Fox is taking a ‘modest’ approach to a new streaming service. That could make it a smart bet in a packed field.

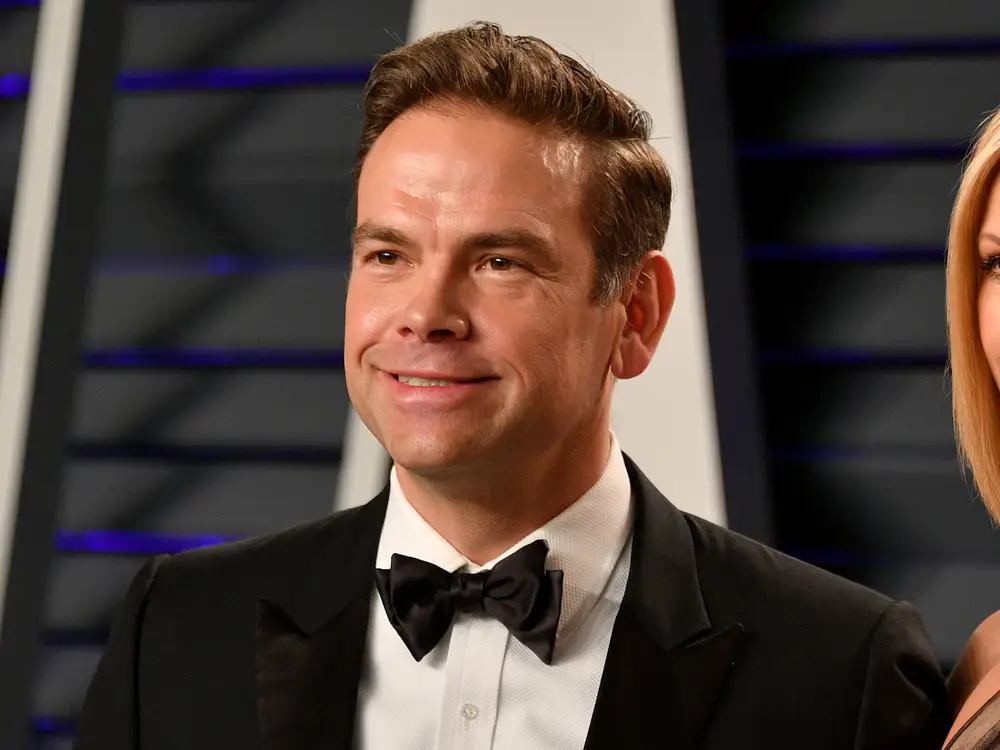

Lachlan Murdoch, pictured, reiterated the importance of Fox’s cable business on an earnings call.

Fox is arriving very late to the streaming party with a new paid service set to launch by year’s end. That might not be such a bad idea.

The streaming field is crowded, and a slew of competitors are brawling for subscribers and seeking profitability as they chase Netflix.

On top of that, Fox already has a paid streaming service, Fox Nation, which launched in 2018 and is stocked with right-wing commentary and lifestyle content focused on history, faith, crime, and military. Fox also has Tubi, a general-interest free streamer.

So, why is it launching a new one? In a nutshell, Fox seems to be trying to wring a small amount of additional value out of the programming it already puts on cable TV.

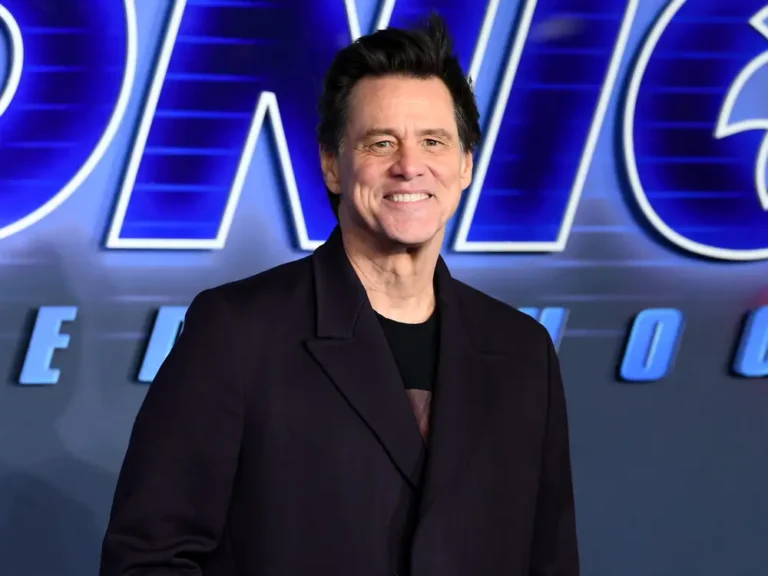

On an earnings call Tuesday, Murdoch said the forthcoming general-interest streamer, which he didn’t name, would target “cord-cutters and cord-nevers.” He reiterated the importance of Fox’s cable business.

“Our subscriber expectation will be modest, and we’re going to price the service accordingly,” Murdoch added.

Two analysts told B-17 that Fox’s streaming service could serve as a good backup plan now that it has abandoned sports-focused Venu, its previously planned joint venture with Disney and Warner Bros. Discovery.

“That’s what the market, I think, has wanted — that kind of consolidation,” said Joseph Bonner, a senior securities analyst at Argus Research. “It didn’t work, so now Fox has got to go it alone.”

Fox also has a forthcoming skinny bundle with Disney’s Fubo.

A Fox spokesperson told B-17 that the stand-alone streamer was part of the company’s initial direct-to-consumer plan.

A ‘low-risk’ strategy

David Joyce, a senior equity analyst at Seaport Research, said Fox’s streaming service “doesn’t seem to have an obvious hole in the marketplace that needs to be filled.” But he said it’s a “low-risk” strategy given the company won’t be spending any further on sports rights.

Sports will be a key differentiator from Fox Nation, though Fox’s offer — which includes college football, Sunday afternoon NFL, NASCAR, and others — is somewhat fragmented, Joyce said. But, he added, “there’s going to be minimal incremental costs because they already have the rights.”

In a note Tuesday, MoffettNathanson wrote the streamer could tee up Fox for future leverage.

“Fox can now use this new DTC service as a tool for future negotiations with linear Pay TV distributors, vMVPDs, and even other streaming services,” the company wrote.

Fox’s stock was up Tuesday largely on the strength of better-than-expected advertising and affiliate fees, Joyce said.