Jeremy Grantham’s GMO just launched an actively managed fund focused on high-quality stocks. Its manager shares 7 unique companies he’s betting on to deliver high returns.

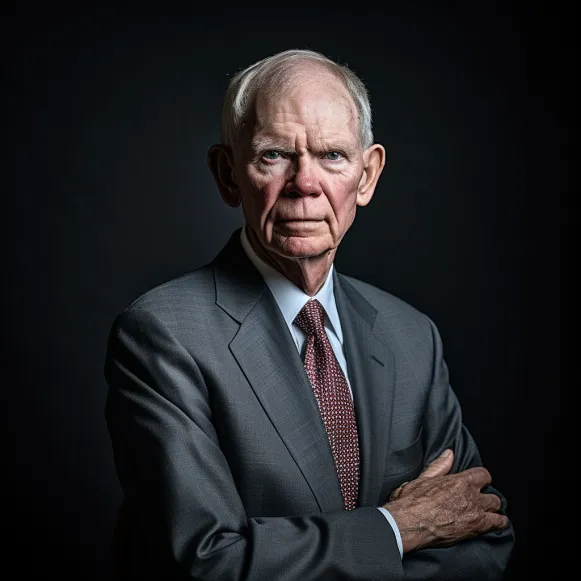

- GMO’s Tom Hancock is heading up the firm’s first-ever ETF, the GMO U.S. Quality ETF (QLTY).

- The fund is actively managed and has 35 holdings.

- Hancock spoke with Business Insider about 7 of them: MSFT, AMZN, AAPL, GOOG, META, UNH, and GE.

GMO has launched an exchange-traded fund for the first time in its 46-year history, opening the door to new inflows as mutual funds become less popular.

The GMO US Quality ETF (QLTY) debuted on November 12 and, as the name suggests, seeks to provide investors with exposure to so-called quality stocks via an actively managed approach.

“Quality” is traditionally applied to businesses that have a track record of producing consistent earnings and profits. According to the fund’s manager, Tom Hancock, this is the case. But it’s also about identifying companies that are well-positioned to capitalize on growth opportunities.

“When we think about quality, we think about companies that can invest at a high rate of return,” he said. “So, they have growth opportunities, and they don’t have to spend a lot of money to get those growth opportunities.”

Hancock explained that firms are in this position because they have moats or unique products that cannot be replicated. They also have strong management teams that can allocate capital effectively and healthy balance sheets.

These are all characteristics Hancock and the firm looked for in companies before adding them to the fund’s final list of 35 holdings. In an interview with Insider last week, Hancock highlighted seven of the holdings and explained why they were appealing.

7 stocks to watch

Five of the fund’s top ten holdings are part of the so-called Magnificent 7, which are the seven largest stocks in the S&P 500 by market capitalization. Microsoft (MSFT), Amazon (AMZN), Apple (AAPL), Alphabet (GOOG), and Meta (META) are among the five stocks in Hancock’s fund.

These stocks, along with Tesla and Nvidia, have contributed to the majority of the S&P 500’s 18% return this year, and some are trading at relatively high valuations. However, Hancock believes they deserve to trade at a premium and are not overvalued in the long run.

“At GMO, internally we also talk about intrinsic value, which is adjusting for growth and quality,” he said. “Those are actually pretty attractively valued.”

While each business is unique, he believes an overarching feature that makes them appealing is their ability to capitalize on new technology, such as artificial intelligence, given their size. At the same time, the success of those businesses is not dependent on a single trend, such as AI.

UnitedHealth Group (UNH) is another stock mentioned by Hancock. According to him, scale matters in the healthcare industry as well, and UnitedHealth’s size gives it a significant advantage: its market cap is around $500 billion. Healthcare companies, he says, tend to trade at lower valuations than those in, say, the technology sector, despite producing double-digit growth. Part of the reason for this is that investors are concerned about the political risk associated with changes to the healthcare system, according to Hancock, but change is ultimately unlikely.

Hancock then mentioned General Electric (GE), a multinational conglomerate. Over the last few years, the company has become more focused on aerospace, with its healthcare and energy businesses splitting off into separate companies. The aerospace industry manufactures and re-services airplane engines, and Hancock believes that the continued resurgence in global demand for travel following the pandemic bodes well for the industry.

“It’s a much different company than it was a few years ago, and a sort of turnaround story that we really like,” Hancock went on to say.

GMO cofounder Jeremy Grantham recently warned of a significant stock sell-off ahead as a recession approaches. Grantham famously predicted both the dot-com crash in 2000 and the 2008 crash. While the timing of the ETF release is unrelated to Grantham’s call, Hancock believes quality stocks are more defensive in a downturn.