Jamie Dimon says a BofA banker’s untimely death sparked questions inside JPMorgan: ‘What can we learn?’

- At JPM’s investor day presentation, bank leaders were asked about the passing of a BofA associate.

- CEO Jamie Dimon acknowledged that questions around the death reverberated through the bank.

- A top investment bank exec at JPM said the bank wants to win, but not at the expense of employees.

Jamie Dimon, the CEO of JPMorgan Chase, signaled Monday that leaders of America’s biggest bank by assets have been tracking the story of the untimely death of a Bank of America banker this month — and that they’re taking seriously the industry-wide concerns it sparked about Wall Street’s unforgiving working conditions.

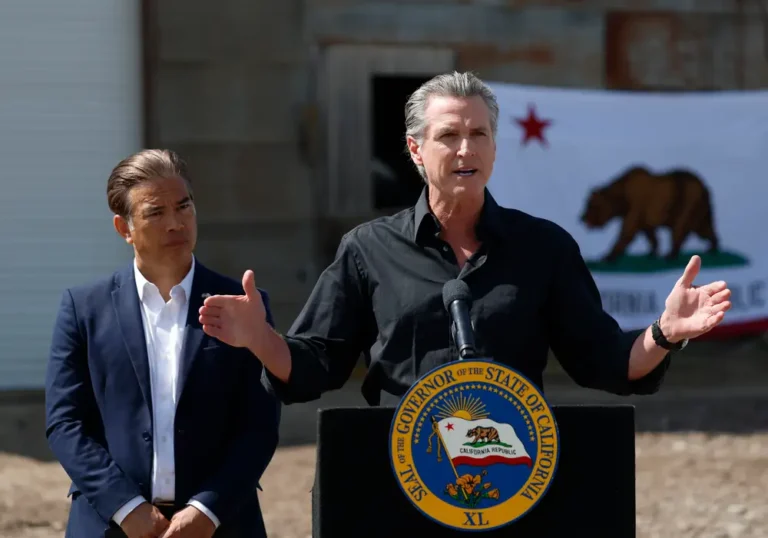

At the bank’s annual presentation to investors on Monday, the chief executive recalled learning about the death of 35-year-old Leo Lukenas III and quickly conferring with fellow bank leaders about the potential fallout. “The second that unfortunate death happened, a bunch of us were right in Robin’s office,” he recounted on stage, referring to Robin Leopold, the bank’s executive vice president and head of human resources. At the time, Dimon said, the priority was to understand “what we do know, what can we learn from it.”

Dimon’s comments come as the investment-banking industry grapples with the surprising deaths of not one but two deaths at BofA this month. Neither death has been linked to work, but they have ignited a dialogue about overwork and the travails of working on Wall Street, known for its crushing demands on junior professionals.

At JPM’s investor day, Dimon and fellow bank bosses gathered to impress upon shareholders their hard-charing vision for the firm’s future, including their plans to grow investment banking wallet share. That promoted a question by an attendee how the firm’s leaders reconcile their vision for aggressive growth with employees’ needs following “a death in one of the American banks recently.”

Troy Rohrbaugh, coCEO for commercial and investment banking, said that while the bank wants to win, it doesn’t plan to do so at the expense of employees. “No strategy is worth the health and well-being of our employees,” he said, according to a transcript of his remarks accessed on the investment research platform Alpha Sense.

“We’re aware of these stories, and they are tragic and incredibly sad,” Rohrbaugh continued, calling it the “job” of bank leaders to look after employees’ health on the job. “Whatever it takes” to safeguard employees’ well-being at work, he said, “that’s what we’re going to do.”

JPMorgan details its investment-banking growth strategy

Why Wall Street is transfixed by a BofA banker’s untimely death

“We have to be out in the field — and every one of us are — so that we have a sense of where the pressure might be mounting,” Rohrbaugh added. “And we need to give people the resources to be able to cope.”

Wall Street’s reckoning

The New York City Officer of the Chief Medical Examiner ruled the cause of Lukenas’s death as “acute coronary artery thrombus,” a condition that causes blood to clot in the heart, and did not establish a connection to his work conditions. Still, the incident raised questions online about whether Lukenas, an associate in the bank’s financial institutions group, was working unsustainable hours leading up to his death.

Current and former employees at BofA told Business Insider that 100-hour workweeks were not unusual at the bank. One current investment banker at BofA, speaking under the condition of anonymity, said that Lukenas’s death prompted some senior bankers to vow in meetings to reevaluate employees’ working hours and try to find areas to cut back.

A Reuters report last week claimed that Lukenas had spoken to a headhunter prior to his passing and indicated he was seeking alternative employment elsewhere, citing demanding work conditions. “He made a comment saying, like, ‘Hey, I’ll trade hours of sleep for a 10%'” reduction in pay, Reuters reported of an interview it had with headhunter Douglas Walters of GrayFox Recruitment.

Earlier this month, a BofA spokesperson spoke of Lukenas’ passing: “We are very saddened by the loss of our teammate. We continue to focus on doing whatever we can to support the family and our team, especially those who worked closely with him.”

Last week, Bloomberg reported last week that 25-year-old Adnan Deumic, a credit portfolio and algorithmic trader at BofA in London, “collapsed of a suspected cardigan arrest” while playing a game of soccer at an industry event and died after failing to respond to efforts aimed at reviving him.