Goldman Sachs beats Wall Street forecasts as investment-banking fees surge 20%

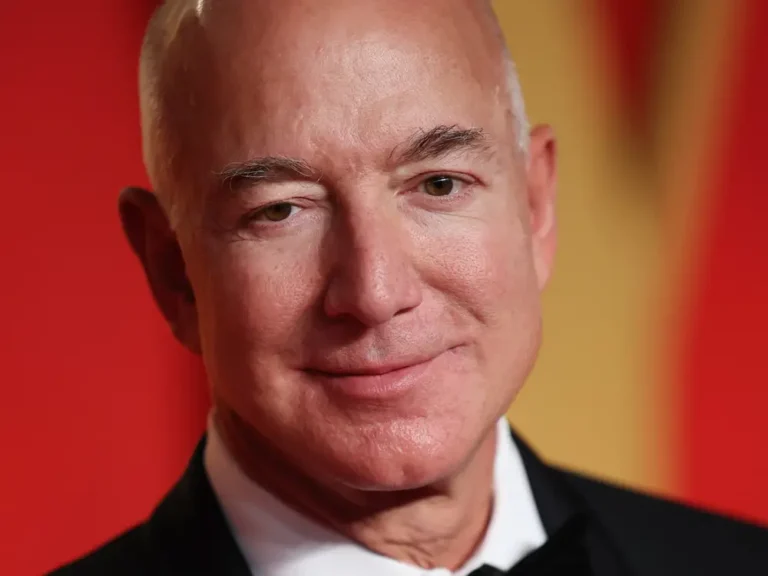

Goldman Sachs CEO David Solomon praised the bank’s strong performance in its third-quarter earnings.

Goldman Sachs reported third-quarter earnings on Tuesday that beat Wall Street’s expectations, sending its stock up as much as 3% in premarket trading.

The investment bank generated $12.7 billion of net revenue, a 7% increase from the same period last year. It also cut its operating expenses by 8%, fueling a 45% surge in net income to $2.99 billion.

Earnings per share were $8.40, exceeding Alphasense’s consensus estimate of $6.71.

Net revenues rose 7% year over year in the global banking and market division, fueled by a 20% jump in investment banking fees to $1.9 billion. The fee bonanza reflected a sharp increase in net revenues from debt underwriting amid strong leveraged finance and investment-grade activity, and higher net revenues in equity underwriting driven by secondary offerings.

The unit also benefited from an 18% rise in net revenues from its equities business, which helped offset a 12% drop in net revenues from the fixed income, currency and commodities (FICC) business.

Goldman’s asset and wealth management segment saw a 16% rise in net revenues as it collected record quarterly management and other fees. Moreover, assets under supervision grew by $169 billion last quarter to a record $3.1 trillion.

CEO David Solomon said in the earnings release: “Our performance demonstrates the strength of our world-class franchise in an improving operating environment. We continue to lean into our strengths – exceptional talent, execution capabilities and risk management expertise – allowing us to effectively serve our clients against a complex backdrop and deliver for shareholders.”

He had struck a cautious tone at a Barclays conference in September, per a transcript provided by AlphaSense, warning that Goldman’s trading unit was trending 10% lower than a year earlier largely due to fixed-income weakness.

Solomon had also warned of a roughly $400 million blow to pre-tax earnings from the bank shifting away from its credit card partnership with General Motors and selling its seller financing loans.

Meanwhile, Bank of America’s third-quarter earnings showed its revenues were almost flat year on year at $25.3 billion. Higher non-interest expenses pushed its net income down 12% to $6.9 billion.

CEO Brian Moynihan said it was another good quarter with “solid earnings results, delivering higher average loans and our fifth consecutive quarter of sequential average deposit growth.”

Bank of America stock was up 1.7% in premarket trading at the time of publication.