Mark Cuban warns that Trump’s tariff plan plus DOGE cuts could lead the country to ‘a far worse situation than 2008’

Mark Cuban warned on Bluesky that President Donald Trump’s aggressive tariffs, combined with DOGE cuts, could cause long-term economic harm “far worse” than the 2008 financial crisis.

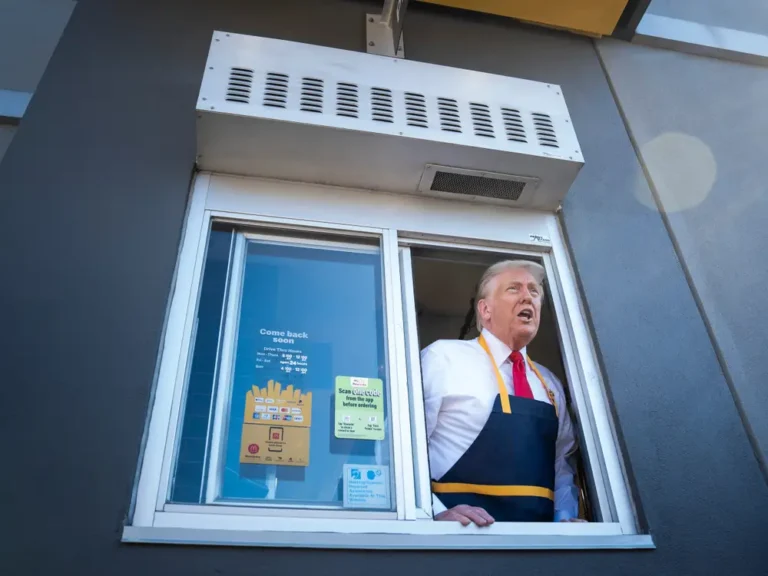

While President Donald Trump has said his aggressive tariff plan may result in “a little pain” in the short term, some business figures, such as the billionaire “Shark Tank” star Mark Cuban, see a greater risk of long-term economic harm.

In a series of Bluesky posts Saturday, Cuban expanded on his previous critiques of Trump’s trade policies. The Cost Plus Drugs cofounder suggested the extensive tariffs announced by the Trump administration on Wednesday, combined with cuts to the federal workforce spearheaded by the White House DOGE office, could result in a worse financial crisis than the Great Recession of 2008.

“If the new tariffs stay in place for multiple years, and are enforced and inflationary, and DOGE continues to cut and fire, we will be in a far worse situation than 2008,” Cuban wrote in response to another user’s question about the economic impacts of Trump’s tariff plan.

The minority owner of the Dallas Mavericks didn’t expand upon why he saw the sweeping cuts to the federal workforce led by the DOGE office as related to the nation’s economic health. The reductions have, however, targeted the Consumer Financial Protection Bureau and the tax evasion enforcement wing of the Internal Revenue Service, among other agencies.

Cuban and representatives for the Trump administration didn’t immediately respond to requests for comment.

During the 2008 financial crisis and its immediate aftermath, the country’s GDP declined by more than 4%, the unemployment rate reached 10%, and the housing market crashed in what economists have recognized as the deepest recession since World War II.

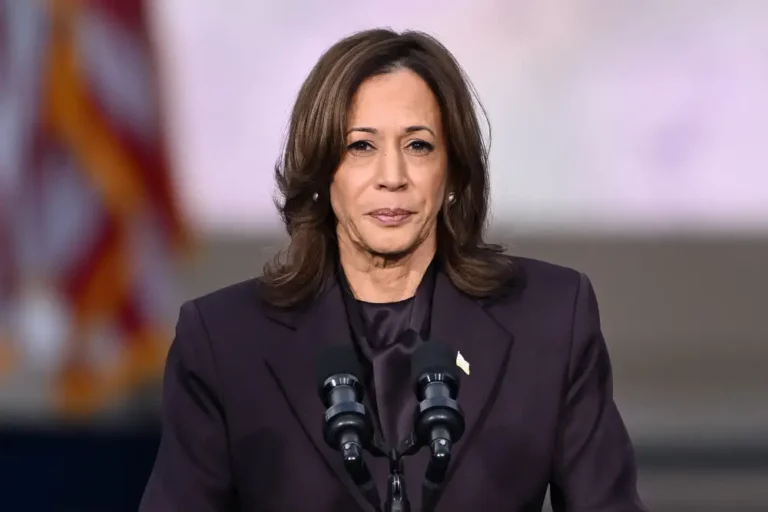

The president said in comments to the press about his trade policy that “we may have short-term some, a little pain, and people understand that,” but in a Friday post on Truth Social, he wrote that “ONLY THE WEAK WILL FAIL!”

The economic uncertainty stemming from Trump’s tariff plan has sent the stock market spiraling downward and prompted consumers to stockpile essentials while cutting back on luxury goods. Economists and supply chain experts previously told B-17 that increased import costs caused by the tariffs were expected to result in higher prices for everything from pantry staples such as coffee and sugar to apparel and larger purchases such as cars and appliances.

Cuban isn’t alone in worrying about the lasting economic impacts of the president’s policies. Many commentators in the financial field have questioned the tariffs and highlighted their potential consequences.

JPMorgan’s chief global economist, in a research note to clients published on Thursday titled “There Will Be Blood,” said the risk of the global economy falling into a recession increased from 40% to 60% in response to Wednesday’s tariff announcement.