How Google’s ad business could be saved by a $150 billion spin-off

The US Department of Justice and 17 state attorneys general are seeking to break up Google in a landmark adtech antitrust trial.

Closing arguments are set to be delivered in November, with a ruling expected next year. The government is hoping the judge will force Google to divest some or all of its adtech business.

But shutting or splitting up Google’s adtech business “might cripple publishers,” according to analysts at Arete Research, who wrote in a note last week that Google’s adtech should instead be spun out into a public-benefit B Corp.

Companies receive B Corp certification from the nonprofit organization B Lab if they meet standards regarding their social and environmental performance, as well as other areas of transparency and accountability.

The complaint against Google alleges that the tech giant used acquisitions and anticompetitive ad auction tactics, and tied its various adtech pieces together to build an illegal monopoly of the digital ad market. The case hones in on the “open web display” digital ad market and the tools that power the ad auctions that take place in the milliseconds it takes for a webpage to load. Google owns the tools publishers use to sell ads, the software advertisers use to buy ads, and the ad exchange that connects them.

Should the judge rule in the government’s favor, many experts believe a likely outcome of the case would be to order Google to spin off or otherwise exit the so-called “sell side” of the adtech business. Here, Google operates an ad server that helps publishers manage their ads as well as the Google Display Network, where it allows advertisers to buy ads across millions of third-party websites that it doesn’t own.

A brute-force breakup or shutdown of parts of Google’s sell-side business could have unintended consequences for publishers, Arete’s analysts wrote. They argue that almost every publisher relies on Google’s adtech tools and that separating its ad server from its ad exchange would be highly disruptive at a time when publishers are already struggling due to other platform changes and shifts in advertiser spending.

A publisher tech executive shared with B-17 their own concerns about a potential breakup of Google’s adtech business earlier this month. And execs who had worked at publishers including News Corp. and The Daily Mail took to the stand in the antitrust trial this month to testify that switching from Google’s adtech to a rival would have cost them millions of dollars in lost revenue a year.

A Google spokesperson declined to comment for this story but pointed B-17 toward a blog post published Friday. In it, the company argues that its changes over the years have benefited competitors and brought down prices for publishers and advertisers. It contends that the adtech market remains fiercely competitive.

NetworkB — the public-benefit adtech company

Enter “NetworkB,” Arete’s hypothetically named Google adtech B Corp.

Arete suggests Google’s parent company, Alphabet, should spin out its entire Network business, which generated $31.4 billion in 2023 (slightly down from the prior year). Some analysts have predicted the unit was likely to shrink further over the coming years anyway, regardless of any antitrust enforcement, as Google prioritizes its own properties versus third-party sites.

Arete proposes Google Network become a B Corp with a capped profit margin that it could extract from its clients, known in the industry as a take rate. Right now, adtech industry players retain anywhere between 8% and 42% of the ad dollars that flow through their pipes, according to Arete’s estimates.

The spinoff would free Google of accusations of self-preferencing and unfair tying within its adtech stack, while also charging lower fees than rival adtech companies, Arete said. That would ultimately mean publishers end up getting paid more, Arete’s analysts wrote. And, as a stand-alone business not attached to YouTube, Network B could press further into other areas like connected-TV advertising, they said.

Arete calculated that while such a move would mean Google forgoing an estimated $29 billion in Google Network revenues this year, it’s only expected to generate around $3.5 billion of EBITDA, or earnings before interest, tax, depreciation, and amortization.

The B-Corp solution would be attractive to Alphabet shareholders, who would end up owning the largest adtech intermediary with a potential market capitalization of between $120 billion and $150 billion — a conservative estimate, according to Arete’s analysts. Meanwhile, Alphabet itself would become a smaller but higher-margin business with fewer antitrust risks.

“Google could shed its lowest-margin unit, end its regulatory overhang and raise the value of its O&O inventory, while helping publishers globally,” the analysts wrote. O&O refers to owned and operated inventory, such as Google Maps and Gmail, where its proprietary data on its logged-in users are valuable to advertisers.

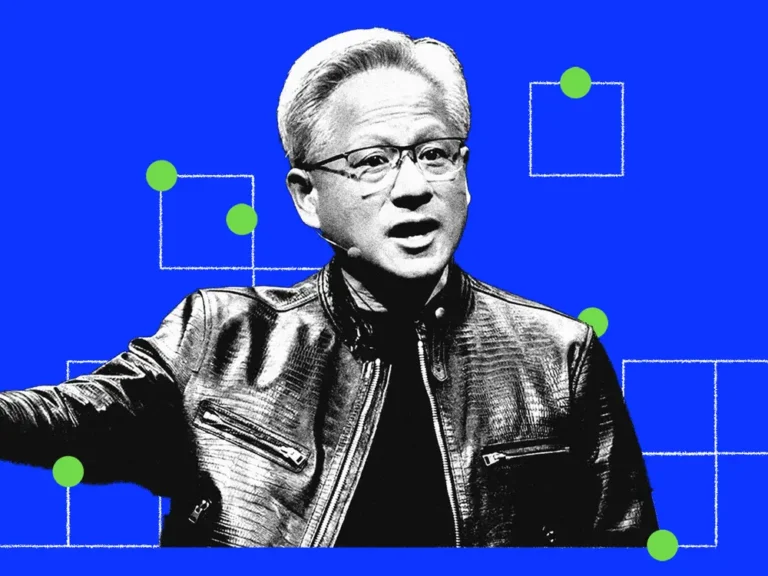

Arete founder Richard Kramer told B-17 that the antitrust case unearthed some “surely unwelcome disclosure” for Google, but also other adtech players, such as actual financials on adtech operations and how they charged advertisers and publishers.

“As analysts we were delighted with the trial because it just opened a window onto cost structures that had always been opaque and hidden,” Kramer said.