ExodusPoint led multistrategy hedge funds in September. Here’s where rivals like Citadel, Millennium, and others stand.

In the last month before a new cash hurdle forces the firm to outperform for performance fees, ExodusPoint led the way among multistrategy hedge funds.

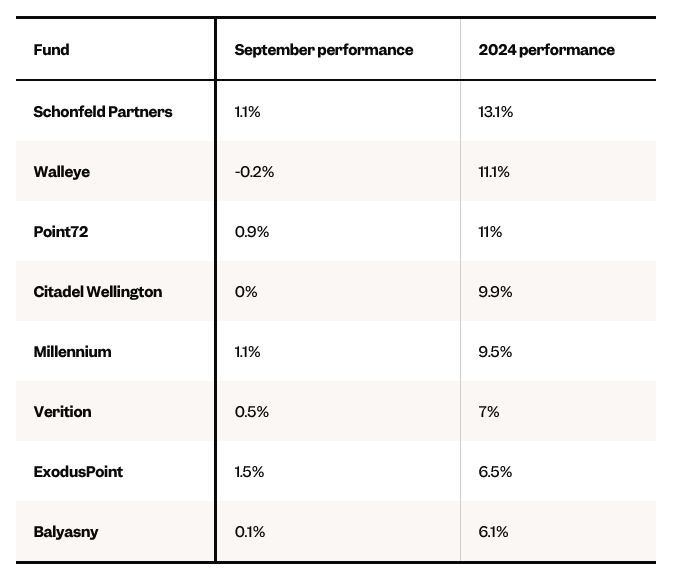

The $11 billion manager was up 1.5% last month, bringing its 2024 numbers to 6.5%, a person close to Michael Gelband’s fund said.

The firm’s new share class, which will only yield performance fees for the manager if it outperforms short-term Treasury bonds, goes into effect next month. It comes on the heels of redemptions and poor relative performance at the New York-based manager but also a broader concerted push by institutional investors to demand more accountability from funds on their soaring costs.

Other top performers last month include Gelband’s old employer, Millennium, which made 1.1% in September and is up 9.5% through the third quarter. Schonfeld continued its bounce-back year, returning 1.1% in its flagship fund, which is up 13.1% for the year, a person close to the manager told B-17. Its fundamental equities fund is up 12% year-to-date after gaining 0.2% in September.

Ken Griffin’s Citadel, meanwhile, trailed most of its peers, finishing September flat in its flagship Wellington fund but it is up nearly 10% on the year, a person close to the firm said. The Miami-based firm’s Tactical Trading fund, which trades equities and quant strategies, gained 0.9% last month and is up 15.6% on the year.

Last month’s star, $5 billion Walleye Capital, lost money in September. The firm was down 0.2% last month, though it is still up 11.1% on the year, a person close to the firm said.

For more returns on multi-strategy managers, see the table below.