Hedge funds are trading in their AI stocks for 2 sectors, marking their largest tilt in a decade

‘Tis the season for sector rotations. But where’s everyone going?

The broad market is rushing into small caps in anticipation of this cycle’s first Fed rate cuts.

The Russell 2000, a small-cap benchmark, was lifted by 7% from a week ago. In anticipation of better days ahead, investors piled into smaller companies that are more interest rate-sensitive and tied to the domestic economy. Hedge funds participated and are now overweight mid- and small-caps relative to the Russell 3000, according to an August 20 note by Goldman’s senior strategist Ben Snider.

However, they made one additional adjustment that helped them sidestep the Magnificent Seven’s July pullback after they trimmed some exposure to AI’s mega-cap tech leaders, except Amazon (AMZN) and Apple (AAPL), during the second quarter, according to the note.

Goldman’s Hedge Fund Trend Monitor showed that they traded in their blue chips for three sectors: financials, healthcare, and utilities. They also moved out of consumer discretionary, the second-worst-performing sector of the quarter.

For financials, it marks the first time since 2010 that hedge funds have been overweight the sector relative to the Russell 3000. As for industrials, their exposure retracted to its decade high from June 2022, the note read.

Societe Generale recently pegged industrials as one of the few parts of the market that could do well regardless of which party takes Washington in 2025. Notable names within the sector are expected to benefit from US reshoring initiatives — a process that ramps up domestic manufacturing — as both parties pursue policies that support the US industry.

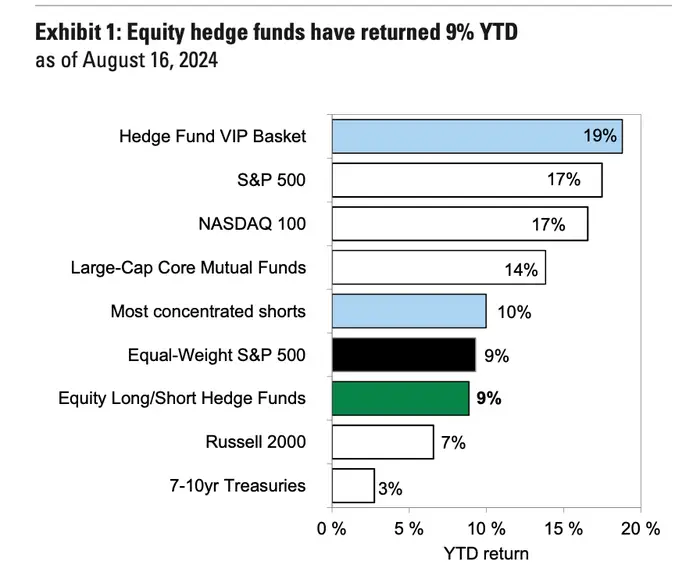

Investors may want to take a cue out of their playbook: this group of market participants has had a stellar year so far: the Hedge Fund VIP basket (GSTHHVIP), which tracks hedge fund’s most popular long positions, was up by 19% in comparison to the S&P 500 and the tech-heavy Nasdaq that were both up 17% as of August 20.

The chart below demonstrates the basket’s performance relative to other market benchmarks.

What’s the smart money buying,, you ask? The bank’s tracker, which follows 693 hedge funds with combined equity positions worth $2.8 trillion, showed that the new favorites among financials included Citizens Financial Group (CFG), Global Payments (GPN), Wells Fargo (WFC), and Factset Research Systems (FDS).

Financials were in the top three popular sectors investors piled into in the 24 hours around the first presidential debate that saw former President Donald Trump take the lead. His administration has historically been seen as a positive force for the stock market and the private sector.

In industrials, they loaded up on Eaton Corporation (ETN), Paylocity Holding (PCTY), and Stericycle (SRCL).