Investment banking has made a multibillion-dollar rebound, but it’s too early to pop the Champagne

Wall Street CEOs are cautious about their enormous wins.

Christmas came early for investment bankers.

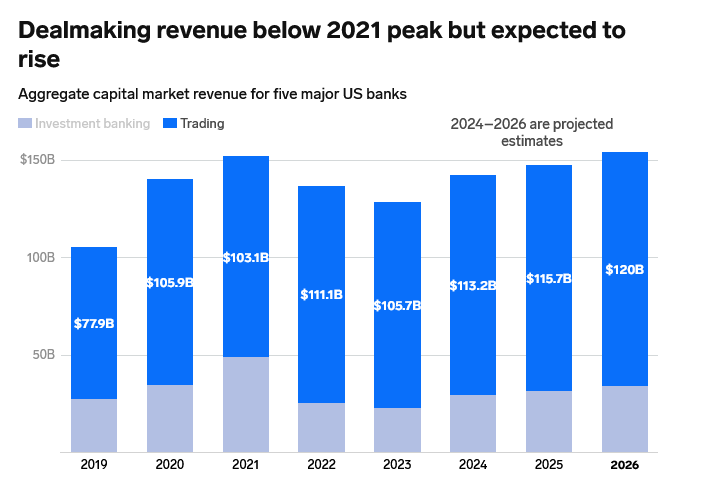

The biggest banks on Wall Street reported a huge boost in dealmaking fees this quarter after a two-year slump. Investment-bank revenue surged 30% on average at Goldman Sachs, JPMorgan, Bank of America, Citigroup, and Morgan Stanley, the Wells Fargo analyst Mike Mayo said.

“We continue to believe we are in the early stages of a multiyear capital-markets recovery,” Morgan Stanley’s CFO, Sharon Yeshaya, said during an earnings call. Morgan Stanley’s investment-bank revenue surged 56% year over year to $1.46 billion, beating Wall Street expectations.

Several tailwinds are at play, including tempering inflation and pent-up demand. Debt underwriting has surged as companies rush to take advantage of interest-rate cuts, S&P Global’s Nathan Stovall told B-17. After years of recession fears, there’s more optimism the Federal Reserve can deliver a soft landing, he said.

“You’re seeing corporates get more comfortable with the world they’re operating in, and they’re willing to take more risks, and this leads to more M&A activity, more equity raising, things like that,” Stovall, his company’s director of financial-institutions research, said.

An incoming flurry of dealmaking could reflect a broader economic recovery, as lower borrowing costs make it easier for companies to fund acquisitions. This past quarter saw several megamergers, such as the candy giant Mars buying the maker of Pringles for nearly $36 billion. Citi advised Mars and provided $29 billion in debt financing with JPMorgan. Paramount agreed to merge with David Ellison’s Skydance Media. Bank of America is one of Skydance’s advisors on the $8 billion deal.

Wall Street CEOs, however, are cautious about their enormous wins. JPMorgan’s Jamie Dimon said on an earnings call that the favorable interest-rate conditions “may not prevail or be the ongoing conditions late next year” and that geopolitical turmoil was “treacherous and getting worse.” Goldman Sachs CEO David Solomon said that while the bank had a healthy backlog, activity in mergers and acquisitions and equity was still well below 10-year averages.

Risks to this comeback loom large, Mayo wrote in a research note.

“There’s little question to us that activity and revenues reflect a degree of bull market banking,” he wrote. “This could end based on potential results and reactions to the upcoming November elections, a stock market decline, and/or unexpected changes in rates (esp. higher).”

Cole Smead, a portfolio manager, described the results as a “head fake.” Smead is watching the US’s ballooning deficit, concerned it could push up bond yields and the cost of borrowing, which would discourage dealmaking.

“This can go on for maybe a quarter or two more, but it is likely going to fall apart long before it ever gets back to anywhere near the numbers of 2021,” the CEO of Smead Capital Management, which owns shares of Bank of America and JPMorgan, said. “Ultimately, this equity market, with many risks out there, is complacent and doesn’t care. The problem is when the chickens come home to roost, this activity will go back to low levels again.”

The potential ‘X-factor’

While the risks are real, this quarter’s upswing isn’t necessarily a blip. For the five banks, Mayo estimated that capital-markets revenue would grow 8% in 2025 to $31.7 billion and another 7% to $34 billion in 2026.

There’s also what Mayo calls “the X-factor”: the $1 trillion-plus of dry powder held by private-equity firms.

Jon Gray, the president and chief operating officer of the private-equity giant Blackstone, said that, anecdotally, the number of confidentiality agreements more than doubled in September compared with a year ago.

“Now that doesn’t necessarily mean it’s going to turn into that volume of deals. But it clearly shows you there is more enthusiasm,” Gray said during the firm’s earnings call Thursday. “And we know in the private-equity world, there’s a lot of companies that need to be sold, similar story in real estate.”

David Stowell, a finance professor, told B-17 that while the upcoming US election and overseas conflict posed economic risks, the sponsors couldn’t sit on the sidelines indefinitely.

“They know that they always have to risk-adjust their investments,” said Stowell, an investment banker for two decades before joining the Kellogg School of Management at Northwestern University. “They pretty much have to spend the money, or their kind of business goes away.”

Stovall acknowledged that one quarter doesn’t make a trend but said that economic data, such as job-creation numbers, pointed to a soft landing. This bodes well for dealmaking for the rest of the year and 2025.

“I’m cautiously optimistic,” he said. “It is wise to not jump up and down and say things are going to go straight up from here, but I do think it’s more encouraging than it’s been for a while.”

For now, some Wall Streeters can already count on larger bonuses, a compensation consultant, Alan Johnson, said. With debt and equity capital markets thriving, underwriters are set to get the biggest gains. For debt and equity underwriters, he estimated bonus increases of 25% to 35% and 20% to 30%, respectively. M&A bankers will likely have to wait longer for a significant boost and should expect maybe a 5% or 10% uptick this season.

“Traditionally, the sexiest area would be M&A — the pipeline looks really good, but most of the closing fees would be for 2025,” Johnson, the founder of Johnson Associates, said. “The headlines around M&A are really going to be next year’s story.”