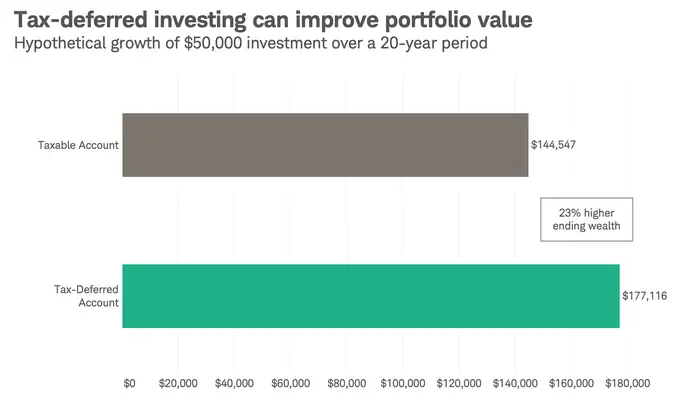

How tax-deferred investing can increase a portfolio’s value by 23% and the account that provides a triple benefit

Nothing is less exciting than thinking about taxes, especially when the bill is coming due.

And once you cross into the first quarter of the year, little can be done to reduce your tax liability, especially if you’re a W2 employee.

That’s why thinking about deferral strategies is a great way to reduce how much you pay in taxes and increase your net worth in the long term. But to maximize your outcome, you have to start with a 401(k) or a Traditional IRA, according to a recent simulated study by Charles Schwab. The study showed how a 401(k) could increase an investment portfolio’s value by 23%.

The study, which was backtested over 20 years, compared two investors, one who used a taxable brokerage account versus one who used a 401(k). At an 8% annual return, it found that the latter finished with a value of $177,116 compared to the taxable account at $144,547. Based on this scenario, it assumed that someone allocating funds after tax in a 24% bracket would have a principal investment of $38,000 compared to $50,000. It also assumed taxable events on a turnover rate every five years and on 2% qualified income dividends and 6% long-term capital gains.

In a scenario where an investor uses a taxable account but doesn’t turnover or realize gains every five years, meaning taxable events are only placed on the 2% dividends, the outcome would lead to an ending value of $152,392.

One caveat is that tax-deferred accounts don’t take into account every phase of where taxation can occur along the investment process, says Rob Williams, managing director of financial planning at Charles Schwab. The first point is when money is earned and before it’s invested. The second is when income and dividend payments are earned along the way. The third point is once gains are realized. The first two taxation points are covered. The last phase isn’t. For this process, other accounts, such as Roth IRAs for after-tax contributions allow gains to grow tax-free.

Roth IRAs could come in handy in retirement during years when you have a higher withdrawal rate and, in turn, fund yourself in a higher tax bracket.

Other tax tips

Another option people don’t think about as much is a health savings account, which is unique, Williams noted. You have to qualify for those with an employer that provides it through a health insurance policy with a high deductible plan. But they are a nice additional tool that investors can use to contribute from their paycheck, he added.

It’s contributed pre-tax. And if the money isn’t used for healthcare costs, it can be saved and invested in that health savings account and grow tax-free. It’s tax deferral and tax avoidance, he noted.

“For a health savings account, that’s powerful,” Williams said. “We call that a triple tax exemption. You get no taxes when you put the money in and no taxes on any growth or capital gains in the fund. And then when you take it out, you don’t have any taxes as well.”

Taxable brokerage or investment accounts are still useful because they allow you to withdraw money before retirement. This is especially great in the event you need to make a big purchase. But when using these accounts, investors should consider the assets they’re buying. For example, exchange-traded funds have less tax drag than mutual funds that have higher turnover and, in turn, more taxable events, Williams noted.

“Any investment or mutual fund that generates a fair amount of investment income, whether it’s interest or dividends, do not tend to be very tax efficient,” Williams said.

This also means considering how funds distribute gains, such as whether they are qualified or ordinary dividends. The latter is taxed at an investor’s tax rate and depending on what margin that’s in, it may not be as advantageous as a qualified dividend.