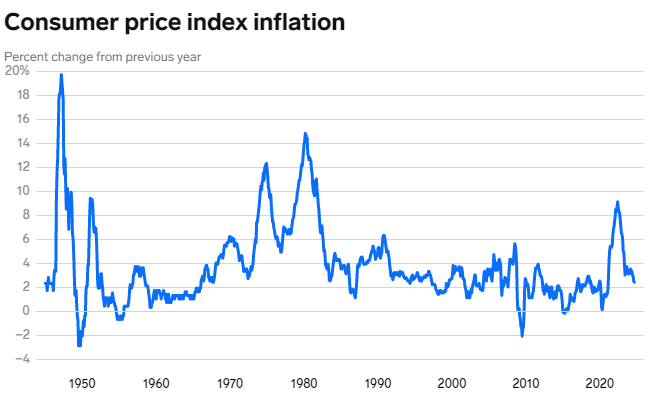

Inflation was hotter than expected in September, but continued its downward trend

Inflation came in hotter than expected in September.

The consumer price index, a closely-watched inflation measure, increased 2.4% from September 2023 to this past September. This index was expected to see a year-over-year increase of 2.3%, a cooler rate than August’s 2.5%.

The surprisingly hot inflation reading is a sign that the economy is running strong, and complicates the Fed’s next rate decision, since in theory higher inflation would make further cuts less likely.

Still, odds of a 25-basis-point rate cut at the central bank’s November meeting ticked higher after the release, and now carries an 83% probability, according to the CME FedWatch tool.

That could be because the market also digested weekly jobless-claim figures that came in higher than expected. The Fed has been closely watching the labor market for signs of tightness, in addition to inflation for signals of what to do next with rates.

Following a surprisingly strong September jobs report, speculation rose that the Fed might slow its pace of rate cuts — or even stop them altogether. But the market appears largely convinced for now that a 25-basis-point move is coming in November.

The Fed will have other data to mull over before the meeting. The Employment Cost Index, a quarterly release that shows how much companies are paying in salaries and benefits, will be published on October 31. Plus, the next jobs report, which includes how job gains looked in October as well as potential revisions for September’s and August’s growth, will be out on November 1.