Insider Today: Blackstone’s holiday cheer

A collage of Blackstone holiday videos

On the agenda today:

- Musicians billed US taxpayers for luxury hotels, shopping sprees, and million-dollar bonuses.

- Their mother inherited a priceless archive. Then a messy legal battle tore their family apart.

- Zillow’s price estimates are screwing up homebuying — but Americans don’t care.

- Inside Citi’s unpopular annual review process.

- But first: Blackstone’s feeling festive.

Some warmth from a Blackstone

Blackstone released its annual holiday video for the seventh consecutive year, which might elicit the reaction: Why is a firm managing $1 trillion worried about holiday videos?

The videos — full of self-deprecating jokes and Blackstone-backed product placement (of course) — have become a bit of an annual tradition on Wall Street. Last year’s notched 8 million views across platforms, a spokesman told B-17. We’ve got a full rundown and ranking of all seven videos here.

Some people are laughing at Blackstone as opposed to with Blackstone, but that’s kind of the point. In an industry full of super serious people doing super serious business for super serious clients, Blackstone’s willing to make itself the butt of the joke.

Ok, yes, there is a business case for the videos. Jay Gillespie, the head of Blackstone’s video team and one of the brains behind the holiday extravaganza, spoke to B-17about the evolution of his role at the firm.

Blackstone’s not alone in its outside-the-box approach to marketing on the Street. More firms are getting a bit — to borrow a phrase from my British colleagues — cheeky in pitching themselves to the general public.

Take BlackRock, which a few years ago took to social media to make clear it’s not Blackstone. (The firms have a long history together and have sometimes lean into the confusion between the two. BlackRock CEO and cofounder Larry Fink made a cameo in Blackstone’s holiday video this year: “Can you believe people confuse US for THEM?”)

Wall Street’s marketing frenzy isn’t foolproof. For an industry that prides itself on what kind of business you are bringing to a firm, marketing’s impact isn’t as direct as landing a massive deal or hitting the perfect trade.

COVID relief money funded musicians’ lavish lifestyles

Wealthy musicians received millions of dollars from the Shuttered Venue Operators Grant, a pandemic relief program intended for struggling independent venues and arts groups. However, stars like Lil Wayne and Chris Brown used the program as a piggy bank to keep the party going, exclusive reporting from B-17 shows.

Thousands of pages of accounting documents reveal how artists directed millions in taxpayer funds toward their own bank accounts, luxury purchases, and entertainment expenses — often outweighing what they spent on touring crew members.

How musicians spent the grant money.

The cursed inheritance

Luisa Isabel Álvarez de Toledo, a Spanish duchess, devoted much of her life to cataloging the Archive of Medina-Sidonia, a priceless collection that had been in her family for generations. Comprising of 6 million documents, the archive details the secrets of the kings, dukes, and explorers of medieval Spain.

After Luisa Isabel died, she left her three children just 743,000 euros. However, the bulk of her estate — and control of the archives — went to the woman she’d married on her deathbed. What ensued after was a bitter legal battle that would shatter the family, captivate Spain, and throw the fate of the archives into doubt.

Inside the palace showdown.

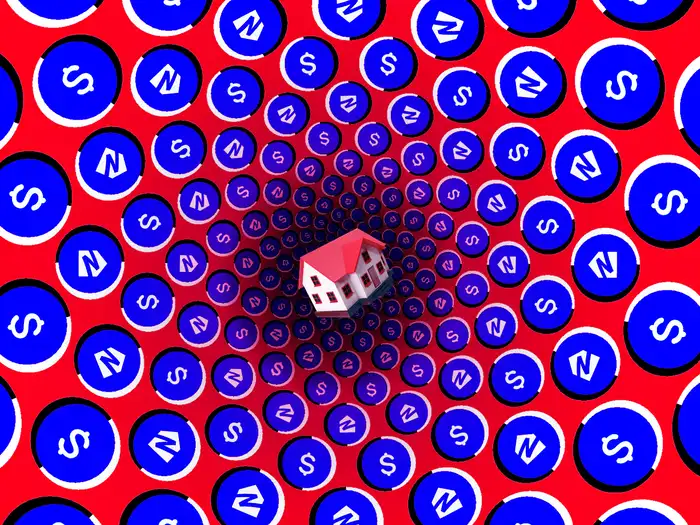

Don’t trust that Zestimate

There is perhaps no real-estate metric more loved — and loathed — than Zillow’s automated home valuation tool. The Zestimate draws casual clickers to the site, whether it’s to lurk on previous residences, friends’ or colleagues’ homes, or the value of your neighbor’s property against yours.

The problem is that the Zestimate is often misguided, and Americans’ obsession with it can create crushing reality checks when homes actually hit the market.

But that’s not a problem for Zillow.

Citi’s controversial curve

Earlier this month, Citigroup welcomed 34 managing directors, marking its biggest class in years. Behind the scenes, however, the bank’s promotion process can be political and pit employees against each other, four current and former managing directors told B-17.

The bank rates its employees on a forced curve, assessing them from best to worst. These rankings influence whether an employee might receive a promotion or lose their bonus.

Managing directors break down how it works.

This week’s quote:

“What we’re having to speak of already sounds like we’re lying — it already sounds like a movie because it’s so horrible.”

— Adria English worked as a dancer at Sean “Diddy” Combs’ famous white parties and filed a lawsuit in July accusing him of sex trafficking. Combs has vehemently denied all accusations of sexual assault and sex trafficking.

More of this week’s top reads:

- How Gwyneth Paltrow’s Goop lost its glow amid layoffs and pivots.

- Is it too late to buy bitcoin? Why some Wall Street experts say no — and 4 ways to start investing now.

- Amazon is delaying full RTO for some employees because it doesn’t have enough workspace, internal notifications show.

- The American dream is shrinking.

- A chip company you probably never heard of is suddenly worth $1 trillion. Here’s why, and what it means for Nvidia.

- Meet the 33 women in venture capital who made partner or higher at firms like Andreessen Horowitz and IVP in 2024.

- AppLovin has rocketed to a $100 billion valuation. Some industry insiders are skeptical its run can last.

- America is one big casino now.

- Want to break into VC in 2025? MBAs and consulting backgrounds are out. Technical skills, especially AI, are in.

- Inside India’s ‘Silicon Valley.’

- AT&T’s CTO tells his US team there won’t be ‘one-for-one seating’ upon the return to 5 days in office — read the memo.

- Leaked MrBeast docs reveal ‘Beast Games’ contestant terms — including a $500K penalty for divulging info.