From $45,000 to $500,000, here’s the bull and bear case for bitcoin in 2025

Bitcoin has been on a tear in 2024, surging 145% year-to-date and breaching the psychological $106,000 in recent days.

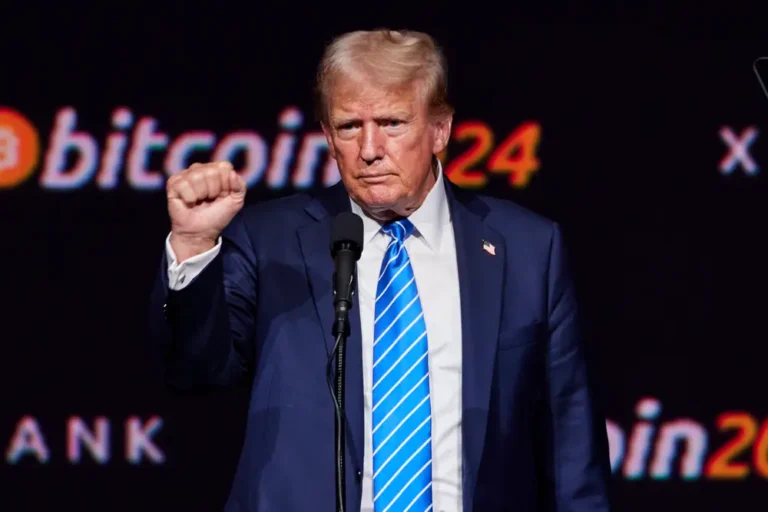

The volatile cryptocurrency has been a polarizing asset, but with an incoming Trump administration, combined with the launch of bitcoin ETFs earlier this year, it seems more and more investors are starting to embrace bitcoin.

But not everyone is bullish, and there are some on Wall Street who still see a coming correction in 2025. Here are the biggest bear and bull cases for the token next year.

Bitcoin will fall to $45,000: BCA Research

Chief global strategist Peter Berezin of BCA Research expects bitcoin to crash in 2025.

Berezin, who is bearish on risk assets broadly for next year on the expectation that a recession will hit, said that bitcoin will finish 2025 at around $45,000, marking a decline of 57% from current levels.

With his bearish outlook, Berezin said gold would finally outperform bitcoin in 2025, as investors seek safe-haven assets amid a period of economic weakness.

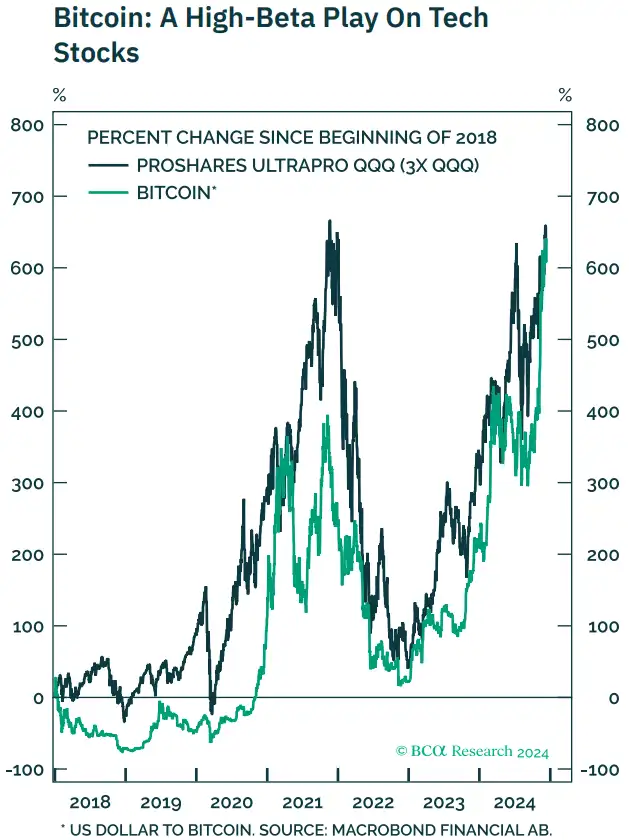

To that point, he argues that bitcoin is not a store of value like gold, but is instead simply a high-beta play on technology stocks.

The strategist provided the chart below, which shows the strong correlation between the price of bitcoin and the ProShares UltraPro QQQ 3x Shares ETF.

The three-times levered ETF seeks to track daily movements in the Nasdaq 100 Index. Since 2018, the price of bitcoin has closely tracked the fund, with both assets trading about 650% higher in that time.

Thus, a crash in tech stocks brought on by a bear market in 2025 would also spark a steep drop in the price of bitcoin.

Bitcoin to hit $250,000-$500,000: Fundstrat

Way on the other end of the spectrum of bitcoin forecasts is Fundstrat’s Tom Lee, who is highly bullish on the coin for next year.

The strategist said the cryptocurrency is on track to soar 140% in 2025 to $250,000. However, the crypto could soar even higher if the Trump administration establishes a national bitcoin reserve.

According to Lee, there are two tailwinds for bitcoin heading into the new year.

The first is the halving price cycle for the cryptocurrency, which tends to be bullish for the price of bitcoin in the year following a halving event.

The last bitcoin halving occurred on April 20 with another scheduled every four years. A halving reduces the amount of bitcoin that miners are rewarded for solving cryptographic problems by half, limiting the supply of new crypto coming to market. With new supply slashed, the price should rise if demand stays constant or increases.

The second factor that is bullish for bitcoin in 2025 is “friendlier government regulations,” Lee said in his outlook note last week.

President-elect Donald Trump is viewed as a close ally to the crypto space, and his recent administration picks, like Paul Atkins for SEC Chairman, have been cheered by the market.

And there could be even more upside for bitcoin in 2025 if a US strategic reserve is announced and implemented.

“Our Head of Digital Assets Strategy, Sean Farrell, believes that a US Bitcoin Strategic Reserve adds upside to Bitcoin as much as $500,000 in 2025,” Lee said in a Monday note.

That target represents a 381% increase from current levels.

Finally, Lee highlighted that a recent white paper from BlackRock recommends a 2% portfolio allocation to bitcoin for investors. The recommendation could spark further institutional adoption of bitcoin and fuel demand for the crypto, helping push the price higher.