Jamie Dimon says a recession has become a ‘likely outcome’

JPMorgan Chase CEO Jamie Dimon speaking in Washington, DC, in October.

An economic downturn could be on the horizon, JPMorgan boss Jamie Dimon said in a Fox Business interview.

The bank chief said he believed a recession was now a “likely outcome” for the US economy, evidenced by the stock sell-off fueled by Trump’s latest round of tariffs.

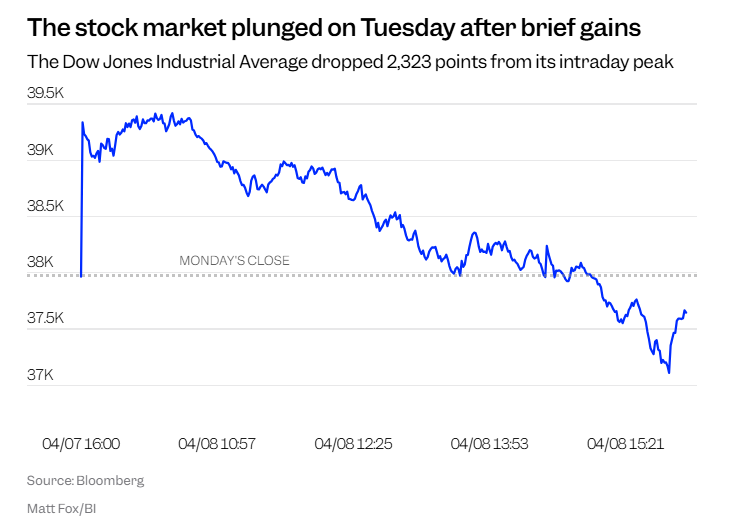

“I mean, when you see a 2,000-point decline, it sort of feeds on itself, doesn’t it,” Dimon said Wednesday on “Mornings with Maria.” Dimon was referring to the 2,000-point drop in the Dow Jones Industrial Average from its intraday peak on Tuesday. “It makes you feel like you’re losing money in your 401(k), you’re losing money in your pension. You’ve got to cut back.”

Dimon said the economy wasn’t on great footing before the presidential election, and tariffs had only worsened the outlook. He pointed to rising geopolitical tensions, “huge” fiscal deficits in the US and other countries, and sticky inflation.

“So tariffs and trade are just part of that mix,” he added.

In his annual letter to shareholders, Dimon warned that tariffs could slow growth in the US and raise inflation.

“While inflation has come down, most of what I see in the future is inflationary: continued high fiscal deficits, the remilitarization of the world, and the need for infrastructure investment, including the green economy and the restructuring of trade and tariffs,” he wrote.

Dimon also mentioned stagflation, a scenario involving weak growth and high inflation. Economists say this could be even worse than a recession, as high inflation would prevent the Fed from lowering rates to boost the economy.

“This tug-of-war can go on for some time, but it’s good to remember that in the stagflation of the 1970s, recessions did not stop the inexorable trend of rising rates,” he added.