Don’t let September’s jobs report fool you — the labor market is still deteriorating at a worrying rate, economists warn

The September payrolls report seemed to switch the investor narrative around the labor market on a dime.

Recession fears that were largely fueled by the triggering of the Sahm Rule in August suddenly changed to worries that the Fed started easing policy too soon, and that inflation was still a prescient threat. Investors didn’t exactly get a conclusive answer to that question on Thursday morning, when September’s CPI came in at 2.4% year-over-year, a bit above consensus.

However, some economists have warned in recent days that this oscillation in sentiment is the wrong path for the market to follow—at least for now.

Perhaps unsurprisingly, one of them includes the seemingly ever-bearish David Rosenberg. The Rosenberg Research founder and former chief economist at Merrill Lynch pointed out in a client note this week how often payrolls numbers get revised downward these days: 75% of revisions in the last year have been negative. The quality of the sample and the response rate for the payrolls survey is also questionable to Rosenberg.

But non-perma-bear types also echo this skepticism. Citing these exact reasons, Samuel Tombs, the chief US economist at Pantheon Macroeconomics, wrote in a note on Wednesday that he and his team “have real doubts about whether September’s 254K jump in payrolls can be trusted.”

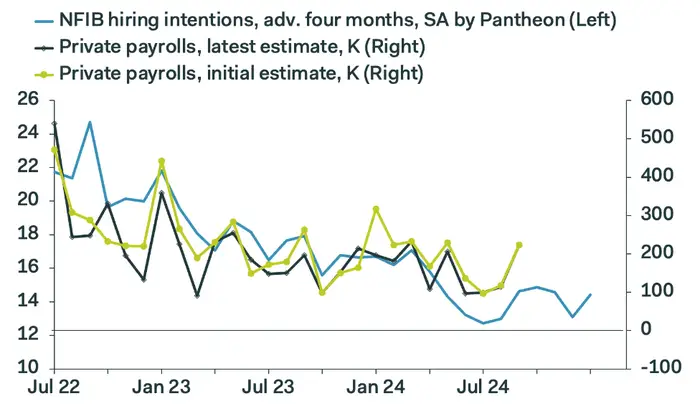

For Tombs, there are other reasons, too, for caution when it comes to adopting a more constructive view of the labor market. Hiring intentions among small businesses are down, for example, and are in line with private non-farm payrolls growth under 100,000 in the months ahead, he said.

And despite recent easing, policy tightening from last year is still taking effect on small businesses, which are having a tougher time getting loans, which they often use to grow and hire employees.

“Market-based measures of financial conditions have eased, but bank credit — the lifeblood of many small businesses — remains very tight,” Tombs said. “We think the latest batch of NFIB numbers are a prime example of how the earlier tightening of monetary policy is still working its way through the economy. Given the usual lags involved between changes in rates and activity, things will probably get worse for small businesses before they get better.”

Neil Dutta, the chief economist at Renaissance Macro Research who earlier this year warned that recession odds were increasing, also highlighted in a note on Monday a number of reasons not to be too quick to jump on the robust labor market bandwagon that’s riding around the streets again after a few months in the garage.

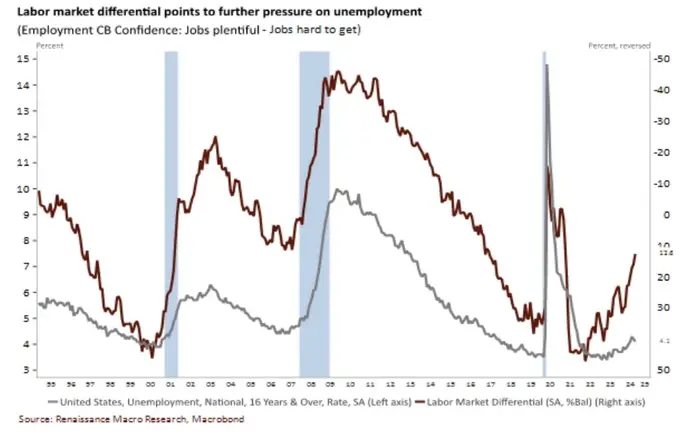

Data from The Conference Board shows consumers say it’s an increasingly difficult time finding a job, Dutta wrote. That usually means the unemployment rate is set to rise further.

Sales growth is also falling, Fed data shows, and manufacturing employment is slowing, points that give Dutta pause on the job market making a sustained reversal.

“The labor market is not out of the woods just yet, and I continue to see another hiccup in the jobs market before year-end,” Dutta wrote. “There are reasons to assume the upward drift in the unemployment resumes.”

Still, it’s unclear how much pressure the labor market will come under in the months ahead. In Rosenberg’s words, the US economy has a tendency to surprise to the upside.

But based on their outlook for the Fed funds rate in the near term, Dutta and Tombs see a continuation of worrying trends ahead. Tombs thinks rates will fall to 2.5% by the middle of next year, a full percent below what the market expects, according to the CME FedWatch tool. Dutta sees another 50 basis point cut this year, even though market expectations for one have virtually evaporated.

“While a 50-basis-point rate cut is unlikely in November, I would not rule of the idea before year-end entirely just yet,” Dutta said. “Some analysts have even gone so far as to say cuts are done for the year. I would resist that idea; they are taking too much signal from one report not unlike those that made similar claims earlier in the year after Q1 inflation data.”