Goldman’s top equity strategist tells B-17 2 similarities between today’s market and the dot-com bubble — and what it means for your portfolio

David Kostin

David Kostin is no stranger to the ups and downs of the stock market.

The Goldman Sachs chief US equity strategist has seen multiple economic boom-bust cycles during his more than 35 years on Wall Street. And right now, Kostin sees two striking similarities between today’s market and the dot-com bubble — conditions that could lead to a decade of lackluster returns for the S&P 500 just as they did after 2000, he told B-17 in an exclusive interview.

First, market concentration is at an all-time high, meaning that the performance of the S&P 500 is disproportionately driven by just a few stocks. This is due to the rise of what Kostin calls “superstar” firms with economies of scale, such as the Big Tech companies whose valuations have spiked this year thanks to the development of AI.

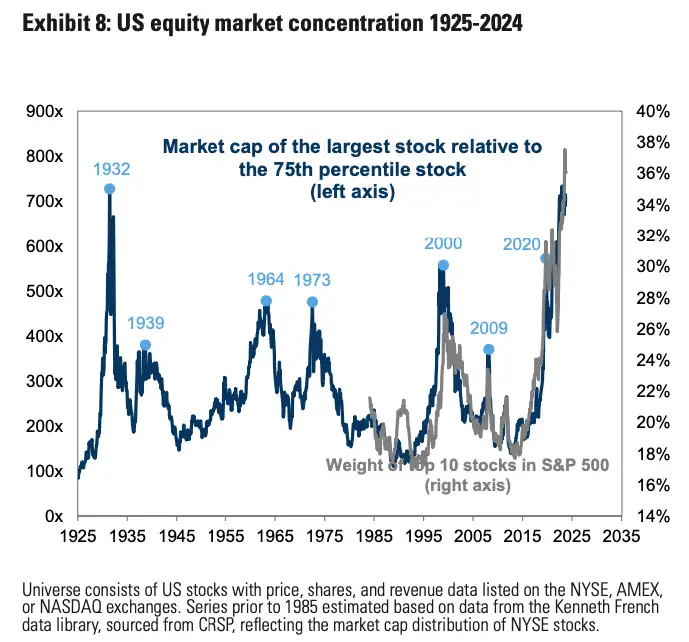

Today, the 10 largest stocks in the S&P 500 make up 36% of the entire index by market capitalization.

“We’re at a level of concentration in the US market today that we haven’t really seen since the tech bubble. It’s even more concentrated than it was 20 years ago,” Kostin said.

In fact, the US equity market is at its highest concentration in 100 years.

Risks become less diversified, and volatility increases in a concentrated market, which is why Kostin is skeptical that the largest companies in the index will maintain their premium valuations going forward.

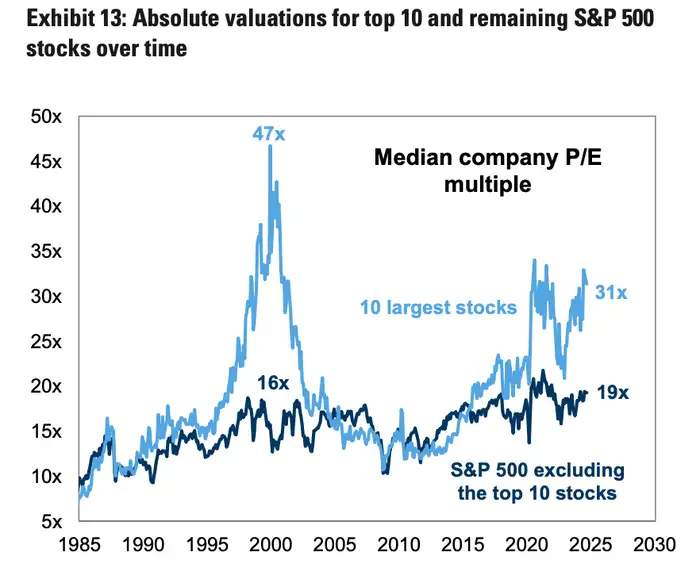

Second, Kostin sees a large valuation gap between the top 10 stocks and the rest of the index.

The largest 10 stocks in the index trade with a median price-to-earnings ratio of 31. Meanwhile, the other 490 stocks have a median P/E ratio of just 19.

That means for the top stocks, the earnings yield — a metric measuring the expected return on investment, calculated by taking the inverse of the P/E ratio — is lower compared to the rest of the market. A stock with a P/E ratio of 31 has an earnings yield of 3.22%, meaning that every dollar invested in the stock would generate earnings per share of 3.2 cents. A stock with P/E ratio of 19 has an earnings yield of 5.26%, meaning that investors are receiving more earnings for every dollar they put in.

This gap between the top S&P 500 performers and the rest of the index hasn’t occurred since the dot-com bubble.

“The valuation of the largest stocks in the market have a negative risk premium to bonds, and that has not happened for 20 years,” Kostin added.

That means the top 10 stocks in the index actually have a negative return in excess of the risk-free 10-year Treasury yields. The 10-year has a nominal yield of 4.28% compared to the top 10’s 3.22%, which is approximately a 1% negative risk premium.

The next decade

The ultra-high concentrations in the market today happened over several years, so Kostin isn’t expecting the market to broaden overnight. But the current disjunction simply isn’t sustainable for the long term, he said. Higher concentration is typically associated with increased volatility in the near term and lower returns over long time horizons.

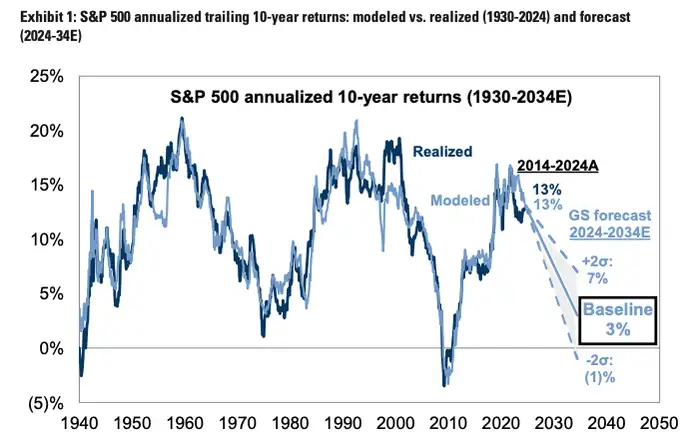

That’s why Kostin predicts that the S&P 500 will generate a 3% annualized nominal total return through 2034 — well below the index’s long-term average of 11%.

“The S&P 500 has roughly a 72% probability of trailing bonds and a 33% likelihood of lagging inflation through 2034,” Kostin and his team wrote in a recent note.

Superstar firms propelled the S&P 500 to new highs in 2024, but maintaining that level of growth in the future will be difficult, especially when valuations are already so elevated, according to Kostin.

“The expectation of revenue growth for these companies is 20%, and the stocks trade at high multiples reflecting that growth rate. So the risk is ultimately, can the companies deliver on these extremely high levels?” Kostin said. “The evidence is strongly in support of the fact that growth rates for high revenue growth companies tend to fade,” he added.

Today’s valuations price in double-digit growth, but that’s not a realistic outcome, in Kostin’s view. When sales and earnings growth for the biggest companies eventually cool, these valuations will come down, and the overall index will decelerate as well.

Kostin pointed to companies like Intel, Microsoft, and Cisco, which saw incredible runups as investors priced in aggressive revenue expectations during the dot-com heyday. When these companies failed to meet these lofty expectations, valuation multiples compressed significantly.

Although Kostin is predicting a decade of lower-than-average growth for the S&P 500, he’s still optimistic about the overall state of the economy as the unemployment rate is holding steady at 4.1% and the US consumer is strong.

While the overall market is shaping up to see lower-than-expected returns for the next decade, that doesn’t mean there aren’t pockets of opportunity for investors to seek higher returns. As the gap between the largest stocks and the rest of the market subsides going forward, the typical stock is positioned to perform better than the current market leaders.

For that reason, Kostin is expecting the S&P 500 equal-weight SPW index to outperform the market-cap-weighted S&P 500.

Kostin also identified mid-cap stocks as a big beneficiary of a broadening market. In his view, mid-cap stocks are much more reasonably valued than the overall S&P 500 and have historically performed well in a rate-cutting environment, making them a compelling investment opportunity.