Don’t make this $130,000 mistake when rolling over a retirement account, Vanguard warns

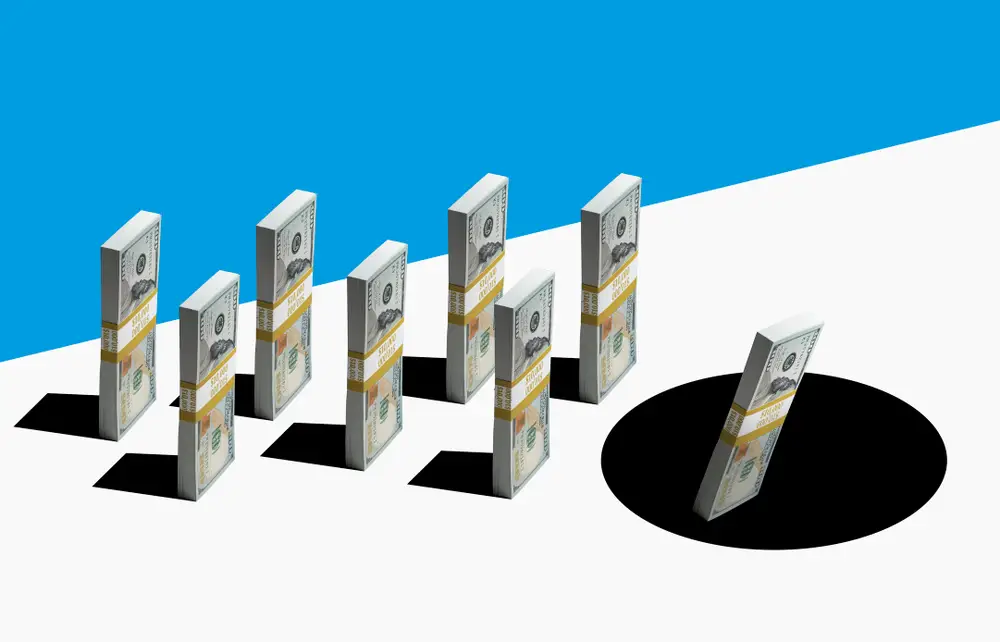

If you’ve rolled over money from a 401(k) into an individual retirement account (IRA), you might be making a costly mistake: leaving the funds in cash.

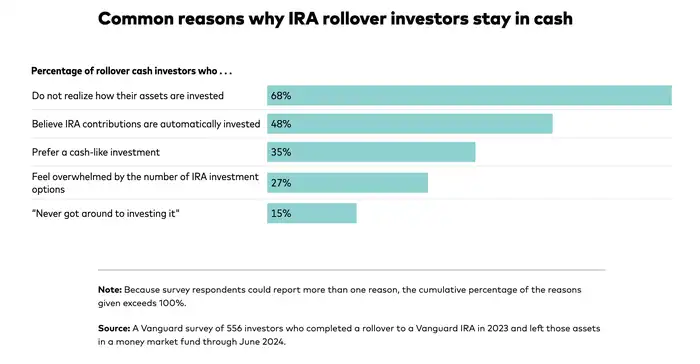

The investment management giant Vanguard noticed that 28% of its clients who had rolled over money into IRAs in 2023 still hadn’t reinvested their funds as the middle of 2024 approached. So, the firm asked 556 of them why they weren’t doing anything with their cash pile.

As it turned out, 68% of them weren’t even aware that their funds were not reinvested in stocks or bonds, according to the September 5 report.

“IRA cash is a billion-dollar blind spot,” Vanguard’s Head of Investor Behavior Research Andy Reed said in the report.

Perhaps surprisingly, over 70% of those whose funds remained uninvested were well-informed investors, familiar with the risk profiles of mutual funds and money market funds. So the problem, it seems, stems from a lack of knowledge around IRA rollovers compared to other retirement plans, according to the survey lead, Vanguard investment strategy analyst Ariana Abousaeedi.

“Investors who are used to their 401(k) assets being automatically invested in target-date funds may believe that IRAs work the same way,” Abousaeedi wrote in the report. “But there is no default investment like in 401(k) plans—money in IRAs requires active engagement to get invested.”

The mistake is costly. According to Vanguard estimates, uninvested people under 55 are leaving at least $130,000 on the table by the time they turn 65 by not investing in a target-date fund. To remedy the problem, Vanguard is advocating for IRA rollovers to be allowed to be invested in target-date funds by default.

Luckily for those unknowingly in cash or cash equivalents like money market funds, short-term interest rates have been good. Vanguard Treasury money market funds are yielding over 5% annually at the moment — some of the best rates in a couple of decades.

But with the Federal Reserve getting ready to cut rates, yields on cash equivalents are set to start declining. That being the case, it may be an especially good time to make sure rolled-over funds are appropriately invested.

“Many investors who have dutifully saved for their retirement in the workplace are unaware that their rollover assets are sitting in cash,” the report said. “Take a close look at your portfolio to ensure it’s allocated in a way that makes sense for your long-term plans. What you find may come as a surprise.”