Inside Microsoft’s struggles with CopilotCustomers are dissatisfied, rivals are circling, and company insiders are skeptical: a B-17 exclusive.

In September 2023, Microsoft’s famously soft-spoken CEO, Satya Nadella, unveiled the company’s flagship AI product, Copilot, with sweeping fanfare. “Copilot will fundamentally transform our relationship with technology,” he declared. The AI assistant, he predicted, would give birth to an “era that uplifts every person, industry, community, and country.”

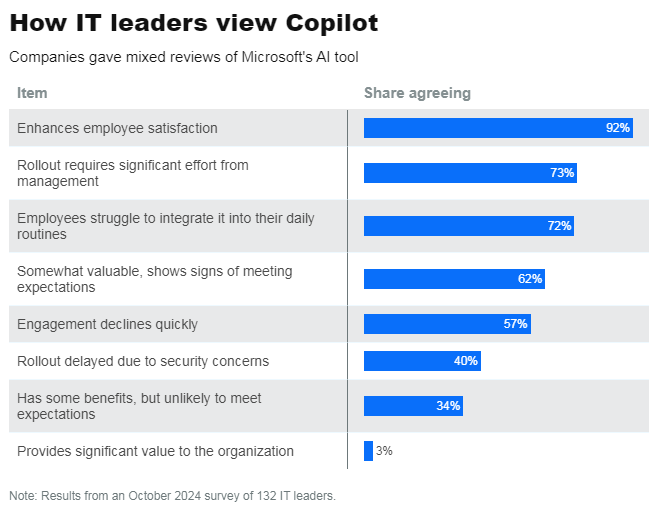

Now, a year after Copilot’s release, the reviews — both inside and outside Microsoft — indicate that the new product is struggling to live up to the hype. While there is no single measurement of Copilot’s performance, given the wide array of features it seeks to provide, many customers appear to be dissatisfied with the AI tool, complaining that it is ineffective, costly, and not secure. In October, when the management consultancy Gartner published a survey of 123 IT leaders, only four said Copilot provided significant value to their companies.

Some of Microsoft’s own employees and executives are privately concerned that Copilot won’t be able to deliver on its ambitions. To assess the tool’s rollout — and the central role it plays in Microsoft’s historic, all-out investment in AI — B-17 reviewed internal emails and pay spreadsheets, spoke with customers and competitors, and interviewed 15 current and former Microsoft insiders, most of whom requested anonymity to speak freely about internal matters. Many of those charged with building Copilot say they harbor doubts about what it will ultimately achieve. Others in the company express serious doubts about Microsoft’s immense investment in a technology that they see as unproven — and potentially unprofitable.

“I really feel like I’m living in a group delusion here at Microsoft,” one longtime employee told B-17. The company touts that “AI is going to revolutionize everything,” the person said, “but the support isn’t there for AI to do 75% of what Microsoft claims it’ll do.”

Copilot’s struggles have created an opening for Microsoft’s rivals, some of whom have seized on the opportunity to promote their own agendas. Salesforce CEO Marc Benioff, who in September announced a competitor product called Agentforce, has taken to social media to dismiss Copilot as “Clippy 2.0,” a reference to Microsoft’s widely maligned cartoon paper-clip assistant. “Microsoft has really disappointed so many of our customers,” Benioff told B-17. “They have not delivered any competitive capability.”

Even Wall Street, whose hype over generative AI catapulted Microsoft to a $3 trillion valuation, has begun to sour on the huge AI swings that some companies have begun to take. In June, Goldman Sachs published a report, “Gen AI: Too Much Spend, Too Little Benefit?” that speculated an industry-wide bubble could soon burst. Venture capitalists have also tempered their enthusiasm. Earlier this month, Marc Andreessen, the cofounder of one of the most AI-bullish venture firms, Andreessen Horowitz, warned that AI models were hitting a “ceiling on capabilities.”

“Copilot will fundamentally transform our relationship with technology,” Microsoft CEO Satya Nadella said when he debuted the AI assistant last year.

Goldman estimates that in the next few years, tech companies will invest more than $1 trillion to develop AI — and Microsoft is one of the biggest spenders. Thanks in large part to its AI strategy, the company’s capital expenditures hit a record $20 billion in its most recent quarter — and a person familiar with the company’s expenses said for the first time in Microsoft’s history that capital expenses have started to exceed its payroll, which now encompasses 228,000 employees. Internally, B-17 has learned, the spending spree on AI delayed budgets for several teams for the current fiscal year. It has also prompted the company to add Copilot-specific sales goals for the first time, turning up the pressure to wring revenue out of its massive investment in AI.

The technology is still in its formative stages, and Microsoft’s big bet may eventually pay off, given enough time and resources. But as the company seeks to win over more converts to its gospel of generative AI, some of its own preachers wonder whether the company is worshiping a false god. “There’s a gap between the ambitious vision and what users are actually experiencing,” said another employee close to Copilot. “Internally, we’re calling it growing pains. We are building the plane as we fly it.”

Last November, when Microsoft released Copilot into its enterprise software suite, Microsoft 365, it called the AI assistant “the most powerful productivity tool on the planet.” Copilot was able to almost instantaneously summarize meetings and emails. It seemed like the wave of the future, and it quickly took off: Microsoft says 70% of Fortune 500 companies now use Copilot.

Internally, though, some employees feared the company was releasing the product prematurely — a move that could backfire with customers. One employee who works with Copilot said that its PowerPoint tool was initially “terrible,” and that even now many of its features for Excel won’t work without assistance from third-party vendors. A C-level executive at a large Microsoft customer told B-17 that many of Copilot’s tools struck him as “gimmicky.” By March, according to current and former executives, the company was engaging in a mad dash to add value to the product, before the initial excitement wore off. One Microsoft executive offered a blunt assessment of Copilot’s ability to deliver useful results. “About one out of 10 times is magic,” the executive said. “The rest of the time it’s: Why do we even try?”

Microsoft defends its new product — and its larger strategy of going all in on AI. The company told B-17 that its investments in Copilot are already paying off, and that many customers are coming back to purchase additional access to the tool. Microsoft also cited a study it commissioned, which found that for every $1 a company devoted to generative AI, the return on investment was $3.70.

Jared Spataro, Microsoft’s chief marketing officer of AI at Work, dismissed criticism from the likes of Benioff as a rival’s sour grapes. “History tells us that when competitors talk about you, it’s because they’re behind,” Spataro told B-17. He also cited what he said were examples of Copilot’s success: Lumen Technologies projects that its sales team’s use of Copilot will save the company $50 million a year. Honeywell has used Copilot to add productivity gains equal to 187 full-time employees. And the fintech giant Finastra has cut creative production to seven weeks from seven months.

But a year after Copilot’s release, such examples may be more outliers than the norm. In the Gartner survey published last month, IT leaders were far from enthusiastic about the product. Ninety-two percent said Copilot enhanced employee satisfaction, and 62% called it “somewhat valuable.” At the same time, nearly 75% said their employees were struggling to integrate Copilot into their daily routines, 57% said users felt the tool didn’t deliver the value they expected, and 53% reported that it provided too many inaccurate results.

Customers also complain that Copilot — which at $30 a month per user can effectively double the licensing fee for Microsoft 365 — is far too costly. In July, Wall Street analysts noted that the chief information officer of a pharmaceuticals company had canceled Copilot for 500 employees after six months, saying the tool cost too much for what it provided. Some features didn’t work well, the CIO said, likening the quality of its slide-generating capability to that of “middle school presentations.” Even worse, what had initially struck him as Copilot’s most compelling feature — its meeting-summary tool — had to be disabled because the company’s legal team was wary of saving transcripts.

Perhaps the biggest concern customers have raised about Copilot involves its security. The tool’s magic — its ability to create a 10-slide road-mapping presentation, or to summon up a list of your company’s most profitable products last quarter — works by browsing and indexing all of your company’s internal information, like the web crawlers used by search engines. Historically, IT departments at many companies have set up lax permissions for who can access internal documents — selecting “allow all,” say, for the company’s HR software, rather than going through the trouble of selecting specific users. That never created much of a problem, because there wasn’t a tool that an average employee could use to identify and retrieve sensitive company documents. But Copilot is that tool.

As a result, many customers have deployed Copilot, only to discover that it can enable employees to read an executive’s inbox or access sensitive HR documents. “Now, when Joe Blow logs into an account and kicks off Copilot, they can see everything,” said one Microsoft employee familiar with customer complaints. “All of a sudden Joe Blow can see the CEO’s emails.”

Another Microsoft employee said the tool “works really darn well” at sharing “information that the customer doesn’t want to share or didn’t think it had made available to its employee, such as salary info.” And fixing the issue is far from simple, said the previous employee: “The problem is that it takes years. These are not easy situations.”

Faced with such issues, some customers have paused their deployment of Copilot. In the Gartner survey, 40% percent of IT managers said their company had delayed implementing the tool for at least three months, citing “oversharing and security concerns.”

A Microsoft spokesperson said the company has addressed Copilot’s security issues in several ways. It has developed features to help customers manage their permissions at scale, making it easier to identify where oversharing might be taking place. It has created a tool that enables users to keep files in libraries that are blocked from appearing in Copilot-generated results. And later this month, it plans to release a guide “that specifically addresses the topic of oversharing, with best practices to help customers manage their data securely.”

According to company insiders, Copilot has also been hampered by a program Microsoft introduced this year called the Secure Future Initiative. The move — which makes security the top priority for every employee — follows years of security issues at Microsoft, including what the Department of Homeland Security called “a cascade of security failures” last year that allowed Chinese hackers to access emails from thousands of customers.

“If you’re faced with the tradeoff between security and another priority,” Nadella wrote in an email to Microsoft employees in the spring, “your answer is clear: Do security.”

As complaints and questions over Copilot mount, so does the pressure to justify Microsoft’s unprecedented level of spending on AI.

Internally, employees have been impressed by the initiative. “It’s the biggest company push I’ve ever seen Microsoft do where they are investing in security,” said one. But some also say that the emphasis on security is delaying the development of new Copilot features, which are desperately needed to attract and retain more customers. “Security continues to be job No. 1,” said one employee familiar with the initiative, “even if it’s deferring feature work.”

In a blog post in September, Microsoft said it was continuing to add capabilities to address customer concerns. “Nearly 1,000 customers have given us feedback on how they’re using Copilot, where it is having the biggest impact, and where it needs to be better,” the post said. “Based on that feedback, we have made more than 700 product updates and shipped over 150 new features this year.”

But when updates do happen, employees say, they sometimes make things worse. A recent attempt to update to the consumer version of Copilot sparked complaints among employees on an internal message board viewed by B-17. Users said the new version was “dumber” than the previous version, providing less real-time information and often answering queries with, “Sorry, I can’t help you with that.”

“Instead of getting better, some people feel it lost functionality,” one employee said.

Employees also expressed frustration at what they see as the company’s tendency to slap the Copilot brand on everything in sight. In the past year, Microsoft has released Copilot into office apps, the Windows operating system, the Edge browser, and several other products. “There is a delusion on our marketing side where literally everything has been renamed to have Copilot it in,” said one employee. “Everything is Copilot. Nothing else matters. They want a Copilot tie-in for everything.”

“Everyone wants to make their impact by jamming a bad Copilot chatbot into their tools,” said another longtime employee. “So now every time I click on certain links, I get two pop-ups for crappy Copilot implementations.”

As complaints and questions over Copilot mount, both inside and outside Microsoft, so does the pressure to justify the company’s unprecedented level of spending on AI. According to an internal document from April, by the end of the year, to serve its skyrocketing needs for data storage and processing, the company plans to amass 1.8 million chips known as GPUs — each of which costs about $30,000. By July 2025, it plans to triple its data-center capacity, which is already at 5 gigawatts, roughly what it takes to power all of New York City each day. And by 2027, the company plans to spend more than $100 billion on GPUs and data centers alone.

“This is an exercise in mass delusion,” says Gary Marcus, a well-known tech critic who is the author of “Taming Silicon Valley: How We Can Ensure that AI Works for Us.” “The fact that people invested a couple hundred billion dollars on basically hope and hype is embarrassing.”

Marcus believes the tech industry is headed toward an “AI winter,” in which Microsoft and other tech giants will pay a steep price for their extravagant investment in the technology without solving the fundamental problems, like hallucinations, that continue to plague AI. “It’s like Wile E. Coyote at the end of the cliff,” he said. “At some point, people are going to realize they are over the end of the cliff and panic. Valuations are going to drop.”

According to employees with direct knowledge of the company’s strategy, Microsoft intends to make its massive bet on AI pay off in two primary ways: by boosting sales and by repackaging prices. For the current fiscal year, which began in July, Microsoft has changed its sales goals to prioritize selling AI tools. And over the summer, the company considered a sweeping plan to repackage AI features into existing licenses or to create a more expensive bundle with Copilot AI capabilities. But those efforts stalled in September amid concerns about whether the plan would actually succeed. Instead, Judson Althoff, Microsoft’s chief commercial officer, opted for a pilot program to test more expensive bundles, and then roll out significant licensing changes next July.

Microsoft has “not delivered any competitive capability,” says Salesforce CEO Marc Benioff, who has released a rival product called Agentforce.

To free up more capital for AI, the company has made significant cuts — including to its main businesses. Last year Microsoft slashed hundreds of jobs from Azure, the world’s second most popular cloud computing platform. In an internal email explaining the decision to employees, Jason Zander, the executive vice president of Azure, said the cuts were made specifically to support the AI push. “Our clear focus as a company is to define the AI wave and empower all our customers to succeed in the adoption of this transformative technology,” Zander wrote.

Employees on the Azure team questioned the wisdom of cutting back on the platform, given the revenue it provides and the services it’s responsible for. “The AI team gets all the money,” one employee said. “But it’s the Azure team that is not only paying the bills but we are the ones doing all of the heavy lifting with security right now.” Another added: “AI is great and it might be the future, but when are you going to focus on your billpayers?”

Microsoft has also cut the number of employees working on its Teams chat app, according to an internal memo shared with B-17. “In early 2022, we recognized the pandemic as a once-in-a-generation opportunity and we surged on Teams to win,” Spataro explained in the email. “Now, we’re doing it again” — but this time, with AI.

Job cuts aren’t the only way Microsoft is funding its AI push. To attract top talent, the company is paying significantly more for AI employees than for other roles. As of September, according to a payroll spreadsheet shared with B-17, average compensation in the Microsoft AI group was about 37% higher than the average for all of the company’s US employees. Software engineers within Microsoft AI, for example, earned 48% more than the average software-engineering role at the company. The message is clear: If you’re applying to Microsoft, it pays to find a role in AI.

The single-minded focus on AI has left many at Microsoft, including top leaders, feeling both frustrated and alarmed. “AI could be disruptive. We’ve got to be first. I get all of that,” one executive said. “But a company of our size should be able to do multiple things at once. It seems like we can only think of one shiny object at a time.”

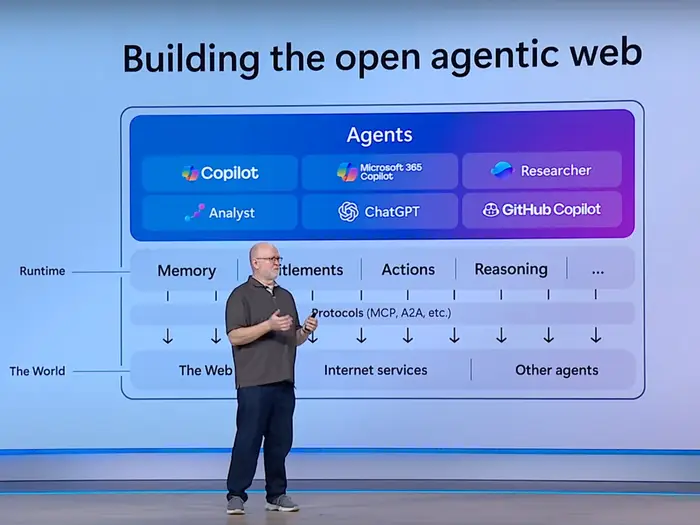

Last month, a year after his sweeping claims that Copilot would uplift all of humanity, Nadella delivered a far more modest keynote address unveiling “wave two” of the technology. To some within the company, the presentation appeared to signal a marked shift in the way Microsoft was casting Copilot — almost as if it were an admission that things weren’t going to plan.

Where Nadella used to boast about the company’s partnership with OpenAI — whose large language model is what drives Copilot’s responsiveness — he was instead referring to LLMs simply as “commodities.” And instead of touting Copilot as the best, most magical tool of its kind, he said the product would now be branded in more technical language, as a “UI for AI.”

“Satya is resetting, after a good several years of saying the opposite,” a former executive said. “They are trying to reinvent themselves. The narrative has shifted away from them. Right now, it’s a lot of, ‘If you build it, they will come,’ which hasn’t happened.”

Competitors also scoffed at the presentation as show over substance. “Microsoft’s trying to rebrand,” Benioff told B-17 — a pivot, he said, necessitated by what he called Copilot’s lack of “AI solutions.”

Microsoft notes that the number of Fortune 500 companies using Copilot is on the rise. And plenty of Microsoft employees are still bullish on the company’s future in AI. One employee who is working on Copilot predicted its path would be similar to that of the iPhone: first excitement over its enticing novelty, then ambivalence about its value to daily life, ultimately arriving at ubiquity. But the analogy, while ambitious, is inexact: Unlike Copilot, the iPhone could do everything Steve Jobs said it could do when it debuted.

Jared Spataro, Microsoft’s chief marketing officer of AI at Work, says the company is exhibiting “strategic patience” over its massive investment in AI.

What’s more, unlike Apple under Jobs, Microsoft is still struggling to figure out how best to pivot its considerable resources to serve its intensive focus on AI. Its new fiscal year began in July, but budgets for several teams were delayed by months, according to an employee with direct knowledge of the delay. The holdup, the person said, is atypical for Microsoft, which usually distributes budgets early in the fiscal year.

But despite the internal concerns, those at the top of the company express no doubt about going all in on artificial intelligence. They caution that it always takes time and investment to develop a new technology — and to find a business model that will support it. Spataro said Microsoft considered AI as important as the invention of the internet and PCs — and would stay the course, despite the massive investments it will require.

“You have to have that strategic patience — no matter what’s happening — to just focus and execute,” Spataro said. “That’s what we’re trying to do as a company.”