Here are the best and worst-case scenarios for Google in its battle with the DOJ

Google CEO Sundar Pichai.

For years, the US Justice Department’s lawsuit against Google’s Search business has been largely ignored by Wall Street and even many of Google’s employees. It always seemed so far away—and perhaps unlikely to hurt Google—to matter.

This week, it became a bit more real, and Google’s close watchers are evaluating what could happen next amid heating competition in the AI wars.

On Tuesday, the DOJ filed a list of remedies it is considering. On November 20, the DOJ will give the judge a more homed-in version of what it wants from Google, giving us a better idea of what’s really at stake.

This all follows an August ruling that found Google had maintained an illegal monopoly in the search and advertising markets.

The proposed remedies from the DOJ this week are broad in scope – “a mile wide and an inch deep,” Bernstein analysts wrote in a note published Wednesday. They include terminating Google’s contracts with Apple and other partners to keep its search engine their default. They also include sharing some of Google’s search data with rivals.

While the DOJ didn’t explicitly mention a breakup, it referred to “structural” remedies for Chrome, Android, and Play — three products the DOJ said Google has used to “advantage” its Search product.

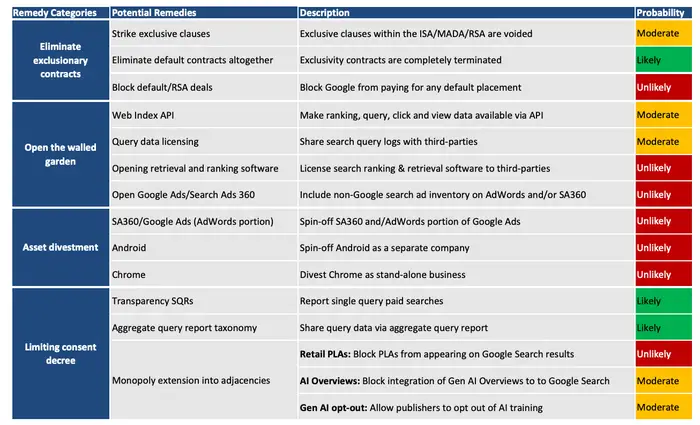

The Bernstein analysts said they hadn’t changed their position on which of these remedies were more likely to happen. Here’s that original list they published last month, scoring the remedies on likelihood:

Bernstein analysts published in a note about how different remedies for Google after its antitrust lawsuit could play out.

A final verdict may still be months, if not years, away. Google, which called the DOJ’s proposals “radical,” said it plans to appeal the decision, potentially putting a stay on any remedies that Judge Amit Mehta decides on. Dan Morgan, senior portfolio manager at Synovus, told B-17 he thinks it could be as long as three to four years before Google is made to do anything.

The DOJ tries to level the search competition

Analysts now see blocking Google’s default search agreements as the bare minimum — and likely not enough to level the playing field in the way the DOJ asks.

The same goes for implementing a “choice screen” to let users decide their search engine the first time they boot up their device. Google introduced that feature for Android users in the European Union after an antitrust ruling by regulators in 2018, but it has done little to dent Google’s search market share in Europe.

The DOJ is also considering cracking open Google’s search index and forcing it to share data, including the nitty-gritty of how Google ranks website quality. Google watchers see this scenario as increasingly likely. The DOJ said this could include the models used for Google’s AI Search features.

It also suggested it may request Google share with advertisers data around search text ads auction and ad monetization — and that actions against Google’s ad products, such as Performance Max, are not off the table.

A breakup is unlikely

The most dramatic outcome would be breaking up Google. The analysts B-17 spoke to consider a total divestiture of Chrome, Android, or Play unlikely, though not impossible.

“The doomsday scenario of a total break-up like AT&T in the 1980’s does not seem likely,” Morgan told B-17.

A structural breakup is “an unlikely outcome,” and any remedies will most likely focus on search distribution, Dan Ives, managing director and senior analyst at Wedbush, wrote in a note this week.

The AI risk for Google

As the DOJ has made clear, it wants its remedies to not just punish Google for its previous sins, but to prevent Google from using its Search monopoly to corner the AI market.

Google has spent the last two years scrambling to reassert itself as the leader in AI against encroaching rivals such as OpenAI. Forcing Google to share data and targeting some of its AI products could blunt its edge in the coming AI battle.

Speaking at The Information’s Women in Tech, Media, and Finance conference this week, Google’s search lead, Liz Reid, acknowledged that data gives Google its advantage in both search and AI.

“We have really great data beyond the web on things like products and maps and sports data,” she said.

Sunshine CEO and former Google executive Marissa Mayer later emphasized the point, saying, “Google has all the data.”

The DOJ has said it’s also weighing a proposal that websites can opt out of Google’s AI training and from appearing in AI search results altogether.

“In our view, the last thing Google needs right now in the broader AI battle is having to fight with one hand tied behind their backs by regulators,” wrote Bernstein analysts in their note published Wednesday.

It’s another reason Google will think hard about a way to appease the DOJ. The company can propose its own remedies by December 20, and it will want to do everything it can to avoid a worst-case scenario.

“Google should be able to put together a proposal that can meet the DOJ’s concerns,” said Morgan.