History says these 5 sectors are poised for double-digit gains within a year after the Fed cuts rates

Federal Reserve Chairman Jerome Powell and his colleagues are in the spotlight this week.

Investors have waited years for interest rates to fall. On Wednesday, their patience will be rewarded, though that’s one of the only sure bets.

Markets know that the Federal Reserve will lower rates at its September meeting, but there’s an unusual level of uncertainty about how much rates will be lowered. As expected, the Fed has been coy about cuts, leaving markets torn between pricing in a 25- or 50-basis-point reduction.

Doves argue that the bigger cut is needed to support a slowing US economy, while hawks prefer a more conservative approach, reasoning that more than 25 basis points could signal that a downturn is imminent. The dovish side has gained serious momentum, as the odds of two cuts have doubled in the last week to 67%, according to the CME FedWatch tool, though that’s still far from bankable.

“Fed funds futures have never been this uncertain about a rate decision as they are, at least since 2015,” Bank of America strategists led by Ohsung Kwon wrote in a September 16 note.

In turn, US stocks are stuck in neutral. Markets have tunnel vision about interest rates, and until there’s clarity on the Fed’s decision, there isn’t much logic in making big bullish or bearish bets.

However, history says investors can take solace in the fact that interest rates are declining in the first place, according to top minds at BMO Capital Markets.

BMO’s team studied the eight monetary easing cycles since 1982 and found that the S&P 500 gained ground in the 12 months after the first cut 75% of the time, rallying by 11.3% on average. But Brian Belski, BMO’s chief investment strategist, noted that the two exceptions were sizable: a 13.5% loss after the dot-com bubble burst, and a nearly 24% slump during the financial crisis.

“In cycles where rate cuts were able to prolong economic expansion and keep corporate earnings on an upward trend, stocks performed quite well,” Belski wrote in a mid-September note. “However, in cycles where monetary stimulus was unable to prevent an economic downturn (i.e., 2001 and 2007), stocks recorded significant losses in the following year as earnings growth struggled.”

While rate cuts aren’t a cure-all, Belski is confident that the economic expansion will continue, which will keep this bull market on firm footing. Although the strategy chief acknowledged that the labor market is softening, he noted that job additions are positive, as are estimates for corporate earnings and GDP growth.

“We believe investor debate about the size and depth of the upcoming easing cycle somewhat misses the point — so long as nothing breaks in the economy, US stocks remain firmly within a bull market,” Belski wrote. “But with significantly strong trailing one-year performance headed into this initial rate cut, future gains are likely to be more muted relative to historical norms.”

Sectors poised to outperform as the Fed finally cuts rates

After outlining how US stocks broadly have fared following cuts in the last four decades, BMO shared relative sector performance before and after periods of rate declines.

The Montreal-based firm analyzed the historical performance for 10 of the 11 market sectors, with the exception of real estate, which wasn’t a distinct group until 2016. Nine of the 10 sectors have been in the green a year after the first cut, and five of those nine were up by double digits.

Those five are listed below, ranked in order of their average performance 12 months after the first cut:

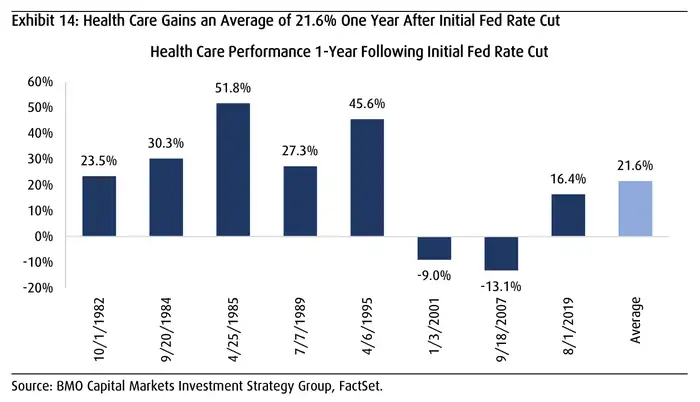

1.Healthcare

Return 12 months after: 21.6%

Return three months after: 5.3%

Return 12 months before: 3.8%

Return in the 12 months before and after: 16.2%

Sector rating: Underweight

Source: BMO Capital Markets

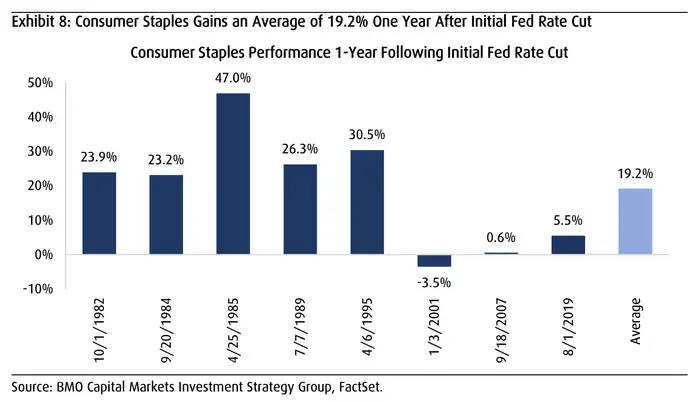

2. Consumer Discretionary

Return 12 months after: 19.2%

Return three months after: 5.3%

Return 12 months before: 18.9%

Return in the 12 months before and after: 42.9%

Sector rating: Underweight

Source: BMO Capital Markets

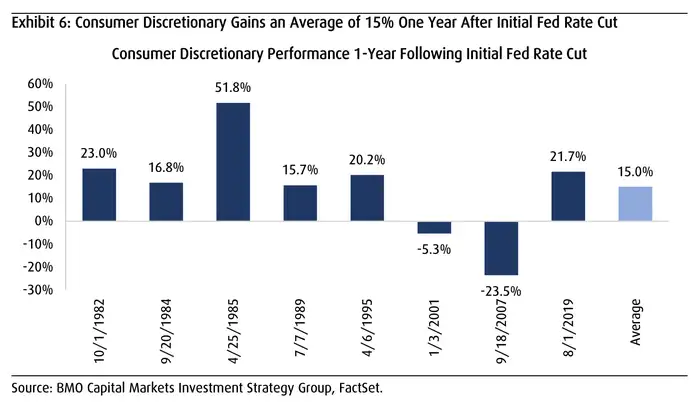

3. Information Technology

Return 12 months after: 15%

Return three months after: 1.1%

Return 12 months before: 9.9%

Return in the 12 months before and after: 27.6%

Sector rating: Market-weight

Source: BMO Capital Markets

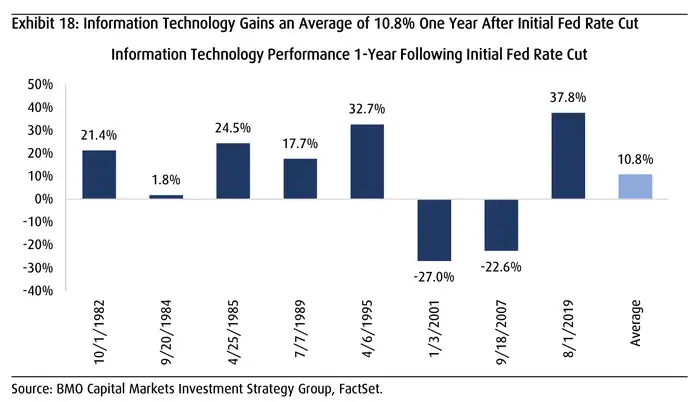

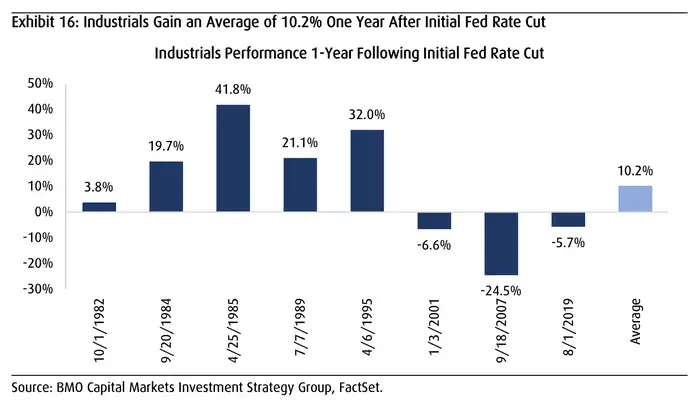

4. Industrials

Return 12 months after: 10.8%

Return three months after: -0.8%

Return 12 months before: 4.8%

Return in the 12 months before and after: 18%

Sector rating: Overweight

Source: BMO Capital Markets

5. Industrials

Return 12 months after: 10.2%

Return three months after: 1.3%

Return 12 months before: 11.4%

Return in the 12 months before and after: 22.5%

Sector rating: Market-weight

Source: BMO Capital Markets