has shifted the entertainment landscape.”

Media companies have increasingly incorporated YouTube into their distribution strategies by releasing shorts and trailers there, but it’s not an ideal setup. Companies don’t control the distribution or revenue from their content, and it’s not clear whether YouTube works as an on-ramp to their own properties in the same way the Disney Channel did for Disney. Kids watching Disney clips on YouTube may have no need for Disney+.

Meanwhile, the movie theater is also faltering. The company had a string of box-office bombs and has focused more on creating content just for its streaming service. But by reaching for streaming dominance, Disney seems to be missing kids in a big way.

In some ways, Disney has the same challenges as other long-standing media and entertainment companies like Comcast and Paramount. For years, the conventional wisdom was that they had to get bigger to compete with the tech giants like Google and Netflix. But streaming, advertising, and the box office aren’t panning out the way they were supposed to. For Disney, the problem is existential. Without a steady stream of kids growing up on Disney content, the downstream effects for the other arms of its business — such as theme parks and merchandise — look grim. Unless it can recapture the hearts of Gen Alpha, the House of Mouse risks losing its next generation of fans to other brands.

Over the course of a century, Disney transformed a quaint cartoon about a mouse into a sprawling $185 billion empire. It became synonymous with wholesome entertainment for millions of children around the world.

Now, not so much. The most popular kids show for the past two years was “Cocomelon,” a show made by Moonbug Entertainment that airs on Netflix. Moonbug — which was acquired in 2021 by two former Disney execs — has quickly gained on giants like Disney, Paramount, and Comcast, clinching the No. 5 spot for kids’ entertainment on YouTube in 2023, according to Tubular, a social video analytics company. On YouTube, shows featuring child stars reign supreme — channels like “Kids Diana Show” (123 million subscribers) and “Ryan’s World” (37 million) have each captured the attention of millions of children.

“Kids are growing up seeing themselves on these platforms; they’re seeing kids like themselves creating the content,” Liz Huszarik, a former research executive vice president at WarnerMedia who is now a managing partner at Maverix, said.

It’s a trend that parents like Nick Macknight, a streaming media executive who lives in Dallas, knows firsthand. He used to try to get his daughters, ages 2 and 4, to watch his favorite Disney movies from childhood over top YouTube shows like “Kids Diana Show.” “I tried desperately because I love ‘The Lion King’ and ‘Aladdin,’ but they will just say, ‘I’d rather watch something on YouTube,'” he said.

This drift toward YouTube threatens a foundational gateway to the wider world of Disney. The Disney Channel, which started in 1983, used to be a marketing juggernaut for all things Disney — kids were introduced to stars like Justin Timberlake and Zendaya and hit TV movies like “High School Musical.” But it’s become just another casualty of cable’s erosion.

Disney is certainly trying to meet kids where they are. To promote “Disney Junior’s Ariel,” it released a series of shorts on YouTube. And earlier this year, it launched a short-form Winnie the Pooh series on YouTube to test interest in a long-form version. In Disney’s biggest games investment ever, Iger bought a $1.5 billion stake in Epic Games to bring Disney characters to mega-popular games like “Fortnite,” where kids and young adults are increasingly spending their time and money. The bet is that efforts like these will entice kids to seek out more content on Disney’s own platforms. But while Disney is now the top media company on YouTube, gaining traction on other companies’ platforms isn’t really a solution to its problem. (Disney declined to comment on the record for this story.)

Kids are known to watch things on repeat and play a key role in keeping their families subscribing to streaming services, which makes them especially valuable to media companies. But it can take a long time to develop new franchises that stick in order to realize that lifetime value. Another problem is that the number of kids in the US is rapidly shrinking. Increasingly, media companies are throwing in the towel. When Netflix’s growth hit a speed bump in 2022, it and other streamers pulled back on kid programming as they promised investors to make streaming profitable.

In some ways, Disney has followed suit. It’s branched out beyond kids into sports, news, and general entertainment, moving to acquire the remaining third of Hulu that it didn’t own in 2023. It is also investing more in the growing “Disney adult” market, which makes up about half of its theme-park visitors — a figure that an insider said had gradually increased over time.

Diversifying, though, has had its challenges. Like the rest of traditional TV, Disney’s TV business is in decline. The highly profitable Experiences arm, which houses its theme parks and resorts along with merchandise tie-ins, has grown more important over time, contributing 70% of the company’s operating income in 2023 compared with less than 25% a decade prior, per Bernstein. But those figures can be misleading. For the past decade, the division has increasingly relied on higher spending per guest rather than increased attendance, Bernstein found. While park and resort attendance has stayed relatively flat, spending per guest grew 7%, raising questions on Wall Street about how much growth is left in parks.

In theory, going after adult audiences — which, unlike kids, advertisers can freely target — could help Disney get its streaming business in the black, but it also puts Disney up against a bigger field of competitors like Netflix and Warner Bros. Discovery’s Max — platforms that have a head start since they aren’t seen as “just for kids” the way Disney is. Iger himself has acknowledged that general entertainment content tends to be undifferentiated compared with Disney’s franchises.

For Disney to secure its future, it needs to replenish its pipeline of young fans. Unfortunately, it doesn’t have any easy fixes. When he first became CEO of the company in 2005, Iger went on a massive buying spree, snapping up Pixar, Marvel, and Lucasfilm. But today, there’s no big equivalent company for it to buy to shore up its kid appeal. Disney already distributes the global kids phenomenon “Bluey,” but it doesn’t have the merchandising or theme-park rights to it.

It’s far too soon to count Disney out, though.

The company has survived plenty of challenges over the decades, from the Great Depression to

expensive flops like “The Black Cauldron” and “Mars Needs Moms” to criticisms over its portrayal of minority groups and a surreal public battle with Florida’s Gov. Ron DeSantis over what critics dubbed the “Don’t Say Gay” law.

Kids preferring short-form videos on YouTube over full-length episodes and movies is a problem that Disney doesn’t seem to be able to solve.

One silver lining is the strength of Disney’s franchises. The company had six of the top 10 streaming movies of 2023, including 2019’s wildly popular “Moana,” “Encanto” (2021), and “Elemental” (2023), according to Nielsen. And it’s still captivating fans with “Star Wars” and Marvel spinoffs like “Andor” and “Ahsoka,” which dominate Disney+. After a string of box-office flops, Iger has been public about his plan to course-correct, starting with making fewer titles and leaning on sequels over original titles. In June, Pixar’s “Inside Out 2” became the year’s biggest-grossing box-office hit, just a week and a half after its release. Its other highly anticipated films of the year are also sequels or spinoffs, like “Moana 2” and “Deadpool & Wolverine.” Disney is also shifting resources from digital series to theatrical releases that can make a big splash, as evidenced by recent Pixar cuts that targeted teams focused on streaming.

Disney’s reliance on franchises comes with risk, though. When Marvel releases stumbled last year, it cast a pall on the company and left Iger vulnerable to losing control of the company. To regain its dominance in the future, Disney will need some fresh stories.

Whether all this can help Disney get ahead of changing consumer behavior is an open question. Kids preferring short-form videos on YouTube over full-length episodes and movies is a problem that Disney doesn’t seem to be able to solve.

When Macknight, the Dallas media executive, sat his kids down to prepare them for a family trip to Disneyland, he showed them a video about the famed theme park. The platform they watched it on? YouTube, of course.