Disney’s strategy to survive the shift to sports streaming is making the marketplace confusing for viewers

Sports fans will soon have a slew of ways to watch their favorite teams on streaming services.

Disney’s fear of not getting sports streaming right is making the whole marketplace confusing for viewers.

A newly announced deal between Disney and Fubo will give sports fans more streaming choices in 2025.

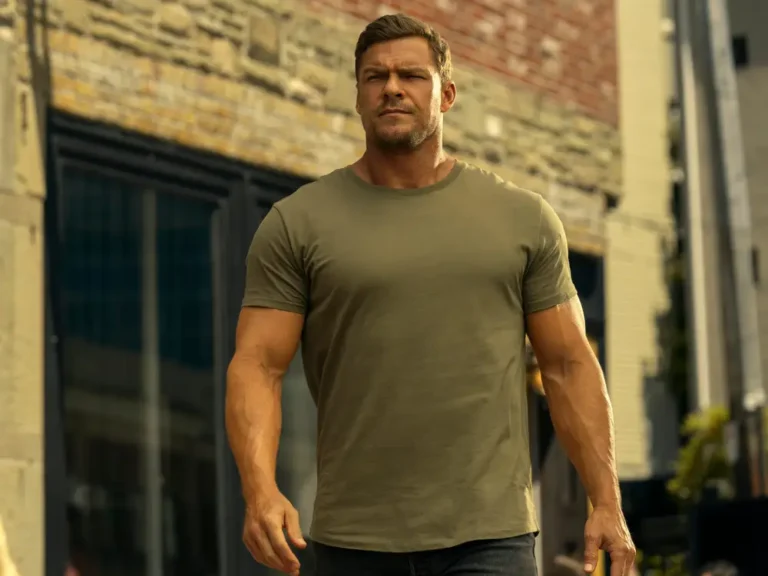

The Mouse House is combining its Hulu + Live TV service with pay-TV streamer Fubo’s business. The deal paves the way for a new sports streamer, Venu, to debut in the coming months, featuring sports content from ESPN, Warner Bros. Discovery, and Fox. (Venu’s launch had been blocked by a ruling in a lawsuit started by Fubo.)

Disney’s ESPN is also set to launch a flagship streaming platform this fall with content from all its networks. The sports broadcaster has a smaller service as well, ESPN+, with niche sports, some of which are now available for no extra charge on Disney+.

Sports fans are now inundated with ways to watch their favorite teams. Most games are on cable or internet-based substitutes like Hulu + Live TV, Fubo, and YouTube TV, which has had a slew of price hikes but is often still cheaper than most pay-TV packages.

But some matches are exclusively streaming on Amazon Prime Video, Peacock, or Netflix, or are simulcast on apps like Paramount+ and Max. Then there are regional sports networks, which have their own streaming apps in some markets.

And that’s all before Venu and stand-alone ESPN enter the market.

In theory, fans should be thrilled. Each customer will be able to almost endlessly customize and control what they pay for, instead of being stuck with the one-size-fits-all approach of the past.

But all these options could confuse casual fans.

Is paralysis by analysis a problem?

Disney is throwing everything at the wall to make sure sports broadcaster ESPN survives the shift to streaming. Sports still drive massive ratings and subscriber growth.

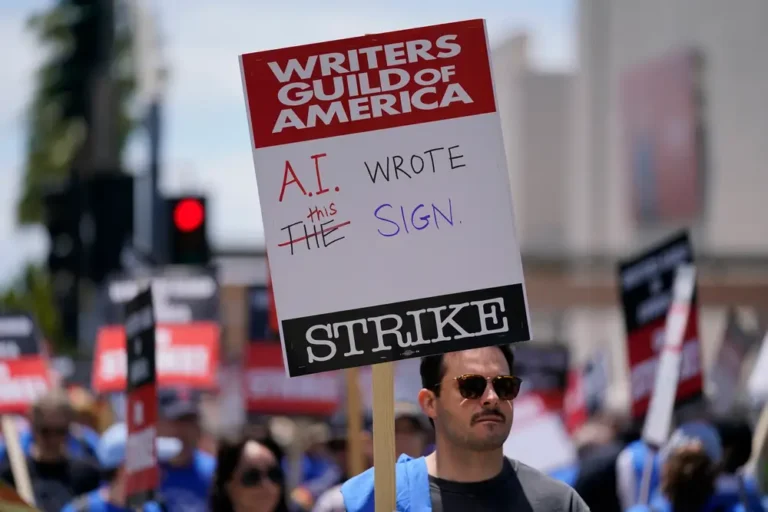

“Why does Disney want to add another streaming platform to its already long and growing list of consumer streaming offerings?” wrote MoffettNathanson’s Robert Fishman and Michael Nathanson in a recent note. They said this deal, which keeps Fubo and Hulu + Live as separate services, “only further confuses the long-term streaming strategy for Disney investors.”

It’s not just investors who have to sift through Disney’s streaming menu. Sports fans may struggle to discern what content is available on which service.

One simple reason Disney is giving sports fans a bevy of options across price points is that it doesn’t know exactly what they’ll want.

It’s unclear if this fast-changing media market can support ESPN’s flagship streamer and Venu, in addition to other pay-TV services — as B-17 wrote. Consolidation may be inevitable.

But while ESPN hopes its stand-alone flagship service breaks through, it doesn’t necessarily matter how the company reaches customers in the late 2020s and 2030s, provided it still gets paid.

Macquarie’s Tim Nollen told B-17 that Disney’s multi-pronged approach is the right one.

“Disney is giving itself a much better chance to succeed,” Nollen said. “It’s smart to provide yourself with the most options you can.”

Consumers can win, despite confusion

Analysts generally said Disney and Fubo’s deal is a win-win for the companies and for consumers.

Venu is entering the market at a price tag of $43 a month, far cheaper than competing pay-TV offerings.

The Disney-Fubo tie-up could eventually lead to higher prices, as consolidation often does, said Adam Rhodes, a distressed debt analyst at credit-intelligence firm Octus, echoing a concern in the ruling against Venu.

However, others said Fubo was already weak and could have folded if it stayed on its own.

“Technically, having one fewer player probably makes it less competitive,” Brian Wieser, who writes the Madison and Wall newsletter, told B-17 of the Disney-Fubo deal. “On the other hand, you could argue that maybe Fubo isn’t in the best position as a smaller player, given the cost of content.”

Now, Fubo could unveil its own skinny sports bundle, similar to Venu’s, which would be a win for consumers.

“They were kind of an also-ran in the marketplace,” Corey Martin, the chair of law firm Granderson Des Rochers’ Entertainment Finance Practice, said of Fubo. “They’re actually better capitalized, and better positioned to execute on its strategy.”

No matter how the sports streaming market shakes out, consumers can’t say they lack choices.