Janet Yellen didn’t name Trump in her big speech, but her fears of his anti-regulation stance loomed large

Treasury Secretary Janet Yellen alluded to what she saw as the significant dangers of a Trump administration.

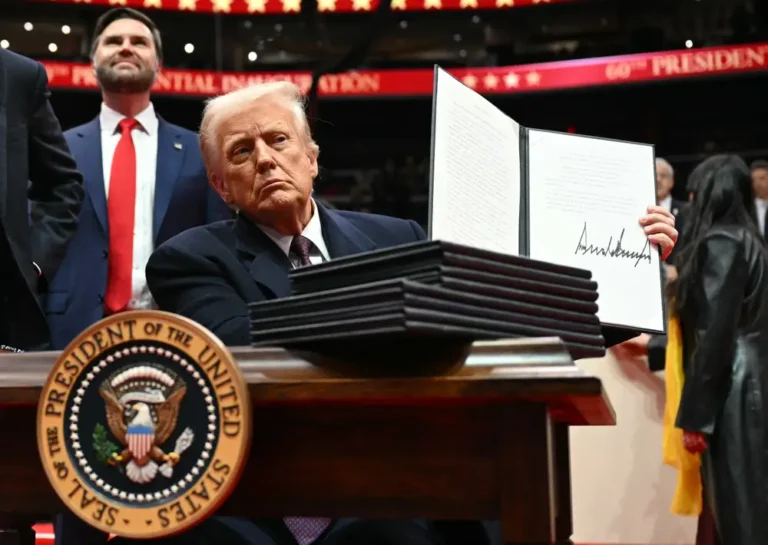

Speaking at the US Treasury Market Conference on Thursday, Treasury Secretary Janet Yellen referenced her predecessors — and their mistakes — often. She stopped short of naming former President Donald Trump or his appointees by name but made it clear that she thinks his administration threatened the country’s financial security.

In sentences laced with allusions to the past and the “prior Administration,” Yellen outlined what she saw as the risks of Trump’s first presidency and then detailed the perceived risks of another Trump term.

“In January 2021, I stepped into a Treasury Department whose focus on financial stability had all but disappeared,” she said. The results, she said, could be detrimental to everyday Americans’ financial wellbeing.

In particular, Yellen pointed out how the Trump administration had slashed the budget of the Financial Stability Oversight Council, which was formed in the wake of the 2008 financial crisis.

The FSOC is a slate of top regulators — including the chairs of the Federal Reserve and Securities and Exchange Commission — who work together to monitor financial risks. In her role as Treasury Secretary, Yellen chairs the commission.

During the Trump years, staffing at and funding for the FSOC dropped off, and Yellen didn’t shy away from expressing her disappointment.

“Put simply, we were without crucial tools to identify and help respond to risks to financial stability,” she said. “So, we rebuilt FSOC, scaling up staff and increasing opportunities for agencies to come together to share expertise and insights.”

The Treasury Department did not immediately respond to B-17 request for comment.

Yellen used vaguely-cloaked language to talk about her predecessors in an interview ahead of the speech. When speaking to Politico, she again avoided naming Trump explicitly, but did allude to the potential for significant deregulation should he win in November. She also said she fears there won’t be a smooth transfer of power after the election.

And when asked about a particular passage of her speech when she mentions “those who advocate to roll back policies and regulation,” Yellen made a nod toward Steven Mnuchin, who held her job under Trump. Again, she didn’t utter Mnuchin’s name, but her message was clear.

There’s nothing indicating that a second Trump administration would bring a different attitude toward regulation than his first. Jon Hilsenrath, a former economics editor at the Wall Street Journal who wrote a biography on Yellen, said another Trump presidency would roll back her regulatory efforts.

“I think it’s fair to say that if Trump is elected, one of his early targets for change will be Yellen’s financial sector regulatory agenda, including Basel III capital regulations for banks,” he told B-17 in a statement, referencing proposed rules about the financial cushions for big banks.

As business leaders focus on economic appointments and regulators mull over the future of bank oversight, Yellen’s veiled allusions to Trump mirror general uncertainty about how the economic landscape will change in November.

More broadly, the economy is a key — if not the key — issue for voters. Both Trump and Vice President Kamala Harris have put their economic agendas at the center of their campaign.