Kohl’s vows ‘aggressive action’ to reverse sliding sales following a ‘frankly disappointing’ quarter

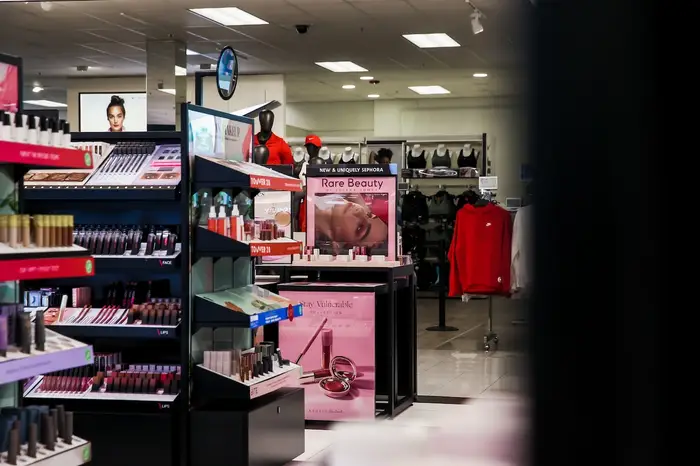

Kohl’s has Sephora outlets in more than 1,000 stores.

Kohl’s continues to fight an uphill battle after sales tumbled following missed opportunities, a decline in footfall, and an overreliance on its partnership with Sephora.

Comparable sales at the department store chain fell 9.3% in the three months to November 2, which CEO Tom Kingsbury called “frankly disappointing” despite attempts to improve its products, strategy, and in-store experiences.

Sales remained soft in apparel and footwear despite strong performances for the Sephora, home decor, gifting, and impulse categories.

“We are not satisfied with our performance and are taking aggressive action to reverse the sales declines,” he said.

Net income fell to $22 million for the third quarter, down from $59 million for the same period last year.

Kohl’s now expects full-year comparable sales to be 6% to 7% lower compared with 2023.

Shares closed down 17% on Tuesday, bringing the decline this year to 45% and valuing the company at less than $1.6 billion.

Earlier this week Kohl’s said Kingsbury would step down on January 15 after two years in the role. He will be replaced by retail veteran Ashley Buchanan.

Investing in key growth categories had a ricochet effect, leading to a 20% drop in inventory for private brands, Kingsbury said. “Not having the appropriate level of private brands hurt our ability to serve our customers.”

The decision to pull back on fine jewelry to focus on Sephora, which now has about 1,050 concessions in Kohl’s locations under a partnership that began in 2021, has also had an impact.

“As we introduced Sephora Shops into our stores, the fine jewelry business was largely displaced which resulted in a persistent headwind to our sales performance for many periods,” Kinsbury said.

Sephora has concessions in many Kohl’s stores.

While the partnership is one of the few bright spots in the quarter, with total beauty sales up 15% in the quarter, it could mean Kohl’s missed opportunities to capitalize on a hot category.

Claudia D’Arpizio, senior partner and global head of fashion and luxury at the consultancy Bain, told B-17 that jewelry has been the “most resilient category” for the luxury goods industry over the past year.

Jewelry, along with beauty and fragrance, are affordable luxury categories particularly in demand with younger customers who have been underserved by luxury players in recent years, D’Arpizio said.