Disney’s Bob Iger may be celebrating today after Nelson Peltz’s latest move

Billionaire hedge fund founder Nelson Peltz has sold his stake in The Walt Disney Company after losing a pricey proxy battle with CEO Bob Iger.

Peltz, the activist investor who founded Trian Partners, once controlled about $3.5 billion in Disney stock. However, according to The New York Times, he has now sold all his shares.

Peltz became a vocal critic of Disney, hammering its streaming division’s losses, unstable stock performances, and uncertain succession plans. Peltz eventually nominated himself and former Disney CFO Jay Rasulo to Disney’s board of directors in December 2023.

But in April, shareholders voted to support Iger and Disney’s current board, blocking Peltz and Rasulo from taking the two spots.

Peltz’s decision to sell his shares now appears to end his war with the entertainment company.

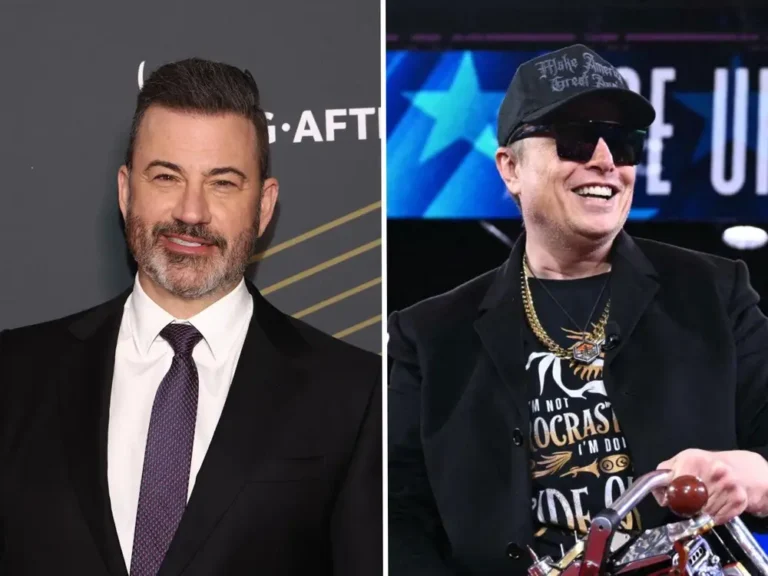

Nelson Peltz, CEO of Trian Fund Management

Representatives for The Walt Disney Company did not respond to a request for comment, and representatives for Trian declined to comment.

At its height, Trian controlled about 1.8% of Disney’s shares, most of which belonged to Ike Perlmutter, a former Marvel Entertainment chairman Disney fired in March 2023.

By all accounts, Peltz’s proxy battle was a financial behemoth, with various entities pouring an estimated $70 million into the campaign.

According to The Wall Street Journal, despite losing the battle, Peltz may have made up to $300 million from its investments in Disney.