How Prada is beating the odds and bucking the luxury slump

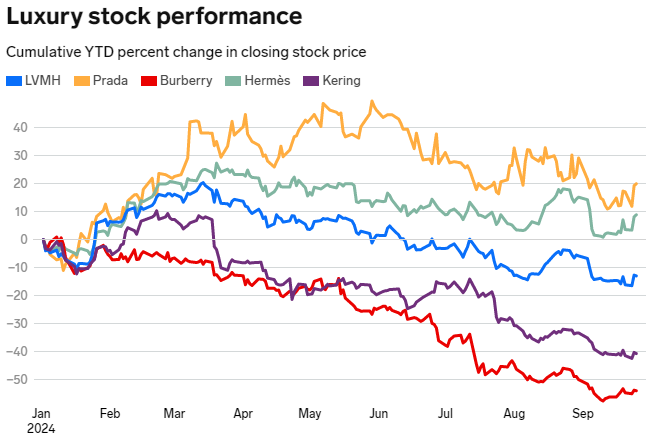

Prada has done what few luxury companies have been able to do this year: grow. Its sales and stock are both up, thanks to a hot streak at Miu Miu and a winning turnaround strategy.

It took something surprisingly small — something that’s been described as “teeny tiny” and “ultra-cropped” — to propel Prada to its place as one of the year’s few luxury winners. In fact, it measures under 10 inches long.

Miu Miu’s micro miniskirt, which debuted in 2021 and subsequently went viral, taking over both TikTok and magazine front covers, is emblematic of the brand’s show-stopping couple of years — and has no doubt helped its parent company, Prada, do what few luxury companies have been able to do this year: grow.

“I think the ‘miracle’ at Prada is Miu Miu,” Luca Solca, a senior analyst at Bernstein, told B-17.

Thanks to Miu Miu’s hot streak, as well as a series of smart business moves at Prada itself — a focus on a controlled retail pipeline and store productivity, plus some experienced new hires — the company is bucking negative luxury trends. It’s selling well in Asia, its stock is up, and investors are excited.

Net revenue for the first half of the year was 14% higher than in the same period in 2023 and 34% more than 2022. At luxury bellwethers LVMH and Kering, first-half sales fell 1% and 11%, respectively, compared to last year. Its stock is up more than 30% year-to-date, even more than that of Hermès, luxury’s perennial market leader. Along with Moncler, it’s one of only two buy-rated luxury stocks at HSBC.

The 111-year-old, family-run, Milanese leather goods shop turned cutting-edge fashion superhouse is now enjoying one of its greatest runs in history.

The trendy little sister

As any elder sibling knows well, sometimes the flashy, fun younger sister can outshine even the most well-prepared eldest. Miu Miu is doing just that.

The more experimental brand has become the “It” girl of the fashion industry. It’s number two on The Lyst Fashion Index, a quarterly measure of the hottest fashion brands. Searches for Miu Miu are up 47% this year on luxury resale platform The RealReal. The micro minis that stormed the runway in 2021, a sneaker collab with New Balance, and the quilted Wander bags have become must-have looks.

That’s translated into impressive results: Retail sales were up 50% in 2023 and 86% in the first half of this year. Last quarter, website traffic was up 110% year over year, Stifel’s Rogerio Fujimori reported in his July note. The brand will likely hit $1 billion in revenue this year.

Miu Miu’s micro miniskirts became a must-have look for the fashion set.

Part of it is the brand’s messaging.

“Miu Miu is resonating with consumers because of a savvy mix of product and communication marketing,” Solca said.

In a recent note, he highlighted the brand’s events — a tennis club, literary club, and film series — that go beyond just fashion to form a “cultural aesthetic.”

Miu Miu has embraced stars (Sydney Sweeney and Gigi Hadid were featured in recent campaigns), which has energized its following.

The brand has also managed to tap into Asian markets — one of the most challenging sectors for luxury brands.

Again, some smart marketing has helped. The brand enlisted K-pop icons as ambassadors and dressed Chinese stars Lexie Liu, Zhao Jinmai, and Wu Yanshu. It also increased spending on Little Red Book, a social media platform in China, and threw events in Tokyo, Taipei, and Nanjing.

In short — pun intended — you can’t get trendier than Miu Miu right now, and being trendy is good for business.

The business behind the boom

But Miu Miu’s popularity, as attention-grabbing as it is, is only part of the story. The brand accounted for 15% of Prada’s sales last year. HSBC analysts called its growth a “(big) cherry on the cake” — the cake being Prada (which didn’t respond to a request for comment from B-17 for this story).

Behind Miu Miu’s Mary Jane shoes and Arcade bags is a success story at its parent company.

The group’s namesake line is growing, albeit at a slower and steadier pace. Prada’s retail sales were up 3% in the first half of the year compared to last year and 7% in 2023. It’s been among Lyst’s top five hottest brands since 2022.

This didn’t happen by accident: In 2017, Prada committed to a turnaround strategy following a few losing years and a drop in profitability. At more than 100 years old, Prada hadn’t entered the new millennium: Its full product line wasn’t available through e-commerce, and its advertising wasn’t digitized.

“In 2015, the tide really turned for them,” Jelena Sokolova, a senior analyst for Morningstar, told B-17. “They fared worse than the industry: Sales were negative for a number of years; their earnings plummeted.”

In response, Prada focused on retail, a channel in which it can control prices and cut back on wholesale, which now represents only 11% of sales. It made an effort to cut down on discounts — a problem that has plagued labels like Burberry and Gucci and can lead to diminishing brand perception.

At its retail stores, new CEO Andrea Guerra, who arrived in 2023 from LVMH, has drilled down on productivity, or how much money each square foot of retail space generates, by launching in-store installations, forming one-to-one relationships between sales associates and customers, and infusing stores with wearable pieces and collaborations. The company closed stores that weren’t performing and renovated the ones that were. It’s worked: Retail productivity has increased 32.5% between 2019 and 2023.

Prada has invested in its retail locations, like this one in Hong Kong, to maximize sales per square foot.

There has also been a slew of management changes.

In 2020, the company brought on Raf Simons, heralded as one of the biggest stars in the design world, as co-creative director, sharing the title with Muccia Prada — the company’s billionaire heiress who The New York Times has referred to as “the most influential woman in fashion.” Prada now has more time to use her keen sense of design at Miu Miu.

In the years following, it recruited talent from LVMH and Goldman Sachs to join its top ranks.

And then there is the sheer cyclicality of fashion and the fact that, after a few years of being less-than-hot, Prada is once again on the rise. It has embraced the 1990s and Y2K aesthetic — a heyday for Prada — popular with Gen Z and was the most searched brand among the demographic on The RealReal.

Hit products pushed the profitable leather goods category to revenues of more than $2 billion last year. There was a reimagining of the early 2010s it-bag, the Galleria, complete with a Scarlett Johansson-led campaign. Other handbag rereleases, like that of the Nylon, have taken off, while new purse styles like the Buckle and Arqué got callouts in last year’s earnings report.

That momentum gave the brand an upper hand going into the luxury downturn.

“People prioritize which brands they want to spend on. With a limited budget, first, you drop the ones that were not hot to begin with,” Sokolova said.

Can Prada’s hot streak last?

Just as fashion comes in, it can come out. And Prada’s story — particularly Miu Miu’s rapid-fire growth — in some ways mimics that of Gucci’s hype-driven rise and plummeting fall under Alessandro Michele.

“You kind of become a victim of your own success,” Sokolova said.

Both Prada and Miu Miu are susceptible to volatility, though for different reasons. Miu Miu is still relatively small, meaning its brand identity is not yet established enough to withstand the whims of consumers. CEO Guerra has acknowledged that such incredible growth can lead to a challenge.

“There appears to be a glass ceiling,” Solca wrote in a recent note. “Being prominent brings fatigue: after a while, consumers feel they have seen and done enough with these brands and move on.”

Prada, meanwhile, is more exposed in the cyclical ready-to-wear category — which makes up 32% of sales — than other brands like Gucci and YSL.

But there are signs of continued growth: Miu Miu is adding 10 to 15 stores next year, while Prada is adding five to 10, the company has said. The brand’s retail footprint is particularly underpenetrated in the US. The company’s beauty business is still nascent. Last year, it launched skincare and makeup through a partnership with L’Oréal, and there is more money to be made in that sector.

With so much control of its sales chain, the company can raise prices and limit overexposure through low-end collaborations or expansion into cheap categories.

Plus, the slowdown hasn’t happened yet: Miu Miu website traffic and sales continued to grow between the first and second quarters, and the company maintains it’s not a flash in the pan.

“This is a result of many years of work on the brand, on the products, on the people,” Guerra said about Miu Miu’s success on the company’s most recent earnings call.

Meanwhile, Prada has maintained its brand value.

But the woman Muccia Prada herself knows the pressure is on.

“I was very nervous for this show,” she told reporters backstage at the line’s fashion show earlier this month about the new collection, The New York Times reported. “Much more than usual.”