How $7.75 billion Hopin went from pandemic darling to selling off its flagship business for $50 million and handing back some investor cash

- Virtual-events startup Hopin was a pandemic winner when it hit a $7.8 billion valuation in 2021.

- Now its CEO is stepping down, it’s selling off parts of its business, and is set to hand back investor cash.

- Ex-staff and backers say the firm was flooded with cash and did too much too quickly.

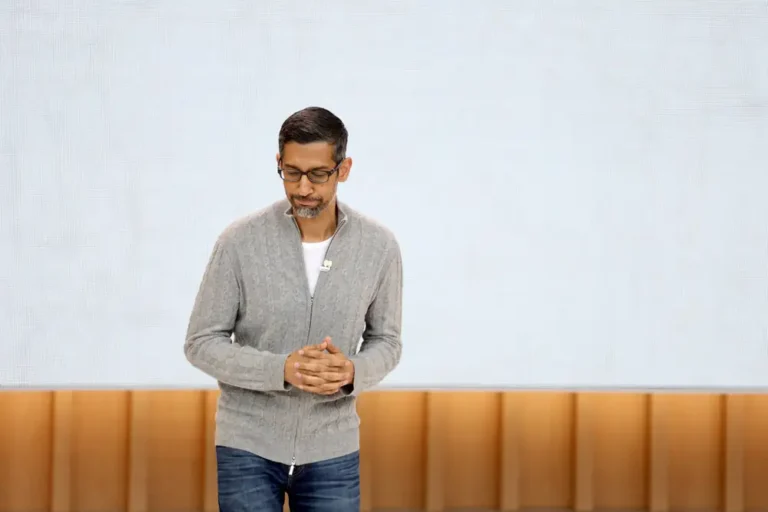

Johnny Boufarhat, Hopin’s 29-year-old CEO, was fond of the acronym “LFG.”

“We had an internal joke that that was his strategy – LFG – let’s fucking go,” one former staffer told Insider on the condition of anonymity.

Boufarhat followed through on his promise.

Whereas Zoom became the go-to for virtual meetings and Peloton became the go-to for at-home exercise, Hopin made it possible for conferences to continue in the face of widespread travel restrictions by bringing them online.

Over the course of 18 months, the firm, which was founded in 2019, raised more than $1 billion in venture capital funding. The company was once valued at $7.75 billion, which was more than 77 times its annual recurring revenue (ARR). Zoom, on the other hand, was valued at roughly 30 times its ARR at the time.

“You’re in a very well-funded company that’s getting more and more financing and traction while the world is ending, which is something I think people forget,” the ex-Hopin employee explained. “We were in a rocket ship while the rest of the world was losing jobs and dying.”

Big-name investors such as Tiger Global, Andreessen Horowitz, and General Catalyst threw money at the firm, as did corporate clients such as Twitch, Slack, and UPS. According to the Information, Hopin had increased its workforce to more than 1,110 people by early 2022 to meet the increased demand.

However, as vaccinations became available and travel restrictions eased, demand for Hopin’s platform declined.

Following three waves of layoffs that reduced headcount by half, the startup is set to sell the flagship virtual-events business that drew investor interest in the first place to cloud conference company RingCentral for just $50 million. Boufarhat has stated that he intends to leave his position.

Even at its peak, Hopin’s giddy valuation raised eyebrows, and former staffers, early backers, and peer investors say it was driven by a combination of pandemic panic and easy cash availability. They believe the company will be better off now that it has reduced its workforce and refocused on the more profitable aspects of its operations.

The startup sector in the United Kingdom is small and tight-knit, and founders, employees, and investors are generally hesitant to openly criticize their peers for fear of jeopardizing investment or employment opportunities. Many people in Hopin’s immediate vicinity spoke only on the condition of anonymity.

“The pandemic was an extraordinary time to be investing,” said one London-based tech investor who did not support Hopin. “So many companies’ revenues were in the air, but it was difficult to tell what was a COVID-19 boost and what was the new normal.”

“There’s always FOMO in VC, and you can’t afford to miss the next breakout company.”

A spokesperson for Hopin told Insider that the decision to step down as CEO was “made by Johnny” and that he would remain involved as a member of the board.

“Where things went wrong was that behavior changed, consumer behavior changed in ways that the company didn’t predict,” said a second former employee.

Hopin grew by gobbling other companies

Boufarhat, who was born in Australia to Lebanese parents, ended up in the UK as a student at the University of Manchester after growing up in the United States, Dubai, and Papua New Guinea.

Long before the COVID-19 pandemic, Boufarhat was diagnosed with an auto-immune disease in 2015, which meant he was frequently homebound and socially restricted as a young man. It gave him plenty of time to create virtual products.

According to the Financial Times, his first known ventures included a social app called Universe, a blogging platform called Readery, and an online dating platform called Quiin, the code from which eventually made its way into the first iteration of Hopin.

Boufarhat was always on the lookout for a good headline.Even before Hopin received its first seed funding, the founder says, “I was feeling optimistic enough to think, ‘If we aren’t the fastest-growing startup in the world next year, I shouldn’t be CEO.'”

This type of optimism is appealing to venture capitalists, who are trained to seek out startups with the potential to provide them with outsized returns. During conversations with Insider, several people waxed lyrical about his integrity and transparency, citing his decision to give stock options to employees affected by previous rounds of layoffs.

Boufarhat chose to make acquisitions with more than $1 billion in investor cash.

More unusually, he received an estimated $195 million from the company through secondary share sales to Hopin’s external investors, according to the Financial Times, and relocated his tax residency to Switzerland.

Founders taking capital out of their companies — known as “taking money off the table” — to keep themselves liquid is not uncommon, but the magnitude of Boufarhat’s maneuver sparked speculation and grudging admiration from other founders. One, who requested anonymity while discussing a peer, joked that he had “made out like an absolute bandit.”

“He just acted in his own self-interest at the time, I mean whatever seemed right to him,” said the second former Hopin employee. “The VCs were dumb enough to do it.”

Hopin paid $250 million in cash and stock for Streamyard in January 2021. Hopin acquired Streamyard to provide its customers with a suite of live-streaming studio tools. Streamyard’s pitch was to make it easier for content creators to create high-quality live streams.

Over the course of 2021, Hopin plans to acquire event networking app Topi, video-collaboration company Jamm, video-hosting service Streamable, event-marketing company Attendify, and event-management platform Boomset (which Hopin recently shuttered).

As Hopin’s fortunes have shifted, one lingering question is whether some of these acquisitions were better businesses than Hopin itself.

“Streamyard is the most important part of the whole thing,” said the first former employee.

Streamyard has made up the majority of the company’s revenues for years, possibly more than half, according to two sources close to Hopin. Streamyard, according to a Hopin spokesperson, “had always been core and central” to the company’s revenue and strategic value.

Hopin had over 100,000 organizations using its platform in August 2021, when it had just closed a $450 million round. Hopin’s core business at the time was hosting approximately 15,000 events per month. Less than a year later, that figure had dropped to 158.

Streamyard was not included in the RingCentral acquisition and will now be part of the remaining company, along with Streamable and a new community product called Superwave.

Hopin will be led by Badri Rajasekar, the company’s current chief technology and product officer, who joined during the acquisition spree.

A big chunk of the $1 billion remains unspent

Despite the acquisitions and Boufarhat’s cash out, the majority of the investor cash remains unspent, estimated to be between $400 million and $900 million by an early backer.

Hopin did not respond to Insider’s request for additional information on its plans to redistribute this money.

Giving cash back is unusual, but it can help a company focus on profitability and avoid exhausting pivots.

According to Axios, Hopin’s Series B investors, which include IVP, Tiger, and Altimeter, can expect to recoup roughly half of their investment.

As a buffer, some cash will remain on Hopin’s balance sheet.

“You don’t need a tonne of working capital to run a profitable standalone steady low-growth business,” the early investor explained.

The future of Hopin

According to Axios, the company is now valued at around $400 million, a 95% decrease from its peak valuation.

According to a company filing, RingCentral paid $50 million for Hopin’s core business. According to the filing, the deal terms are $15 million up front, with the remaining $35 million contingent on performance goals.

The inflated valuation was, as it turned out, inflated.

“You only need one term sheet,” stated the early investor. “Microsoft requires 1,000 market participants to agree that it is worth $1 trillion.” A private company’s price is set by a single person.”

I’m hoping he’s not alone here. Share prices in hot pandemic stocks like Zoom and Peloton have plummeted from late 2020 highs. Private technology companies that thrived during the pandemic years, such as buy-now, pay-later firm Klarna, saw their valuations slashed through 2022.

What remains for Boufarhat and the rest of the Hopin team is a viable, albeit smaller, business.

“The company tried to do too many things, it was a bit confused,” said the second former employee. “I don’t see them becoming a very large, growing, and successful company.” They’ll end up being a decent small- to mid-sized tech company, and that’s about it.”