Microsoft’s massive AI bet continues to be a ‘waiting game’ for investors

Microsoft’s chairman and CEO, Satya Nadella.

Microsoft’s first-quarter results topped expectations though its stepped-up spending on artificial intelligence capabilities raised fresh questions about how long the company will continue to pour huge sums into the technology.

Capex totaled $20 billion for the quarter, it said Wednesday. That compares with $19 billion in its fiscal fourth quarter and is almost double the $11.2 billion in the first quarter a year earlier.

Microsoft CFO Amy Hood said during the earnings call that the company expects capex to increase sequentially going forward because of the demand it’s anticipating for cloud and AI services.

Jeremy Goldman, senior director of briefings at EMARKETER, called Microsoft’s Q1 AI investments the true wild card of the earnings.

“It’s pouring cash into building out infrastructure, with major capex implications,” he said. “Yet, the revenue returns from AI remain more of a promise than a present reality,” he said.

Satya Nadella, the company’s chairman and CEO, said on the call that Microsoft’s AI business is on track to top an annual revenue run rate of $10 billion next quarter. He said that would make it the fastest business in the company’s history to reach that milestone.

However, Q2 consumption growth in its key Azure cloud computing platform will be “stable” compared to Q1, Hood said, due to AI capacity constraints. While Hood said she expects Azure growth to increase in the fiscal second half as those constraints ease, shares fell more than 3% in late trading.

Investors have been tracking spending on AI at many of the so-called Magnificant 7 stocks, of which Microsoft is one — along with fellow tech giants including Apple, Amazon, and Google parent Alphabet. Some are concerned that returns on companies’ AI investments could fall short of expectations. That’s a worry at Microsoft partly because feedback on the company’s Copilot AI has been mixed. Others have been concerned that Big Tech spending on artificial intelligence is outpacing results.

Goldman said Microsoft has been counting on its AI Copilot and other generative AI efforts at Windows, Edge, and Microsoft 365 to draw enterprise clients. But, he said, enterprises are “still assessing” whether the tools will justify what he described as “steep” per-user costs.

“Questions linger over whether the hype around generative AI will translate into high returns anytime soon. For investors, it’s a waiting game,” he said.

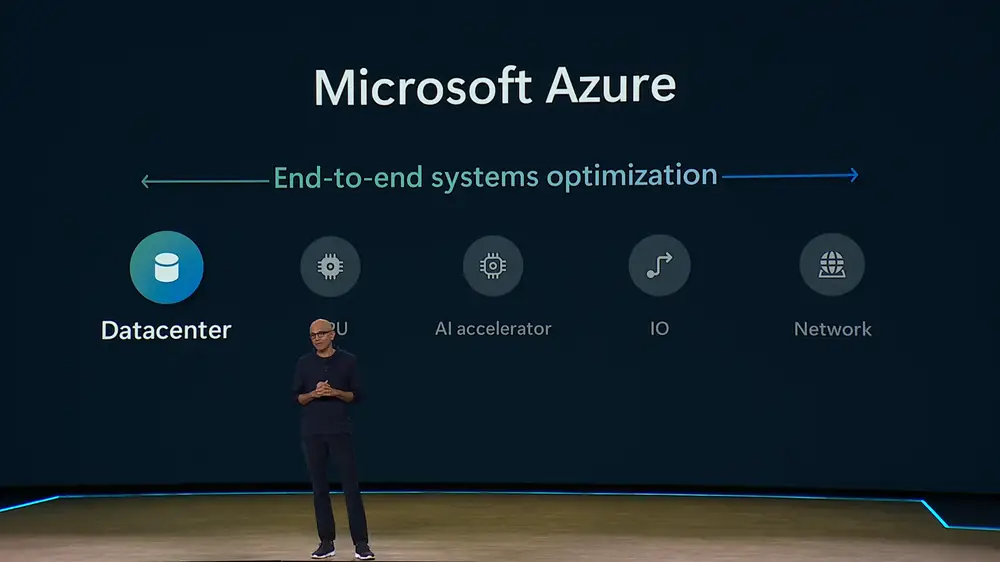

Much of Microsoft’s spending has been going toward data centers, graphics processing units, and other AI projects. By year end, Microsoft intends to amass 1.8 million GPUs. By July 2025, the Redmond, Washington, company plans to triple its data-center capacity.

In the first quarter, revenue from the Azure cloud computing platform and additional cloud services rose 33% — and, on a constant currency basis, by 34% compared with the 30.4% analysts surveyed by Bloomberg had expected, on average. Microsoft’s revenue and EPS also beat.

Goldman said that while Microsoft’s earnings came in “a bit above” expectations, some investors might be seeking greater clarity. He said Azure, which he described as the “linchpin” of the company’s growth strategy, showed “strong enough” gains, though also saw a “deceleration from its breakneck pace of previous quarters.”

Microsoft disclosed an equity investment in OpenAI for the first time. That could signal that Microsoft recently purchased stock or share rights in OpenAI, instead of just partnering with the ChatGPT maker, according to accounting expert Francine McKenna.

Here are several key metrics for the quarter that ended September 30 and how they compared with analysts’ consensus expectations as reported by Bloomberg.

- Earnings per share: $3.30 vs. $3.11 expected

- Revenue: $65.59 billion vs. $64.51 billion expected

- Operating income: $30.6 billion vs. the $29.21 billion expected

- Azure and additional cloud services revenue growth: 33% and, on a constant currency basis, 34% vs the 30.4% expected