Everything to know about Trump Media & Technology Group and its main product, Truth Social

Trump owns a majority stake in Trump Media, largely considered a “meme stock” with a volatile valuation.

Since leaving the White House after his first term, President-elect Donald Trump has used his home-grown social media site, Truth Social, as a personal megaphone. For Trump, Truth Social is more than a messaging tool — the platform, which is the flagship product of the Trump Media & Technology Group, is now a significant part of his personal wealth.

Formed in the wake of the January 6 riots and Trump’s banishment from traditional social media, Trump Media has seen its financial fortunes shift alongside the president-elect’s political prospects. A self-identified “safe harbor for free expression amid increasingly harsh censorship by Big Tech corporations,” Truth Social largely caters to Trump supporters. Yet the site serves a widespread political purpose, as it’s often where Trump makes key announcements like Cabinet nominations.

Having persisted through lawsuits, volatile stock valuations, and a rocky presidential campaign, Trump Media is likely here to stay, posting questions of how the president-elect will engage with the company once he retakes residence in the White House.

Trump Media’s founding and leadership

After January 6, 2021, many social media sites banned Trump or suspended his account, including Mark Zuckerberg’s Facebook and what was then Twitter. Amid the fallout, Andrew Litinsky and Wes Moss, two former contestants on “The Apprentice,” approached Trump about forming Trump Media and promised to give him a majority stake.

Trump formed Trump Media after he was kicked off of other social media sites.

Truth Social hit the Apple App Store in early 2022, advertising itself as an alternative to traditional social media sites. In March 2024, Trump Media debuted on the Nasdaq as a publicly traded company after merging with a shell company. It trades under DJT: Donald J. Trump.

The president-elect owned about 58.7% of the outstanding shares of Trump Media as of June 2024, according to the company’s website. When the media group went public, Litinsky and Moss owned 5.5% of the company through their investment partnership, United Atlantic Ventures LLC. Yet the duo had a falling out with Trump, battling him in court over disagreements about their stake in Trump Media. In turn, Trump Media argued that Litinsky and Moss weren’t entitled to their shares because they had bungled the company’s rollout. By late September, United Atlantic Ventures liquidated almost all of its shares.

Despite his significant financial investment in Trump Media, Trump has no official role in the company. Its CEO is Devin Nunes, a former Republican congressman from California, and Donald Trump Jr. sits on the board. Linda McMahon and Kash Patel, whom Trump has tapped to lead the Department of Education and Federal Bureau of Investigation respectively, are also board members. A lawyer for McMahon previously said that she would resign from outside boards if she serves in the administration.

Two days after winning the presidential election on November 6, Trump said in a post on Truth Social that he has “NO INTENTION OF SELLING” his nearly 115 million shares of Trump Media, valued at around $3.5 billion at the time. Though TMTG has lost money, his stake has significantly boosted his net worth, which was $2.4 billion at the start of 2024 and $6.3 billion by December, per Forbes. The stock is his most valuable asset.

How Truth Social works

Similar in form to X, Truth Social is a free social media platform based in the United States. Users can post “Truths” and “Retruths,” follow others, and build a profile. There is limited content moderation and advertising on the site.

As of early December 2024, Trump had 8.29 million followers on Truth Social. According to Similarweb, a site that tracks data, approximately one-third of the platform’s traffic relates to Trump’s posts. Truth Social’s user base is tiny, compared to Elon Musk’s X. In October 2024, Truth Social had 650,000 monthly active users in America compared to X’s 70.4 million, per Similarweb.

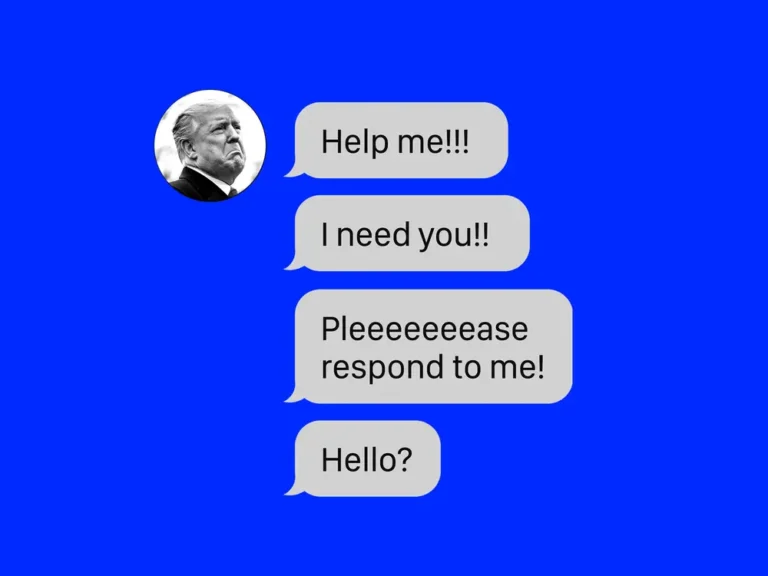

Despite its small size, Truth Social demands the country’s attention, as it’s often where Trump drops key information, like proposed tariffs against allies and Cabinet nominations. Though Trump’s accounts on Facebook and X have been reinstated, Truth Social remains his preferred platform.

Truth Social is a free social media site that functions much like X, formerly known as Twitter.

Trump Media’s stock and earning history

Trump Media’s value is volatile and closely tied to Trump’s political fortunes. Since it’s a publicly traded company, anyone can buy shares. Most TMTG shareholders are individual investors with fairly small stakes, the company says.

“TMTG’s success depends in part on the popularity of our brand and the reputation and popularity of President Donald J. Trump,” Trump Media said in a Securities and Exchange Commission filing from September 30, 2024.

The company racked up early market wins on its first day of trading on the Nasdaq — the market capitalization was nearly $8 billion and shares ended the day at $57.99. Since then, the share price has been on a downward trajectory. Stocks plummeted after Trump debated Vice President Kamala Harris in September and continued to decline, reaching $12.13 per share on September 23.

Trump Media stock is closely linked to Trump’s political prospects.

On November 6, 2024, Trump Media reported a $19.2 million net loss during the year’s third quarter. Later that day, Trump won the presidential election and shares of the company rose dramatically. By the time the market opened on November 7, shares were 31% higher than they had been at the previous close. Stock exchanges briefly paused trading that day due to the volatility and the stock continued to bounce around in the following weeks. As of early December, the company’s market capitalization was $7.7 billion.

After a storm of post-election activity, trading activity has calmed down and the company continues to struggle to generate revenue. Trump Media’s third-quarter earnings report shows that it had lost $363 million since the beginning of the year and generated $2.6 million in earnings. Given the gaps between the stock’s share price and profitability, some consider Trump Media a “meme stock,” which are publicly traded equities that are popular because of internet hype rather than business prospects.