How Discord is laying the groundwork for ads to make as much revenue as subscriptions

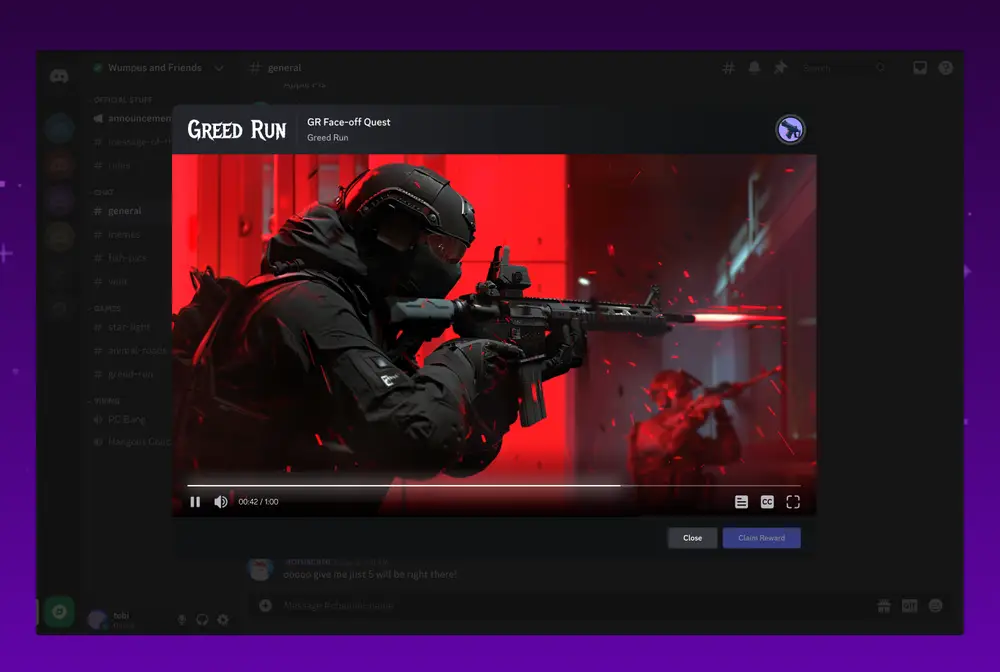

A Video Quest ad for the “Greed Run” game on Discord.

The gaming-focused chat app Discord is readying the launch of its second ad format, part of a plan to steadily grow its ads business ahead of a potential initial public offering.

Video Quests will reward viewers for watching a video ad, such as with an in-game item, a skin for a character in that game, or a way to augment how their profile appears on Discord.

The ads will initially appear in the lower-left area of the app on desktop, via mobile banners, and in the Quests home page.

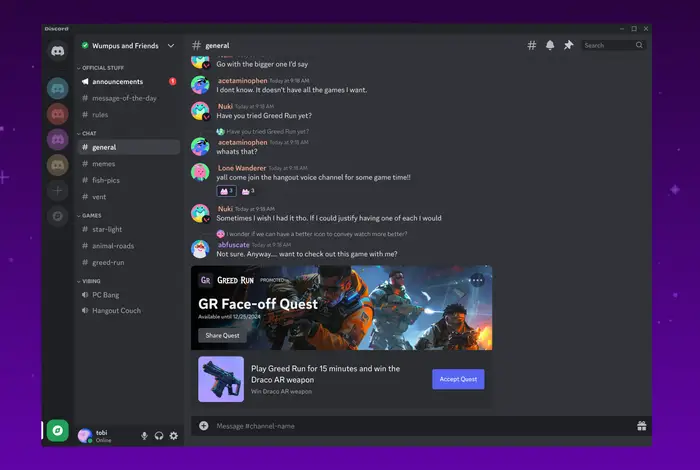

Discord first rolled out ads earlier this year when it introduced Quests — now known as Game Quests — which let games developers and publishers offer users in-game rewards if they streamed their gameplay from a specific game with friends.

Until then, Discord had eschewed advertising over concerns it would be too intrusive and that users wouldn’t want to share their data with marketers.

That’s why the company is taking a deliberately slow-and-steady approach to advertising. Both Quests formats are only currently available to games developers and publishers, though Peter Sellis, Discord’s SVP of product, said the company would be open to having conversations with gaming-adjacent brands over time.

Activision Blizzard’s World of Warcraft, Epic Games’ Fortnite, and HoYoverse’s Genshin Impact have run Quests on Discord this year.

“Discord is a place where you play games with your friends, so game-related ads feel really good,” Sellis told B-17 in an interview. “We have to be really careful with how we use that kind of superpower.”

For now, Quests can only be bought directly from the Discord sales team — there’s no self-service facility or integrations with third-party ad-buying platforms.

Game Quest ads offer users virtual prizes for playing and streaming games.

Advertisers can target their campaigns by age, geography, and a user’s gameplay history. Sellis said the cost of an overall campaign tends to be large but that they are “competitively priced” versus other platforms such as Netflix that launched their ad businesses with sky-high CPMs — the cost-per-mille, or the cost to reach 1,000 impressions — only to later bring them down.

“Those other platforms gave gone to market with very premium CPMs, sometimes $50-plus in some cases; at Discord we’re looking at something that’s half of that or even less,” Sellis said. (Sellis previously worked on business products at Snap, which also came out of the gate with large CPMs when it first offered ads on Snapchat.)

He added that the design of Quests lends itself to users sharing content with their friends, which boosts the overall impressions a campaign is likely to generate.

Discord ad revenue could one day become ‘on par’ with its subscription business

Growing Discord’s advertising revenue will be crucial as the nearly 10-year-old company looks to turn a profit and plot a path towards a potential IPO.

Discord’s chief executive, Jason Citron, told Bloomberg in March that “at some point, we’d probably go public.” The company has raised around $1 billion in investment to date, according to PitchBook.

Right now, the company generates the vast majority of its revenue from its Nitro subscription service, where users pay either $2.99 or $9.99 a month to unlock benefits like high-definition streaming, custom emojis, and the ability to upload larger files. Otherwise, Discord is free to use. It also makes money by taking a 10% commission from developers who sell their games on Discord and when users pay to boost their communities — known as servers — to a bigger audience.

Peter Sellis, Discord’s SVP of product, thinks ads could one day be on par with subscriptions for the company.

The company is expected to generate around $600 million in annual revenue this year, Bloomberg reported in March.

“I do foresee that advertising could be a very significant contributor to our business, on par with our subscription business, long-term,” Sellis said.

Discord is currently growing its in-house advertising ranks. It recently hired Adam Bauer, formerly of FaZe Clan, as its VP of sales, and it lists seven open ad sales roles on its careers site.

But Discord is a late entrant in a crowded market. While Discord has grown to around 200 million monthly active users, competitors like Meta and Google have billions — as well as precision-targeting, measurement, and brand safety features that Discord doesn’t yet offer. A laser focus on the gaming category could also limit its potential pool of advertisers.

Hon-Ming Gianotti, strategic industries lead for games at the marketing agency Monks, said that “intimacy” is one of the platform’s unique selling points that Discord should attempt to pitch to the advertising community.

“When you’re communicating directly to a group of friends about specific labeled topics or a bunch of people with similar interests to you, you’re in a very different type of mindset — you’re seeking to actually socialize and communicating with people about real things rather than viewing a thing and reacting in the comments,” Gianotti said.

For advertisers, he added, “The benefit of being a filter or layer or entity that contributes to that intimate experience is exciting.”