Inshur provides embedded insurance to ride-hailing companies like Uber. Check out the 16-slide pitch deck used to secure $19 million.

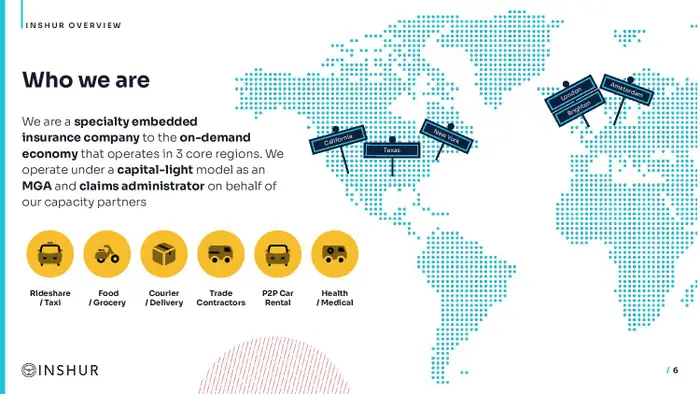

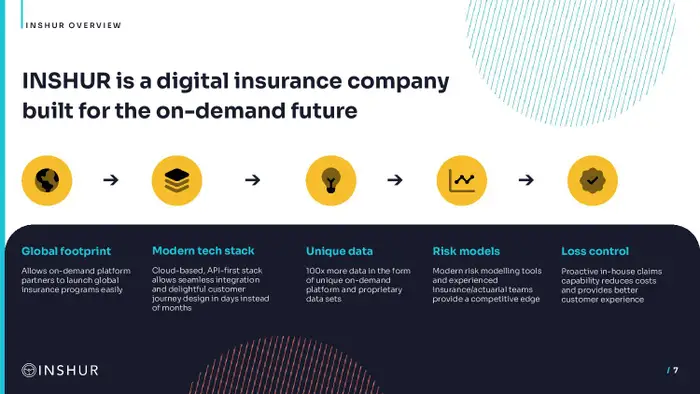

New York-based startup Inshur, which provides bespoke insurance for workers in the on-demand economy, has secured $19 million in Series B funding.

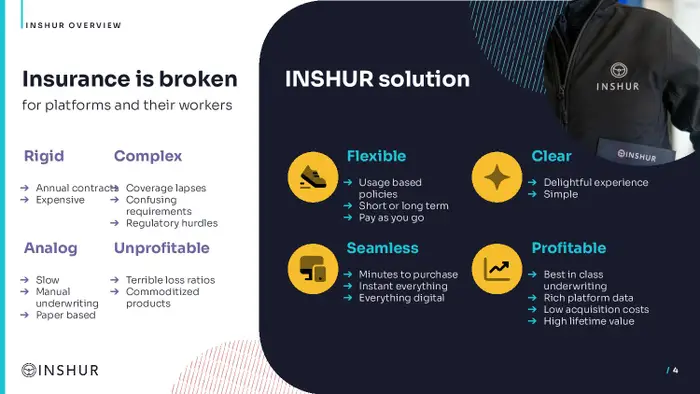

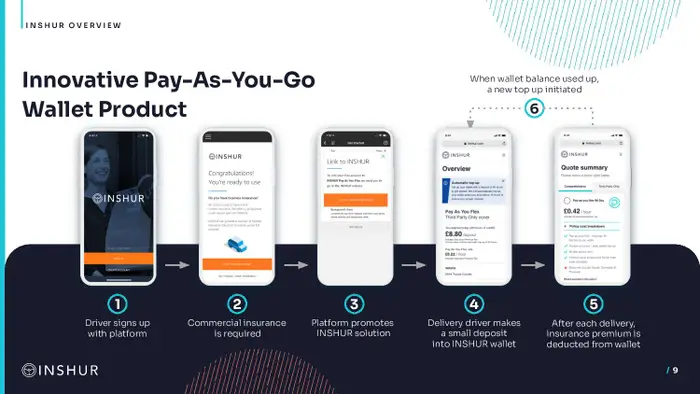

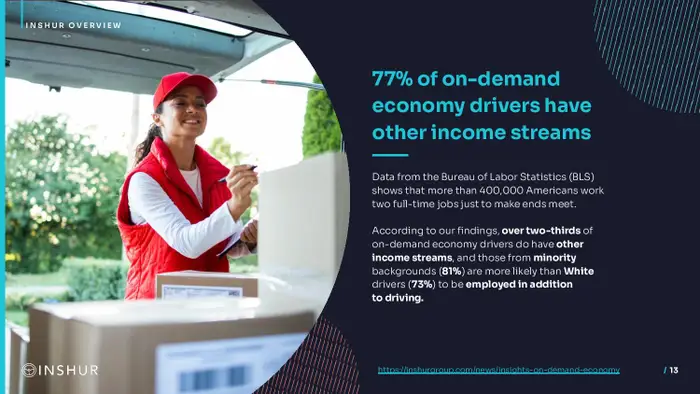

The insurtech startup, which launched in 2016, provides instant coverage through its app — or via companies such as Amazon Flex — to delivery and ride-hailing drivers.

More recently, the startup says it has embedded AI into its offerings to speed up its services.

“We use AI and machine learning primarily as an augmented assistant rather than a replacement for insurance expertise, such as ID verification, fraud detection and assistance with claim triage and handling, and we embed insurance into the apps so that it’s accessible for drivers,” Inshur’s CEO, Dan Bratshpis, told B-17.

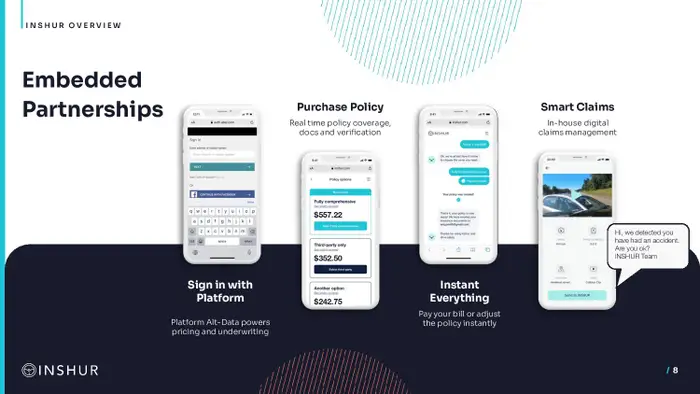

Its products are used by ride-hailing clients such as Uber and can be embedded into a company’s existing platform.

For example, Uber drivers can log in using their Uber credentials on the Inshur app, to get a quote, said Bratshpis. “Because we’re embedded, we can pull data from Uber and underwrite a fair and comprehensive policy for the on-demand driver,” he added.

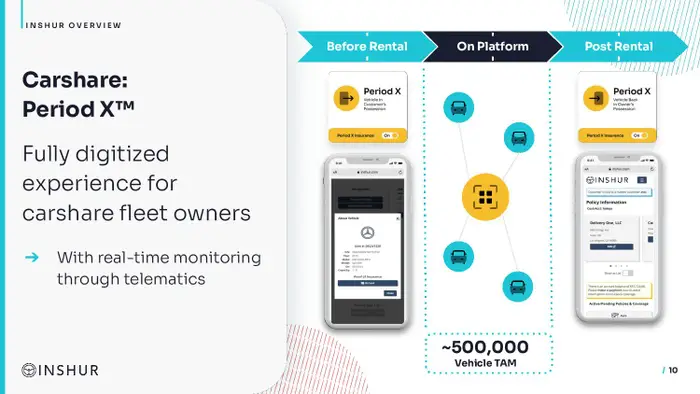

The startup claims that its car-sharing insurance platform has grown by 100% in the past year. In April, it acquired American Business Insurance Services and has since expanded its footprint in the US.

The Series B, led by Viola Growth and with participation from MS&AD, brings the startup’s total funding to $80 million.

With the capital injection, Inshur said it will continue to scale its team in the US, and develop its product offerings for drivers and commercial partners.

Check out the 16-slide pitch deck used to secure the fresh funding.